Region:Asia

Author(s):Geetanshi

Product Code:KRAB5788

Pages:100

Published On:October 2025

By Type:The market is segmented into various types of loans, including Personal Loans, Business Loans, Payday Loans, Buy Now, Pay Later (BNPL), Installment Loans, Salary Loans, and Others (e.g., Emergency Loans, Medical Loans).Personal Loansare particularly popular due to their flexibility, ease of access, and competitive rates, accounting for the majority of user activity and downloads.BNPLoptions are rapidly gaining traction, especially among younger, digitally savvy consumers who seek to manage expenses more flexibly. The growth of payday and installment loans is also notable, driven by short-term liquidity needs and the increasing acceptance of digital credit solutions .

By End-User:The market is segmented by end-users, including Individual Borrowers, Micro, Small, and Medium Enterprises (MSMEs), Self-Employed Professionals, and Informal Sector Workers.Individual Borrowersdominate the market, reflecting the growing need for personal financing and the convenience of digital loan access.MSMEsare also significant contributors, leveraging online lending platforms for business expansion, working capital, and operational costs. The rise in digital engagement among self-employed professionals and informal sector workers further underscores the sector’s role in promoting financial inclusion .

The Philippines Online Loan & Lending Apps Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cashalo, Home Credit Philippines, Tala Philippines, GCredit (by GCash/Mynt), Digido, JuanHand, CashMart, LenddoEFL, Online Loans Pilipinas, BillEase, Atome Philippines, UnaCash, Asteria Lending, Pera247, and Finbro contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Philippines online loan and lending apps market appears promising, driven by technological advancements and increasing financial literacy among consumers. As digital payment systems continue to evolve, lenders are likely to enhance their offerings, focusing on user-friendly interfaces and faster processing times. Additionally, the integration of artificial intelligence in credit scoring will enable more accurate assessments, fostering responsible lending practices. This dynamic environment is expected to attract more players, further stimulating competition and innovation in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Loans Business Loans Payday Loans Buy Now, Pay Later (BNPL) Installment Loans Salary Loans Others (e.g., Emergency Loans, Medical Loans) |

| By End-User | Individual Borrowers Micro, Small, and Medium Enterprises (MSMEs) Self-Employed Professionals Informal Sector Workers |

| By Loan Amount | Micro Loans (up to PHP 10,000) Small Loans (PHP 10,001 - PHP 50,000) Medium Loans (PHP 50,001 - PHP 200,000) Large Loans (over PHP 200,000) |

| By Interest Rate Type | Fixed Interest Rate Variable Interest Rate |

| By Repayment Period | Short-term (up to 1 year) Medium-term (1-3 years) Long-term (over 3 years) |

| By Distribution Channel | Mobile Apps Websites Third-party Platforms |

| By Customer Segment | First-time Borrowers Repeat Borrowers High-risk Borrowers Low-risk Borrowers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Personal Loan Users | 100 | Individuals aged 18-45, employed, with prior loan experience |

| Small Business Loan Applicants | 60 | Small business owners, entrepreneurs seeking funding |

| Microloan Recipients | 50 | Low-income individuals, informal sector workers |

| Fintech Industry Experts | 40 | Financial analysts, fintech consultants, and academics |

| Online Lending Platform Users | 80 | Users of various online lending apps, diverse demographics |

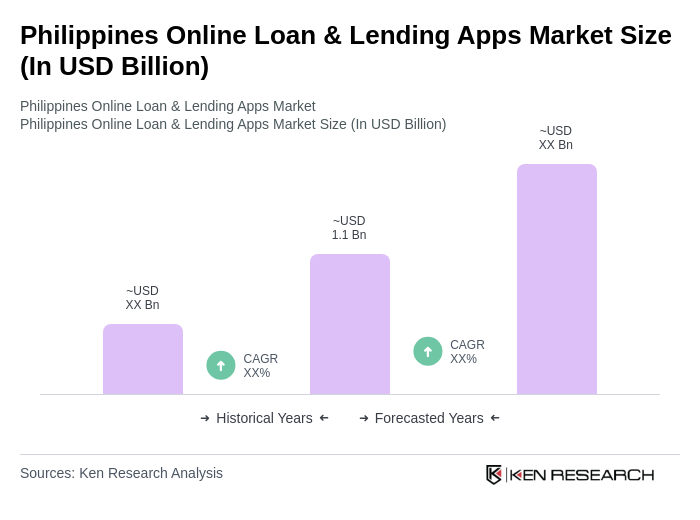

The Philippines Online Loan & Lending Apps Market is valued at approximately USD 1.1 billion, driven by the increasing adoption of digital financial services and the demand for quick and accessible credit solutions among a large unbanked population.