Japan Polyurethane Elastomers Market Overview

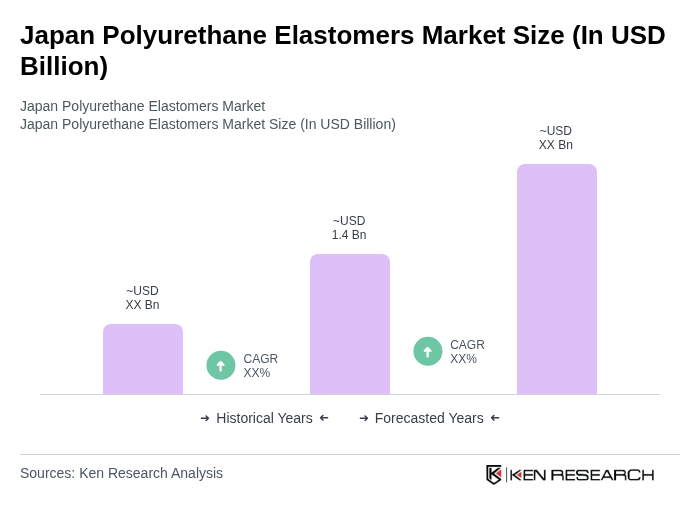

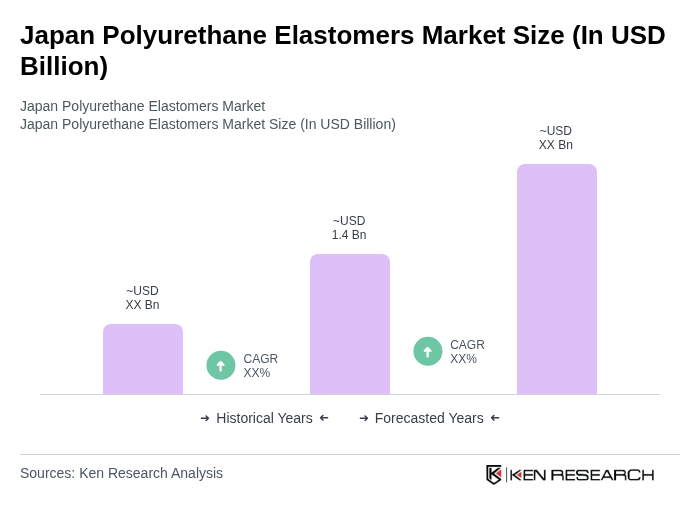

- The Japan Polyurethane Elastomers Market is valued at approximately USD 1.4 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand from various industries such as automotive, construction, and electronics, which utilize polyurethane elastomers for their superior flexibility, durability, and resistance to wear and tear. The automotive sector remains the dominant driver, with Japan's major automakers including Toyota, Honda, Nissan, Mitsubishi, and Mazda continuously expanding production and facility capacity, significantly impacting polyurethane elastomer demand.

- Key players in this market include Tokyo, Osaka, and Nagoya, which dominate due to their robust industrial infrastructure, high concentration of manufacturing facilities, and proximity to major supply chains. These cities are also hubs for innovation and technology, further enhancing their market position. Japan maintains strong industrial demand for casting and thermoplastic polyurethane elastomers in rollers, conveyor belts, and precision parts, where reliability and wear resistance are crucial.

- The Japanese government has implemented environmental regulations promoting sustainable manufacturing practices and the adoption of eco-friendly materials. This initiative encourages industries to adopt sustainable practices, thereby increasing the demand for polyurethane elastomers that meet environmental standards and support Japan's automotive innovation roadmap toward carbon neutrality.

