Region:Asia

Author(s):Shubham

Product Code:KRAA6977

Pages:81

Published On:January 2026

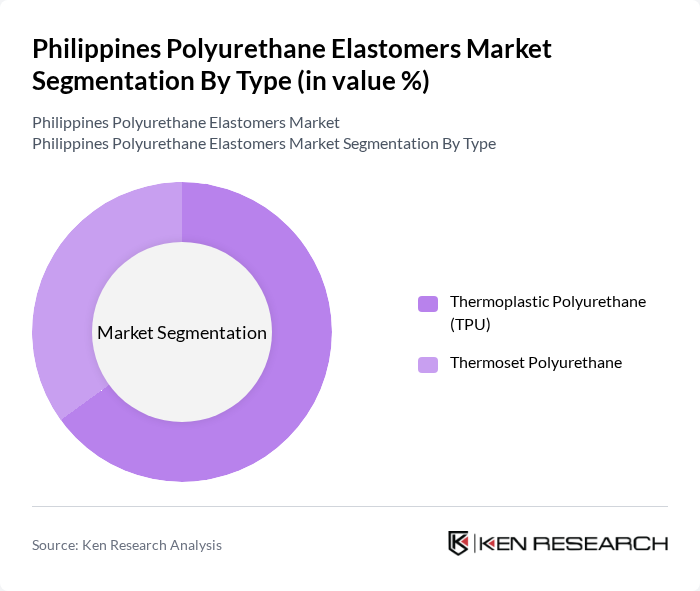

By Type:

The market is segmented into Thermoplastic Polyurethane (TPU) and Thermoset Polyurethane. Thermoplastic Polyurethane (TPU) is currently the leading subsegment due to its versatility, ease of processing, and superior mechanical properties, making it suitable for a wide range of applications, including automotive parts and consumer goods. The demand for TPU is driven by its ability to be recycled and its growing use in high-performance applications. Thermoset Polyurethane, while also significant, is primarily used in applications requiring high durability and resistance to heat and chemicals, such as industrial machinery and construction materials.

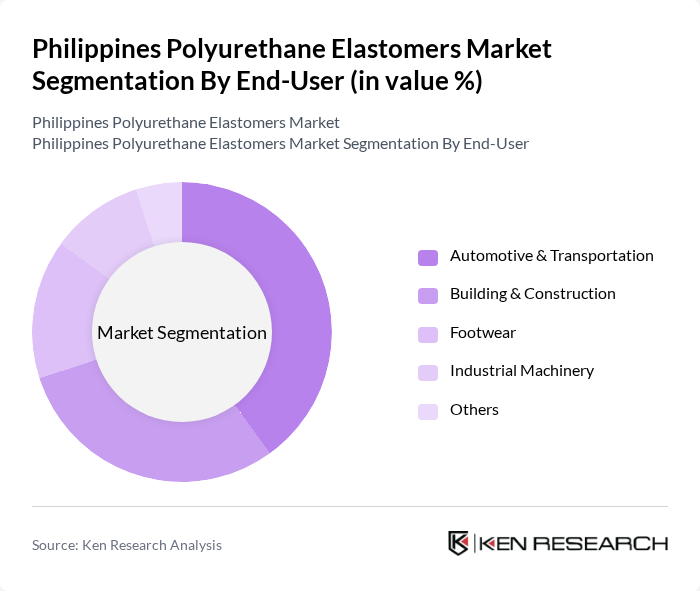

By End-User:

The end-user segmentation includes Automotive & Transportation, Building & Construction, Footwear, Industrial Machinery, and Others. The Automotive & Transportation sector is the dominant segment, driven by the increasing demand for lightweight and fuel-efficient vehicles. Polyurethane elastomers are extensively used in automotive applications for components such as seals, gaskets, and interior parts due to their excellent mechanical properties and durability. The Building & Construction sector follows closely, benefiting from the growing infrastructure projects in the Philippines.

The Philippines Polyurethane Elastomers Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF Philippines, Huntsman Corporation, Covestro AG, Dow Chemical Company, Wanhua Chemical Group, Mitsui Chemicals, Tosoh Corporation, Sika AG, 3M Company, Chemline Inc., A. Schulman, Inc., KRAIBURG TPE, PolyOne Corporation, RAMPF Holding GmbH & Co. KG, Elkem ASA contribute to innovation, geographic expansion, and service delivery in this space.

The future of the polyurethane elastomers market in the Philippines appears promising, driven by technological advancements and increasing applications across various sectors. As manufacturers invest in innovative production techniques, the quality and performance of elastomers are expected to improve. Additionally, the growing focus on sustainability will likely lead to the development of more eco-friendly products, aligning with consumer preferences. This evolving landscape presents opportunities for companies to expand their market presence and enhance product offerings in response to emerging trends.

| Segment | Sub-Segments |

|---|---|

| By Type | Thermoplastic Polyurethane (TPU) Thermoset Polyurethane |

| By End-User | Automotive & Transportation Building & Construction Footwear Industrial Machinery Others |

| By Application | Industrial Components Consumer Goods Medical Devices Others |

| By Processing Method | Injection Molding Extrusion Casting Others |

| By Region | Luzon Visayas Mindanao |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Applications | 100 | Product Engineers, Procurement Managers |

| Construction Materials | 80 | Project Managers, Material Suppliers |

| Footwear Manufacturing | 70 | Design Managers, Production Supervisors |

| Adhesives and Sealants | 60 | R&D Managers, Quality Control Analysts |

| Coatings and Paints | 90 | Marketing Managers, Technical Sales Representatives |

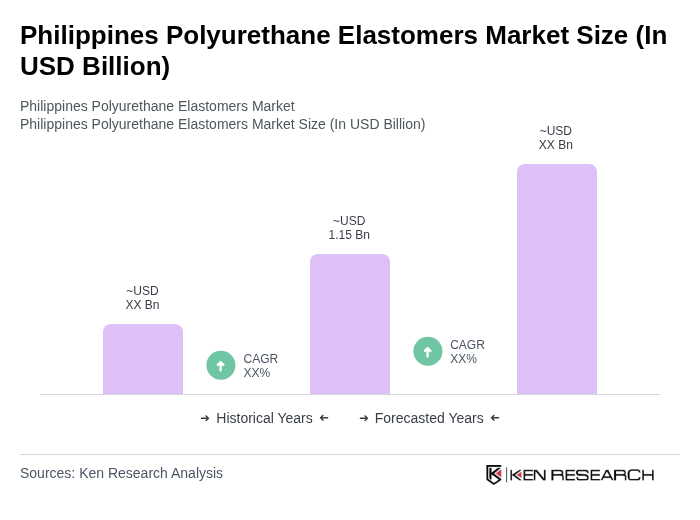

The Philippines Polyurethane Elastomers Market is valued at approximately USD 1.15 billion, driven by demand from sectors like automotive, construction, and footwear, along with advancements in technology and a shift towards lightweight materials in manufacturing.