Region:Middle East

Author(s):Geetanshi

Product Code:KRAB7733

Pages:88

Published On:October 2025

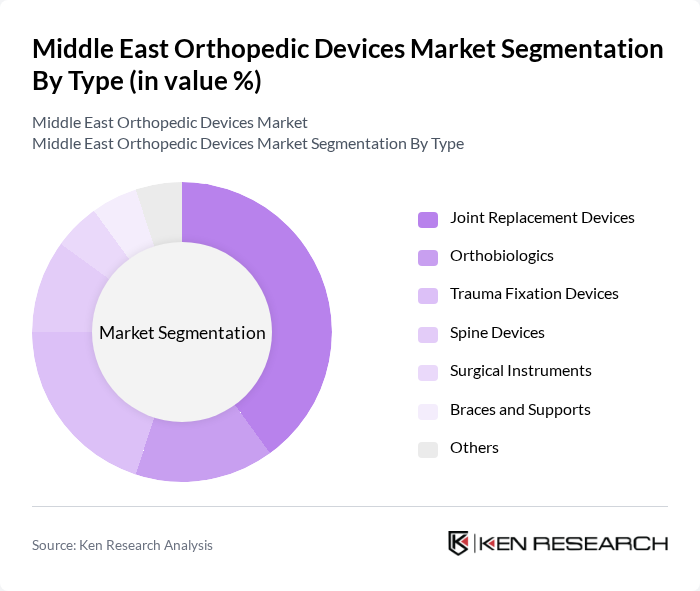

By Type:The orthopedic devices market can be segmented into various types, including Joint Replacement Devices, Orthobiologics, Trauma Fixation Devices, Spine Devices, Surgical Instruments, Braces and Supports, and Others. Among these, Joint Replacement Devices are currently leading the market due to the increasing incidence of joint-related disorders and the growing elderly population requiring surgical interventions. The demand for these devices is further supported by advancements in surgical techniques and materials, making them more effective and durable.

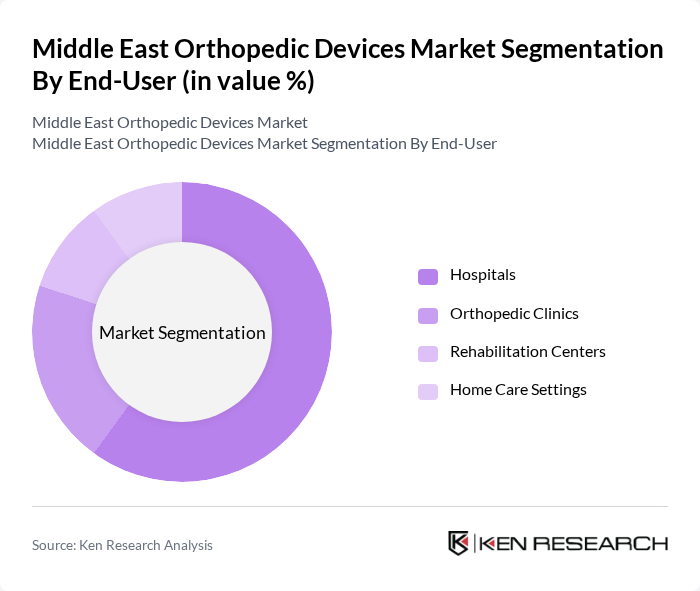

By End-User:The market can also be segmented based on end-users, which include Hospitals, Orthopedic Clinics, Rehabilitation Centers, and Home Care Settings. Hospitals are the leading end-user segment, primarily due to the high volume of orthopedic surgeries performed in these facilities. The increasing number of surgical procedures, coupled with the availability of advanced medical technologies in hospitals, drives the demand for orthopedic devices in this segment.

The Middle East Orthopedic Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Stryker Corporation, Zimmer Biomet Holdings, Inc., DePuy Synthes (Johnson & Johnson), Medtronic plc, Smith & Nephew plc, Arthrex, Inc., NuVasive, Inc., Aesculap, Inc., Orthofix Medical Inc., B. Braun Melsungen AG, Conmed Corporation, RTI Surgical Holdings, Inc., Integra LifeSciences Holdings Corporation, K2M Group Holdings, Inc., Exactech, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the orthopedic devices market in the Middle East appears promising, driven by technological advancements and demographic shifts. As healthcare infrastructure continues to expand, particularly in urban areas, access to orthopedic care is expected to improve. Furthermore, the increasing prevalence of chronic conditions will likely lead to a higher demand for orthopedic interventions, fostering innovation and competition among manufacturers to meet evolving patient needs effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Joint Replacement Devices Orthobiologics Trauma Fixation Devices Spine Devices Surgical Instruments Braces and Supports Others |

| By End-User | Hospitals Orthopedic Clinics Rehabilitation Centers Home Care Settings |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Pharmacies |

| By Region | GCC Countries Levant Region North Africa |

| By Application | Trauma Surgery Joint Reconstruction Spine Surgery Sports Medicine |

| By Price Range | Premium Mid-Range Economy |

| By Policy Support | Subsidies for local manufacturers Tax incentives for R&D Grants for healthcare innovation |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Orthopedic Surgeons | 150 | Orthopedic Surgeons, Medical Directors |

| Healthcare Procurement Managers | 100 | Procurement Managers, Supply Chain Coordinators |

| Patients with Orthopedic Conditions | 80 | Patients, Caregivers, Rehabilitation Specialists |

| Medical Device Distributors | 70 | Sales Managers, Product Managers |

| Regulatory Experts | 50 | Regulatory Affairs Managers, Compliance Officers |

The Middle East Orthopedic Devices Market is valued at approximately USD 3.5 billion, driven by factors such as the increasing prevalence of orthopedic disorders, advancements in technology, and a growing geriatric population.