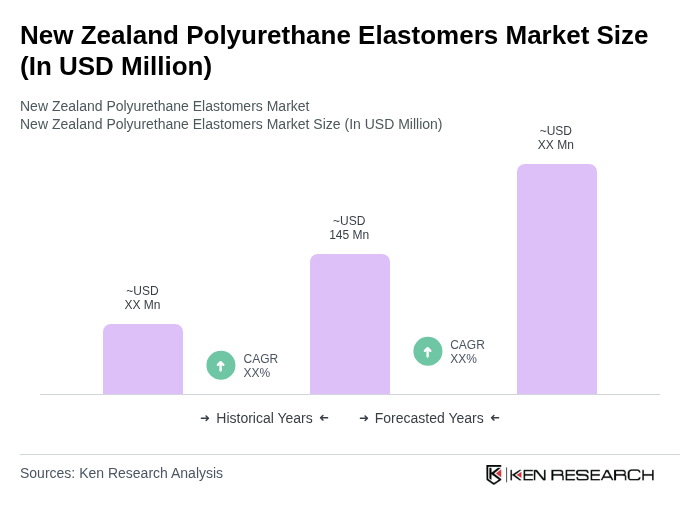

New Zealand Polyurethane Elastomers Market Overview

- The New Zealand Polyurethane Elastomers Market is valued at USD 145 million, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for lightweight and durable materials in various industries, including automotive and construction, alongside rising adoption of bio-based and environmentally friendly polyurethane elastomers to meet sustainability demands. The versatility of polyurethane elastomers in applications such as coatings, adhesives, and sealants further fuels market expansion, as industries seek innovative solutions to enhance product performance.

- Auckland and Wellington are the dominant cities in the New Zealand Polyurethane Elastomers Market due to their robust industrial base and significant manufacturing activities. Auckland, being the largest city, hosts numerous companies involved in the production and application of polyurethane elastomers, while Wellington's strategic location supports logistics and distribution, making it a key player in the market.

- The Hazardous Substances and New Organisms (HSNO) Act 1996, issued by the Environmental Protection Authority (EPA), regulates the import, manufacture, and use of polyurethane elastomers by controlling hazardous isocyanates used in production. It requires safety data sheets, exposure limits for workers, labeling standards, and compliance assessments for facilities handling these substances above specified thresholds, ensuring safe handling and minimizing environmental release.

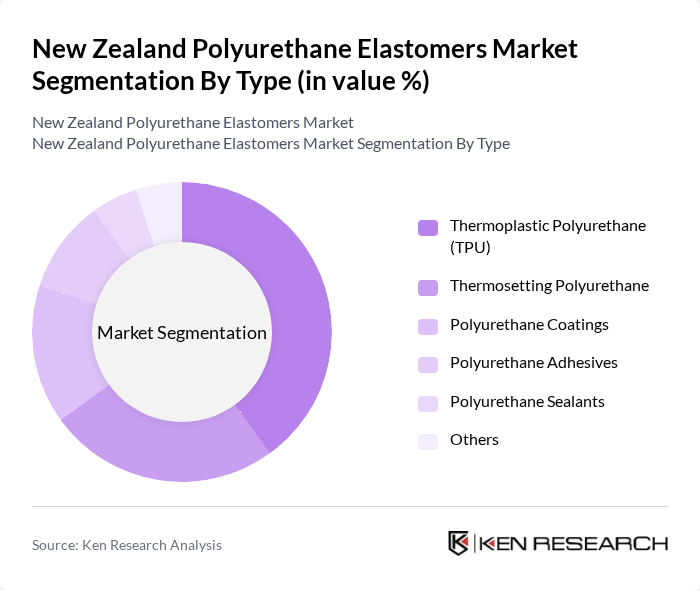

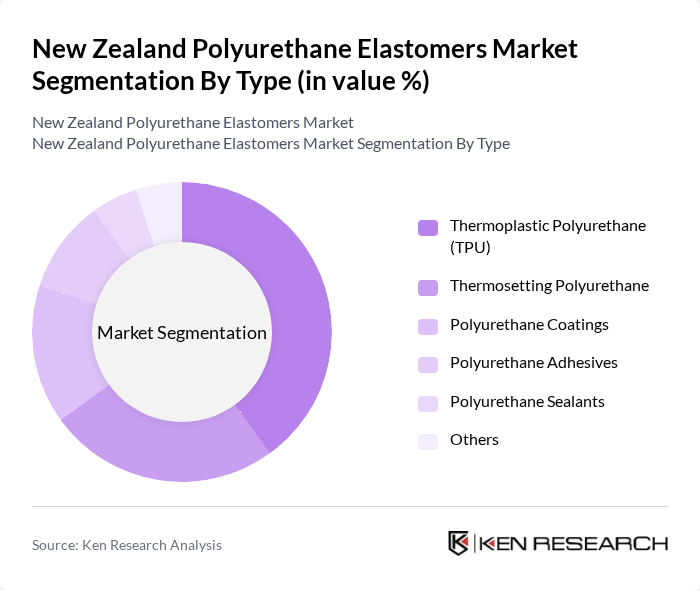

New Zealand Polyurethane Elastomers Market Segmentation

By Type:The polyurethane elastomers market is segmented into various types, including Thermoplastic Polyurethane (TPU), Thermosetting Polyurethane, Polyurethane Coatings, Polyurethane Adhesives, Polyurethane Sealants, and Others. Among these, Thermoplastic Polyurethane (TPU) is the leading subsegment due to its excellent elasticity, durability, and versatility, making it suitable for a wide range of applications in automotive, footwear, and industrial sectors. The growing trend towards lightweight materials in manufacturing further boosts the demand for TPU, positioning it as a dominant player in the market.

