Region:Asia

Author(s):Shubham

Product Code:KRAA6982

Pages:85

Published On:January 2026

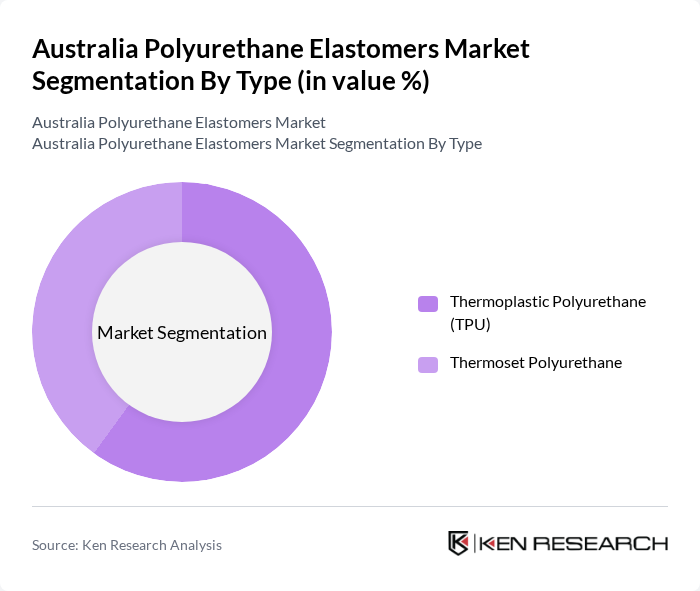

By Type:The market is segmented into Thermoplastic Polyurethane (TPU) and Thermoset Polyurethane. Thermoplastic Polyurethane (TPU) is gaining traction due to its versatility and ease of processing, making it suitable for various applications. Thermoset Polyurethane, while less flexible, is preferred for applications requiring high durability and resistance to extreme conditions.

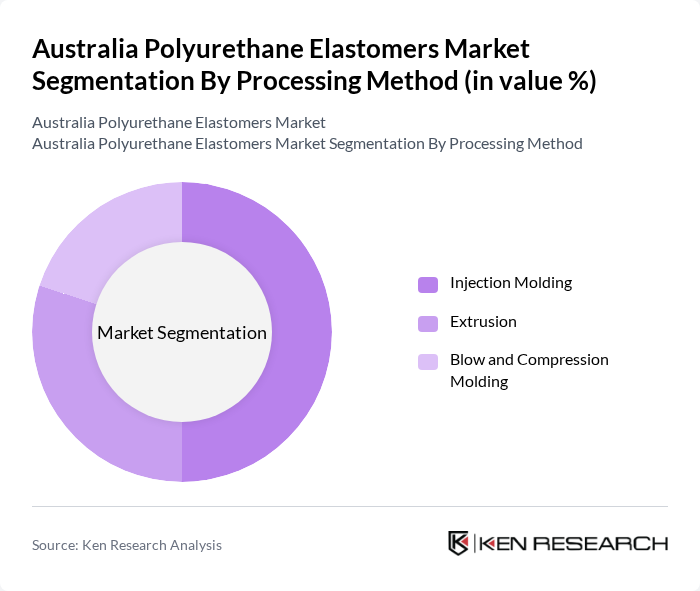

By Processing Method:The processing methods include Injection Molding, Extrusion, and Blow and Compression Molding. Injection Molding is the most widely used method due to its efficiency and ability to produce complex shapes. Extrusion is also significant, particularly for continuous profiles, while Blow and Compression Molding are utilized for specific applications requiring unique properties.

The Australia Polyurethane Elastomers Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF Australia, Covestro Australia, Huntsman Corporation, Dow Chemical Company, Wanhua Chemical Group, Era Polymers, Mitsui Chemicals, Sika AG, 3M Australia, Chemours Company, PolyOne Corporation, Eastman Chemical Company, Momentive Performance Materials, KRAHN Chemie, Ingevity Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the polyurethane elastomers market in Australia appears promising, driven by increasing demand across various sectors, particularly automotive and construction. As manufacturers adapt to stringent environmental regulations, the focus on sustainable and bio-based materials is expected to grow. Additionally, technological advancements will likely enhance product performance and customization, allowing companies to meet specific customer needs. The integration of smart technologies in manufacturing processes will further streamline operations and improve product quality, positioning the market for robust growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Thermoplastic Polyurethane (TPU) Thermoset Polyurethane |

| By Processing Method | Injection Molding Extrusion Blow and Compression Molding |

| By Application | Automotive and Transportation Industrial Machinery Footwear Building and Construction Mining Equipment Medical Devices |

| By Region | New South Wales Victoria Queensland Western Australia South Australia Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Applications | 100 | Product Engineers, Procurement Managers |

| Construction Sector Usage | 80 | Project Managers, Material Specialists |

| Consumer Goods Manufacturing | 70 | Operations Managers, Quality Control Analysts |

| Footwear Industry Insights | 60 | Design Managers, Production Supervisors |

| Adhesives and Sealants Market | 90 | Technical Sales Representatives, R&D Managers |

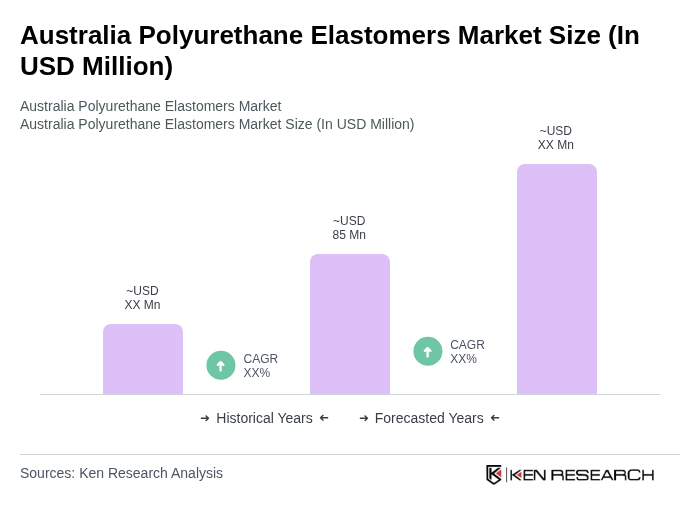

The Australia Polyurethane Elastomers Market is valued at approximately USD 85 million, reflecting a five-year historical analysis. This growth is driven by increasing demand from industries such as automotive, construction, and industrial manufacturing.