Region:Asia

Author(s):Shubham

Product Code:KRAA6449

Pages:91

Published On:January 2026

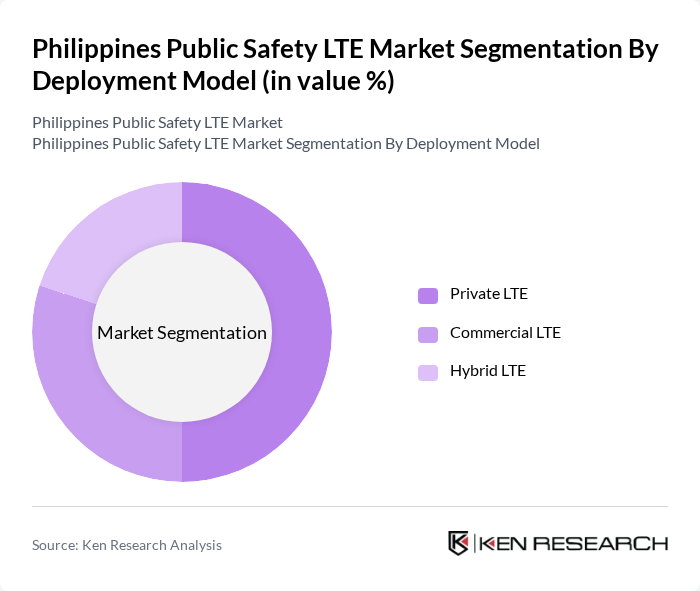

By Deployment Model:

The deployment model segment includes Private LTE, Commercial LTE, and Hybrid LTE. Private LTE is gaining traction among public safety agencies due to its enhanced security and control over communication networks. Commercial LTE is widely used for its cost-effectiveness and scalability, while Hybrid LTE combines the benefits of both private and commercial models, catering to diverse operational needs. The leading subsegment is Private LTE, as agencies prioritize secure and dedicated networks for critical communications.

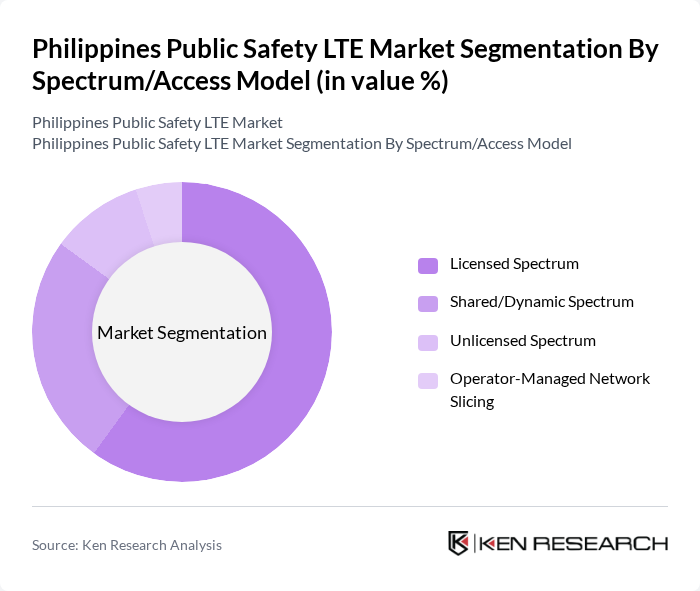

By Spectrum/Access Model:

This segment comprises Licensed Spectrum, Shared/Dynamic Spectrum, Unlicensed Spectrum, and Operator-Managed Network Slicing. Licensed Spectrum is preferred for its reliability and regulatory compliance, while Shared/Dynamic Spectrum offers flexibility in resource allocation. Unlicensed Spectrum is utilized for cost-effective solutions, and Operator-Managed Network Slicing allows for tailored services. The leading subsegment is Licensed Spectrum, as it ensures secure and uninterrupted communication for public safety operations.

The Philippines Public Safety LTE Market is characterized by a dynamic mix of regional and international players. Leading participants such as Motorola Solutions, Nokia Corporation, Ericsson, AT&T, Verizon, Samsung Electronics, PLDT Inc., Globe Telecom, Smart Communications, Cisco Systems, Huawei Technologies, ZTE Corporation, NEC Corporation, Thales Group, Siemens AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Philippines Public Safety LTE market appears promising, driven by ongoing government initiatives and technological advancements. As urbanization continues, the integration of smart city technologies will enhance public safety communication systems. Furthermore, the increasing collaboration between public and private sectors is expected to foster innovation and funding opportunities. With a focus on improving rural infrastructure, the market is likely to see a more equitable distribution of public safety resources, ultimately enhancing overall community safety.

| Segment | Sub-Segments |

|---|---|

| By Deployment Model | Private LTE Commercial LTE Hybrid LTE |

| By Spectrum/Access Model | Licensed Spectrum Shared/Dynamic Spectrum Unlicensed Spectrum Operator-Managed Network Slicing |

| By Application | Law Enforcement & Border Control Firefighting Services Emergency Medical Services Disaster Management |

| By Technology Type | LTE FDD LTE TDD LTE-Advanced G-enabled LTE Devices |

| By Device Type | Rugged Smartphones Handheld LTE Radios Vehicle-Mounted Routers Wearable Devices Body-Worn Cameras |

| By End-User | Public Safety Agencies Industrial Transport Utilities |

| By Region | Luzon Visayas Mindanao |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Safety Agencies | 100 | Chief Safety Officers, Emergency Response Coordinators |

| Telecommunications Providers | 80 | Network Engineers, Business Development Managers |

| Local Government Units | 70 | City Planners, Public Safety Directors |

| First Responder Organizations | 60 | Fire Chiefs, Police Captains |

| Emergency Management Consultants | 50 | Consultants, Policy Advisors |

The Philippines Public Safety LTE market is valued at approximately USD 1.1 billion, driven by the increasing demand for reliable communication systems among public safety agencies and government initiatives aimed at modernizing emergency response services.