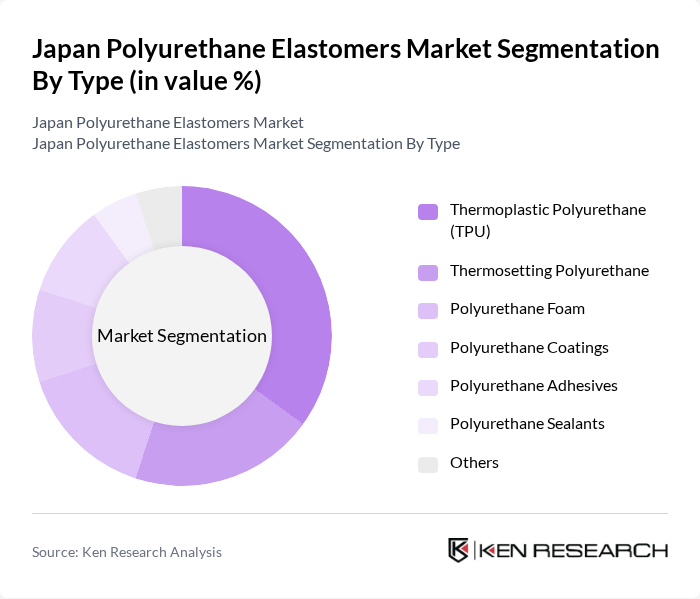

Japan Polyurethane Elastomers Market Segmentation

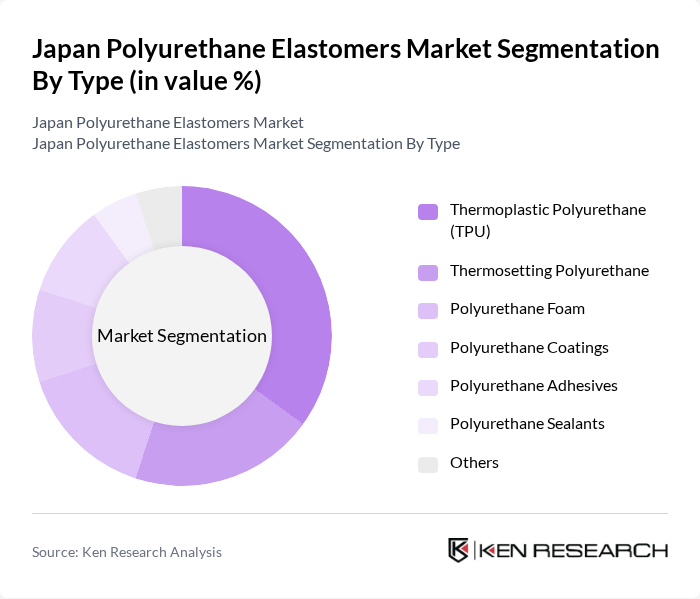

By Type:The polyurethane elastomers market is segmented into various types, including Thermoplastic Polyurethane (TPU), Thermosetting Polyurethane, Polyurethane Foam, Polyurethane Coatings, Polyurethane Adhesives, Polyurethane Sealants, and Others. Among these, Thermoplastic Polyurethane (TPU) is the leading subsegment due to its versatility and wide range of applications in industries such as automotive and consumer goods. The demand for TPU is driven by its excellent mechanical properties and ease of processing, making it a preferred choice for manufacturers. Mitsui Chemicals, Inc. continues to lead through significant R&D investment in functional PU materials, targeting improvements in mechanical resilience, temperature resistance, and long-term flexibility.

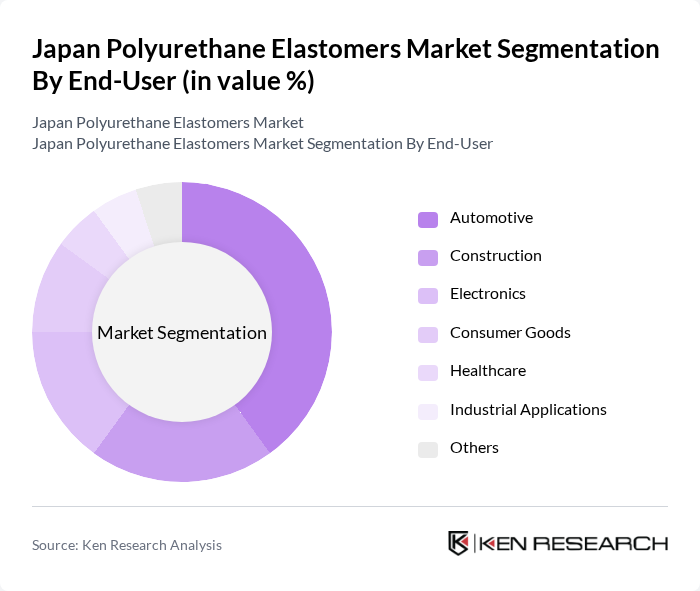

By End-User:The end-user segmentation includes Automotive, Construction, Electronics, Consumer Goods, Healthcare, Industrial Applications, and Others. The automotive sector is the dominant end-user, driven by the increasing demand for lightweight and durable materials in vehicle manufacturing. Polyurethane elastomers are extensively used in automotive components such as bumpers, seals, and interior parts, contributing significantly to the market's growth. Japan's automotive industry continues to drive demand through innovations in vehicle weight reduction, impact absorption, and safety enhancement technologies.

