Region:Middle East

Author(s):Shubham

Product Code:KRAA6980

Pages:89

Published On:January 2026

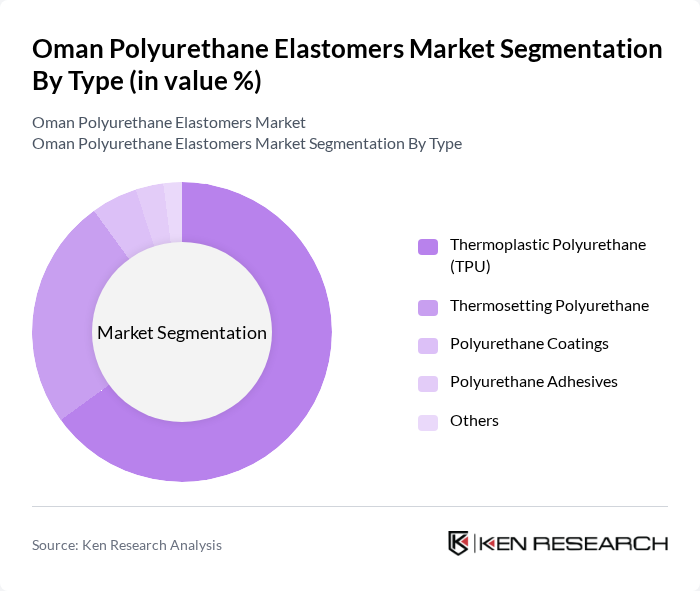

By Type:The market is segmented into various types of polyurethane elastomers, including Thermoplastic Polyurethane (TPU), Thermosetting Polyurethane, Polyurethane Coatings, Polyurethane Adhesives, and Others. Among these, Thermoplastic Polyurethane (TPU) is the leading subsegment due to its versatility and wide application in industries such as automotive and consumer goods. The demand for TPU is driven by its excellent mechanical properties and ease of processing, making it a preferred choice for manufacturers.

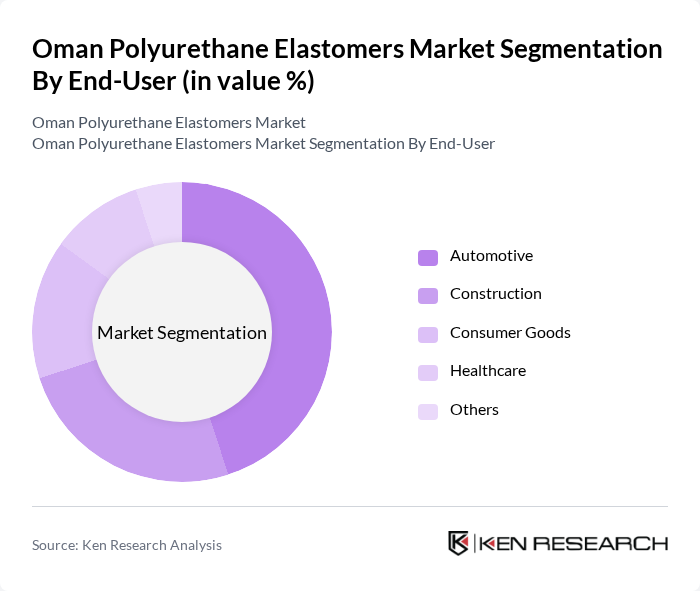

By End-User:The end-user segmentation includes Automotive, Construction, Consumer Goods, Healthcare, and Others. The automotive sector is the dominant end-user, driven by the increasing production of vehicles and the need for lightweight, durable materials. Polyurethane elastomers are extensively used in automotive applications for components such as bumpers, seals, and interior parts, which require high performance and longevity.

The Oman Polyurethane Elastomers Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Covestro AG, Huntsman Corporation, Dow Inc., Wanhua Chemical Group Co., Ltd., Mitsui Chemicals, Inc., Tosoh Corporation, Lubrizol Corporation, Recticel SA, RAMPF Holding GmbH & Co. KG, Perstorp Holding AB, KRAHN Chemie GmbH, A. Schulman, Inc., Sika AG, Evonik Industries AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman polyurethane elastomers market appears promising, driven by technological advancements and a shift towards sustainable practices. As manufacturers invest in eco-friendly production methods, the demand for bio-based polyurethane elastomers is expected to rise. Additionally, the integration of smart technologies in various applications will likely create new market segments. The ongoing expansion of the automotive and construction sectors will further bolster market growth, positioning Oman as a key player in the regional polyurethane elastomers landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Thermoplastic Polyurethane (TPU) Thermosetting Polyurethane Polyurethane Coatings Polyurethane Adhesives Others |

| By End-User | Automotive Construction Consumer Goods Healthcare Others |

| By Application | Foam Products Sealants and Adhesives Coatings Elastomers Others |

| By Formulation | Water-based Polyurethane Solvent-based Polyurethane High-solids Polyurethane Others |

| By Region | Muscat Salalah Sohar Nizwa Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Others |

| By Product Form | Sheets Films Blocks Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Applications | 100 | Product Managers, R&D Engineers |

| Construction Sector Usage | 80 | Project Managers, Procurement Specialists |

| Footwear Manufacturing | 60 | Design Engineers, Production Managers |

| Adhesives and Sealants | 70 | Quality Control Managers, Technical Sales Representatives |

| Consumer Goods Applications | 90 | Marketing Managers, Product Development Leads |

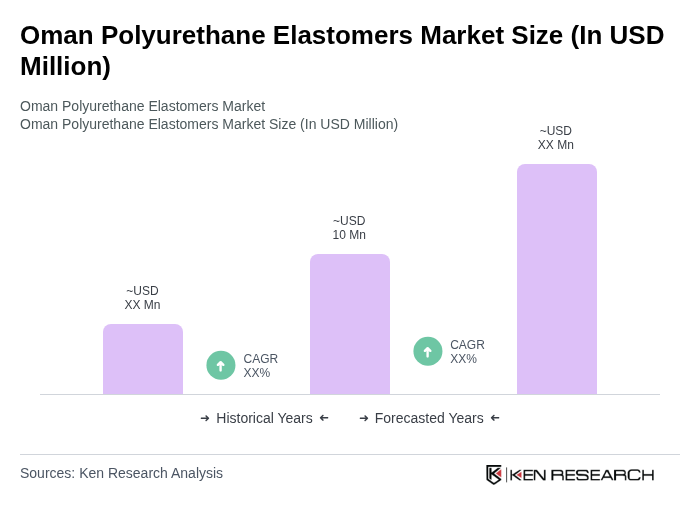

The Oman Polyurethane Elastomers Market is valued at approximately USD 10 million, reflecting a five-year historical analysis. This valuation is influenced by the growing demand from key industries such as automotive, construction, and healthcare.