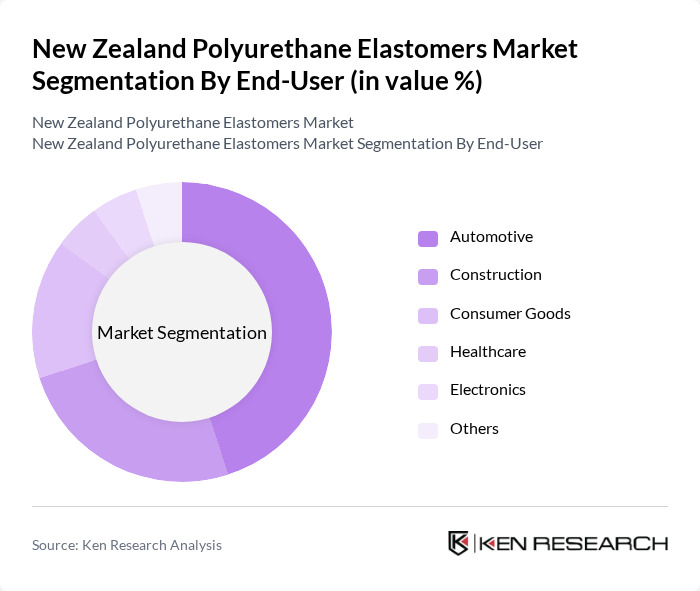

By End-User:The end-user segmentation of the polyurethane elastomers market includes Automotive, Construction, Consumer Goods, Healthcare, Electronics, and Others. The Automotive sector is the leading end-user, driven by the increasing demand for lightweight and high-performance materials that enhance fuel efficiency and reduce emissions. The trend towards electric vehicles and advanced automotive technologies further propels the growth of polyurethane elastomers in this sector, making it a significant contributor to market dynamics.

New Zealand Polyurethane Elastomers Market Competitive Landscape

The New Zealand Polyurethane Elastomers Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF New Zealand, Huntsman Corporation, Covestro AG, Dow Chemical Company, Wanhua Chemical Group, Mitsui Chemicals, Inoac Corporation, Recticel, RAMPF Group, Sika AG, 3M Company, A. Schulman, Inc., KRAHN Chemie, Axiom Materials, PolyOne Corporation contribute to innovation, geographic expansion, and service delivery in this space.

New Zealand Polyurethane Elastomers Market Industry Analysis

Growth Drivers

- Increasing Demand from Automotive Industry:The New Zealand automotive sector is projected to reach NZD 5.4 billion in future, driven by a surge in vehicle production and sales. Polyurethane elastomers are increasingly utilized in automotive applications due to their durability and lightweight properties. The demand for electric vehicles (EVs) is also rising, with EV sales expected to increase by 35% annually, further boosting the need for advanced materials like polyurethane elastomers in vehicle components.

- Rising Construction Activities:New Zealand's construction industry is anticipated to grow by 5.0% in future, reaching NZD 48 billion. This growth is fueled by government investments in infrastructure and housing projects. Polyurethane elastomers are essential in construction for applications such as insulation, sealants, and coatings, which enhance energy efficiency and durability. The increasing focus on sustainable building practices further drives the demand for these materials in the construction sector.

- Growing Consumer Electronics Market:The consumer electronics market in New Zealand is expected to reach NZD 4.0 billion in future, with a significant rise in demand for lightweight and durable materials. Polyurethane elastomers are increasingly used in electronic devices for their flexibility and resistance to wear. The trend towards smart devices and wearables is also contributing to the growth of this market segment, as manufacturers seek innovative materials to enhance product performance and longevity.

Market Challenges

- Fluctuating Raw Material Prices:The polyurethane elastomers market faces challenges due to the volatility of raw material prices, particularly isocyanates and polyols. Recently, the price of toluene diisocyanate (TDI) surged by 18%, impacting production costs. This fluctuation can lead to unpredictable pricing for end-users and manufacturers, potentially hindering market growth as companies struggle to maintain profit margins amid rising costs.

- Environmental Regulations:Stringent environmental regulations in New Zealand are posing challenges for the polyurethane elastomers market. The government has implemented policies aimed at reducing carbon emissions, which may affect the production processes of polyurethane materials. Compliance with these regulations often requires significant investment in cleaner technologies, which can strain smaller manufacturers and limit their competitiveness in the market.

New Zealand Polyurethane Elastomers Market Future Outlook

The future of the New Zealand polyurethane elastomers market appears promising, driven by technological advancements and a shift towards sustainable practices. As industries increasingly adopt eco-friendly materials, the demand for bio-based polyurethane elastomers is expected to rise. Additionally, the integration of smart technologies in manufacturing processes will enhance product customization and efficiency. These trends indicate a robust growth trajectory, with companies focusing on innovation to meet evolving consumer preferences and regulatory requirements.

Market Opportunities

- Expansion in Renewable Energy Applications:The renewable energy sector in New Zealand is projected to grow by 25% in future, creating opportunities for polyurethane elastomers in wind and solar energy applications. Their durability and resistance to environmental factors make them ideal for components in renewable energy systems, thus driving demand in this emerging market.

- Development of Bio-Based Polyurethane Elastomers:With increasing consumer awareness regarding sustainability, the development of bio-based polyurethane elastomers presents a significant market opportunity. The global market for bio-based materials is expected to reach USD 600 billion in future, encouraging local manufacturers to innovate and produce eco-friendly alternatives, thereby enhancing their market position.