Japan Polyurethane Elastomers Market Competitive Landscape

The Japan Polyurethane Elastomers Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF Japan Ltd., Mitsui Chemicals, Inc., DOW Chemical Company, Asahi Kasei Corporation, Kuraray Co., Ltd., Tosoh Corporation, Nippon Polyurethane Industry Co., Ltd., Wanhua Chemical Group Co., Ltd., Huntsman Corporation, Covestro AG, Sika AG, Evonik Industries AG, PolyOne Corporation, Momentive Performance Materials Inc., Chemours Company contribute to innovation, geographic expansion, and service delivery in this space.

Japan Polyurethane Elastomers Market Industry Analysis

Growth Drivers

- Increasing Demand from Automotive Industry:The automotive sector in Japan is projected to produce approximately 9 million vehicles in future, driving the demand for polyurethane elastomers. These materials are essential for manufacturing components such as seals, gaskets, and interior parts, which require durability and flexibility. The automotive industry's shift towards lightweight materials to enhance fuel efficiency further propels the need for polyurethane elastomers, which are lighter than traditional materials, thus supporting overall vehicle performance and compliance with stricter emissions regulations.

- Rising Applications in Construction and Building Materials:Japan's construction industry is expected to reach a value of ¥65 trillion (approximately $600 billion) in future, significantly boosting the demand for polyurethane elastomers. These materials are increasingly used in insulation, flooring, and roofing applications due to their excellent thermal and mechanical properties. The government's focus on infrastructure development and sustainable building practices is further enhancing the adoption of polyurethane elastomers, as they contribute to energy efficiency and durability in construction projects.

- Growth in Consumer Goods and Electronics Sectors:The consumer goods market in Japan is anticipated to grow to ¥22 trillion (around $200 billion) in future, with polyurethane elastomers playing a crucial role in the production of various products. Their versatility allows for applications in electronics, such as casings and protective components, which require high-performance materials. The increasing demand for innovative and durable consumer products is driving manufacturers to incorporate polyurethane elastomers, enhancing product longevity and user satisfaction.

Market Challenges

- Fluctuating Raw Material Prices:The polyurethane elastomers market faces significant challenges due to the volatility of raw material prices, particularly isocyanates and polyols. In future, the price of toluene diisocyanate (TDI) surged by 18%, impacting production costs. This fluctuation can lead to unpredictable pricing for end products, making it difficult for manufacturers to maintain profit margins and competitive pricing, ultimately affecting market growth and stability in the polyurethane elastomers sector.

- Stringent Environmental Regulations:Japan's commitment to environmental sustainability has led to stringent regulations governing chemical manufacturing and usage. Compliance with the Chemical Substances Control Law (CSCL) requires manufacturers to invest in cleaner production technologies and processes. In future, companies may face increased costs associated with meeting these regulations, which could hinder innovation and limit the market's ability to respond to growing demand for eco-friendly polyurethane elastomers.

Japan Polyurethane Elastomers Market Future Outlook

The future of the polyurethane elastomers market in Japan appears promising, driven by technological advancements and a growing emphasis on sustainability. As manufacturers increasingly adopt bio-based materials and smart technologies, the market is likely to witness a shift towards high-performance, eco-friendly products. Additionally, the ongoing expansion of the automotive and construction sectors will further stimulate demand, creating opportunities for innovation and collaboration among industry players to enhance product offerings and meet evolving consumer needs.

Market Opportunities

- Expansion in Emerging Markets:As Japan's economy continues to recover, opportunities for exporting polyurethane elastomers to emerging markets are increasing. Countries in Southeast Asia are experiencing rapid industrialization, creating a demand for high-quality materials. This expansion can lead to increased revenue streams for Japanese manufacturers, allowing them to leverage their expertise in producing advanced elastomers to meet the needs of these growing markets.

- Innovations in Product Formulations:The development of new formulations that enhance the performance characteristics of polyurethane elastomers presents significant market opportunities. Innovations focusing on improved durability, flexibility, and environmental impact can attract a broader customer base. By investing in research and development, companies can create specialized products that cater to niche markets, thus enhancing their competitive edge and driving growth in the polyurethane elastomers sector.