Region:Asia

Author(s):Geetanshi

Product Code:KRAA3290

Pages:93

Published On:September 2025

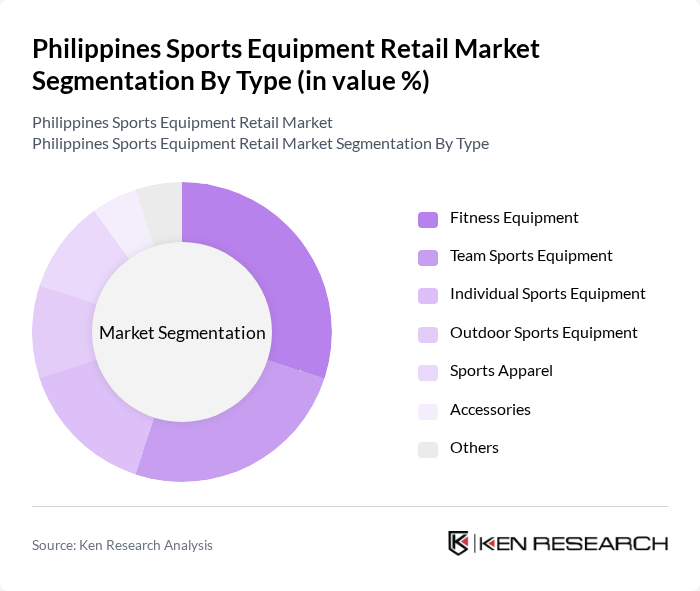

By Type:The market is segmented into fitness equipment, team sports equipment, individual sports equipment, outdoor sports equipment, sports apparel, accessories, and others. Each sub-segment addresses distinct consumer needs, reflecting diverse interests in fitness, organized sports, and recreational activities. The growing demand for performance-enhancing and sustainable products, as well as the integration of smart features in fitness gear, is shaping product innovation and customization .

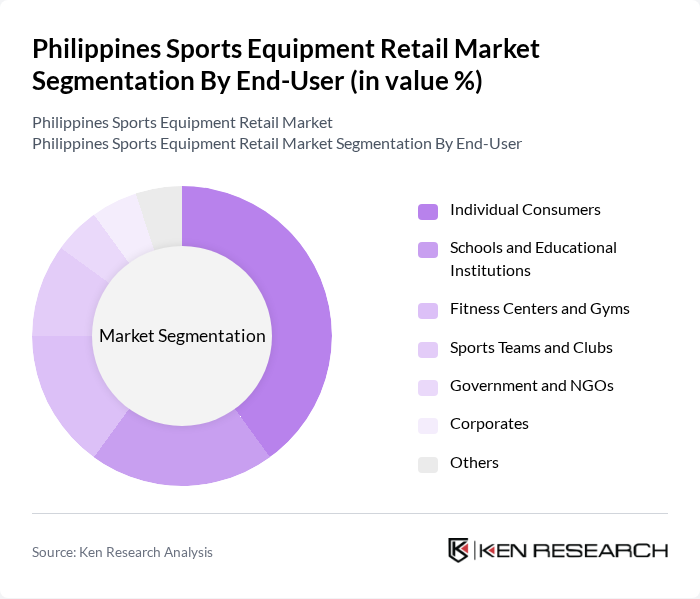

By End-User:The end-user segmentation includes individual consumers, schools and educational institutions, fitness centers and gyms, sports teams and clubs, government and NGOs, corporates, and others. This segmentation highlights the broad customer base driving demand for sports equipment in the Philippines, with individual consumers and educational institutions representing the largest segments. The rise of fitness centers and gyms, as well as the growing involvement of corporates in wellness initiatives, further contribute to market expansion .

The Philippines Sports Equipment Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Decathlon Philippines, Toby's Sports, Sports Central, Olympic Village, Chris Sports, Nike Philippines, Adidas Philippines, Under Armour Philippines, Mizuno Philippines, Asics Philippines, Puma Philippines, Wilson Sporting Goods Philippines, Head Philippines, Yonex Philippines, and Salomon Philippines contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Philippines sports equipment retail market appears promising, driven by increasing health awareness and a growing interest in sports participation. As e-commerce continues to thrive, retailers are likely to enhance their online presence, catering to the evolving shopping preferences of consumers. Additionally, the integration of technology in sports equipment and the rise of eco-friendly products are expected to shape market dynamics, providing opportunities for innovation and differentiation in a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Fitness Equipment (e.g., treadmills, stationary bikes, weights, resistance bands) Team Sports Equipment (e.g., basketballs, volleyballs, footballs, nets, protective gear) Individual Sports Equipment (e.g., tennis rackets, badminton rackets, golf clubs, table tennis paddles) Outdoor Sports Equipment (e.g., bicycles, skateboards, scooters, camping gear) Sports Apparel (e.g., jerseys, shorts, shoes, athleisure wear) Accessories (e.g., water bottles, gym bags, sports watches, fitness trackers) Others (e.g., yoga mats, swimming gear, martial arts equipment) |

| By End-User | Individual Consumers Schools and Educational Institutions Fitness Centers and Gyms Sports Teams and Clubs Government and NGOs Corporates Others |

| By Sales Channel | Online Retail (e-commerce platforms, brand websites) Brick-and-Mortar Stores (specialty sports stores, department stores) Wholesale Distributors Direct Sales Sports Events and Expos Others |

| By Price Range | Budget Mid-Range Premium Luxury Others |

| By Brand Type | Local Brands (e.g., Toby's Sports, Chris Sports, Olympic Village) International Brands (e.g., Nike, Adidas, Decathlon, Under Armour, Puma, Asics, Mizuno, Wilson, Yonex, Head, Salomon) Private Labels Others |

| By Distribution Mode | Direct Distribution Indirect Distribution Franchise Models Others |

| By Customer Segment | Casual Users Professional Athletes Fitness Enthusiasts Recreational Players Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sales Analysis | 100 | Store Managers, Retail Buyers |

| Consumer Preferences Survey | 120 | Active Sports Participants, Fitness Enthusiasts |

| Brand Loyalty Assessment | 80 | Brand Managers, Marketing Executives |

| Product Usage Feedback | 60 | Athletes, Coaches |

| Market Trend Insights | 70 | Industry Analysts, Retail Consultants |

The Philippines Sports Equipment Retail Market is valued at approximately USD 570 million, reflecting a significant growth trend driven by increased health consciousness, sports participation, and the expansion of e-commerce platforms, making sports equipment more accessible to consumers.