Region:Asia

Author(s):Geetanshi

Product Code:KRAA3634

Pages:100

Published On:September 2025

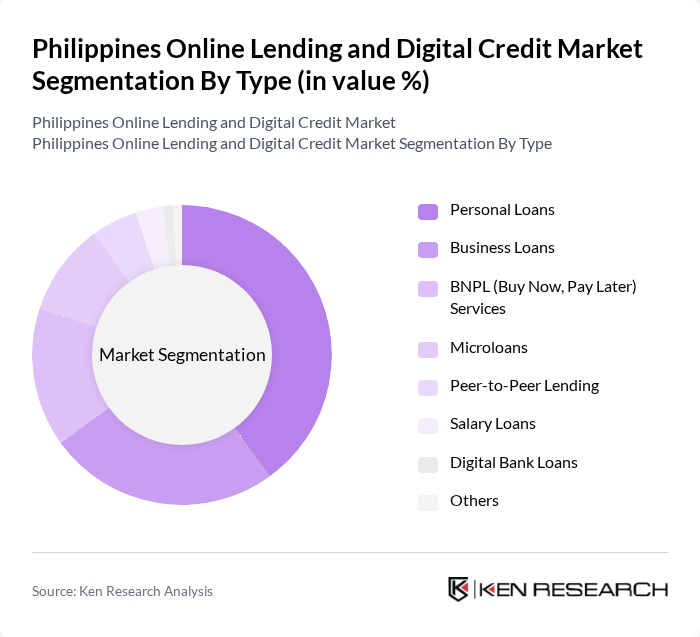

By Type:The market is segmented into various types of lending products, including Personal Loans, Business Loans, BNPL (Buy Now, Pay Later) Services, Microloans, Peer-to-Peer Lending, Salary Loans, Digital Bank Loans, and Others. Personal Loans dominate the market due to their flexibility and accessibility, catering to a wide range of consumer needs. The increasing trend of e-commerce and online shopping has also boosted the popularity of BNPL services, allowing consumers to make purchases without immediate payment .

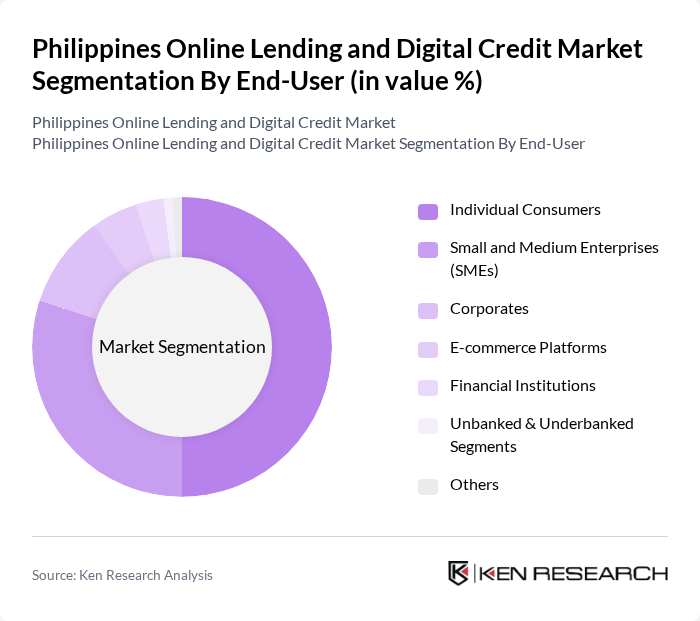

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Corporates, E-commerce Platforms, Financial Institutions, Unbanked & Underbanked Segments, and Others. Individual Consumers represent the largest segment, driven by the increasing need for personal financing solutions. SMEs are also significant contributors, as they seek accessible funding to support their operations and growth .

The Philippines Online Lending and Digital Credit Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cashalo, Home Credit Philippines, Tala Philippines, GCredit (GCash), Loan Ranger, LenddoEFL, Digido Finance Corp., JuanHand, Atome Philippines, BillEase, SeedIn Technology Inc., First Circle, Kiva Philippines, RCBC (Rizal Commercial Banking Corporation), UnionBank of the Philippines, PayMaya (Maya Bank), Grab Financial Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Philippines online lending and digital credit market appears promising, driven by technological advancements and evolving consumer behaviors. As digital payment systems continue to expand, lenders are likely to adopt more innovative solutions, enhancing customer experience. Additionally, the integration of artificial intelligence in credit scoring will improve risk assessment, enabling lenders to offer tailored products. The market is expected to witness increased collaboration between traditional banks and fintech companies, fostering a more inclusive financial ecosystem that addresses diverse consumer needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Loans Business Loans BNPL (Buy Now, Pay Later) Services Microloans Peer-to-Peer Lending Salary Loans Digital Bank Loans Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Corporates E-commerce Platforms Financial Institutions Unbanked & Underbanked Segments Others |

| By Application | Retail Purchases Emergency Expenses Business Expansion Education Financing Medical Expenses Bill Payments Others |

| By Distribution Channel | Online Platforms Mobile Applications Direct Sales Partnerships with Retailers Agent Networks Others |

| By Customer Segment | Millennials Gen Z Working Professionals Retirees Self-Employed Others |

| By Loan Amount | Below PHP 10,000 PHP 10,000 - PHP 50,000 PHP 50,001 - PHP 100,000 Above PHP 100,000 |

| By Loan Tenure | Short-term (up to 6 months) Medium-term (6 months to 2 years) Long-term (above 2 years) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Personal Loan Borrowers | 100 | Individuals aged 25-45, employed, with varying income levels |

| Small Business Owners | 60 | Entrepreneurs, business managers, and financial decision-makers |

| Fintech Industry Experts | 40 | Analysts, consultants, and executives in the fintech space |

| Regulatory Bodies | 40 | Officials from the Bangko Sentral ng Pilipinas and other regulatory agencies |

| Online Lending Platform Users | 80 | Users of various online lending platforms, diverse demographics |

The Philippines Online Lending and Digital Credit Market is valued at approximately PHP 56 billion, driven by the increasing adoption of digital financial services and the demand for quick, accessible credit solutions.