Region:Asia

Author(s):Dev

Product Code:KRAD6406

Pages:87

Published On:December 2025

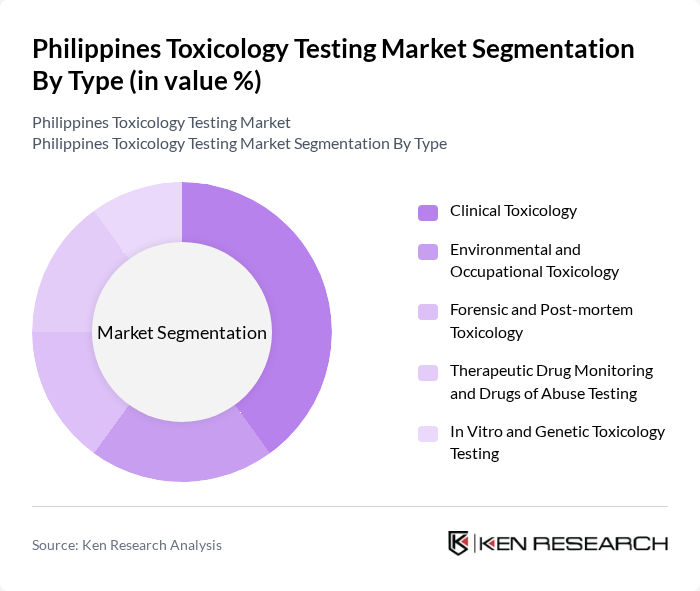

By Type:The market can be segmented into various types of toxicology testing, including Clinical Toxicology, Environmental and Occupational Toxicology, Forensic and Post-mortem Toxicology, Therapeutic Drug Monitoring and Drugs of Abuse Testing, and In Vitro and Genetic Toxicology Testing. Clinical toxicology and drugs of abuse-related testing collectively represent the leading portion of demand, supported by hospital-based diagnostic services, emergency care, and routine drug screening in institutional settings. Among these, Clinical Toxicology is the leading segment due to the increasing prevalence of drug-related health issues, poisoning and overdose cases, and the need for accurate diagnosis and treatment monitoring in tertiary and secondary care hospitals.

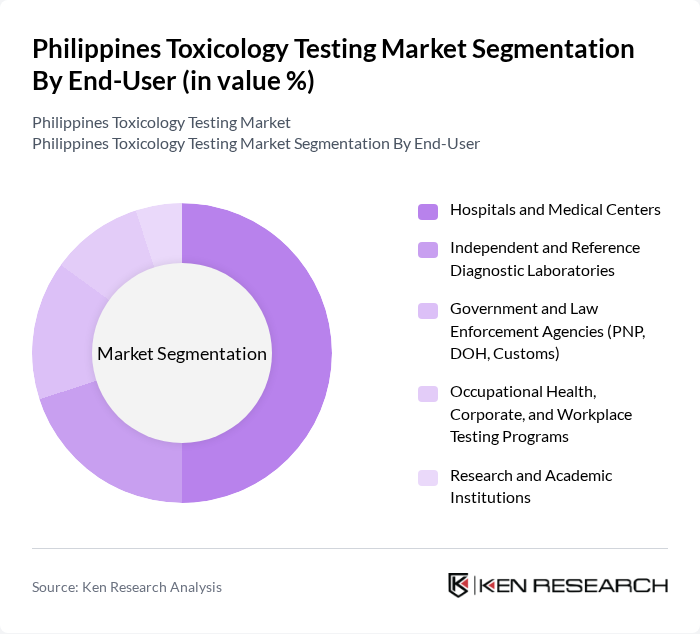

By End-User:The end-users of toxicology testing services include Hospitals and Medical Centers, Independent and Reference Diagnostic Laboratories, Government and Law Enforcement Agencies, Occupational Health, Corporate, and Workplace Testing Programs, and Research and Academic Institutions. Hospitals and Medical Centers dominate this segment, reflecting the central role of hospital and clinical laboratories in overall diagnostic testing volume in the Philippines and their involvement in emergency care, therapeutic drug monitoring, and management of poisoning and overdose cases. Independent and reference diagnostic laboratories, along with government and law enforcement agencies such as the Philippine National Police and customs authorities, also contribute significantly through outsourced drug screening and forensic toxicology services.

The Philippines Toxicology Testing Market is characterized by a dynamic mix of regional and international players. Leading participants such as St. Luke's Medical Center, The Medical City, Makati Medical Center, Philippine General Hospital, University of the Philippines – National Institutes of Health, Research Institute for Tropical Medicine, Hi-Precision Diagnostics, The Medical City – CLINICA Drug Testing and Diagnostic Center, Philippine Drug Enforcement Agency (PDEA) – Laboratory Service, National Bureau of Investigation (NBI) – Forensic Chemistry Division, Philippine National Police Crime Laboratory (PNP CL), Cardinal Santos Medical Center, Chong Hua Hospital, Cebu Doctors’ University Hospital, Manila Doctors Hospital contribute to innovation, geographic expansion, and service delivery in this space.

The future of the toxicology testing market in the Philippines appears promising, driven by technological advancements and increasing public health awareness. As the government continues to implement stricter drug testing laws, the demand for reliable testing solutions will likely rise. Additionally, the integration of artificial intelligence in testing processes is expected to enhance accuracy and efficiency. These trends indicate a robust growth trajectory for the market, with significant opportunities for innovation and expansion in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Clinical Toxicology Environmental and Occupational Toxicology Forensic and Post-mortem Toxicology Therapeutic Drug Monitoring and Drugs of Abuse Testing In Vitro and Genetic Toxicology Testing |

| By End-User | Hospitals and Medical Centers Independent and Reference Diagnostic Laboratories Government and Law Enforcement Agencies (PNP, DOH, Customs) Occupational Health, Corporate, and Workplace Testing Programs Research and Academic Institutions |

| By Sample Type | Blood Samples Urine Samples Hair and Nail Samples Saliva and Breath Samples Tissue, Organ, and Other Specialized Samples |

| By Testing Method | Immunoassays (ELISA, CLIA and Rapid Tests) Chromatography (HPLC, GC) Mass Spectrometry (LC-MS/MS, GC-MS) In Silico and High-throughput Screening Methods |

| By Application | Workplace and Pre-employment Drug Screening Clinical Diagnosis and Therapeutic Drug Monitoring Forensic Investigations and Post-accident Testing Environmental and Industrial Exposure Assessment Research, Drug Development, and Regulatory Toxicology |

| By Region | Luzon Visayas Mindanao |

| By Policy Support | Government-funded Public Health and Drug Screening Programs Accreditation and Quality Assurance Initiatives (DOH, ISO, CAP) Research Grants and International Donor-funded Projects Tax Incentives and Investment Support for Laboratory Expansion |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Toxicology Testing | 100 | Laboratory Managers, Quality Assurance Officers |

| Environmental Toxicology Assessments | 80 | Environmental Scientists, Regulatory Compliance Officers |

| Food Safety Testing | 70 | Food Safety Inspectors, Quality Control Managers |

| Industrial Chemical Testing | 60 | Safety Managers, Chemical Engineers |

| Academic Research in Toxicology | 50 | Research Scientists, University Professors |

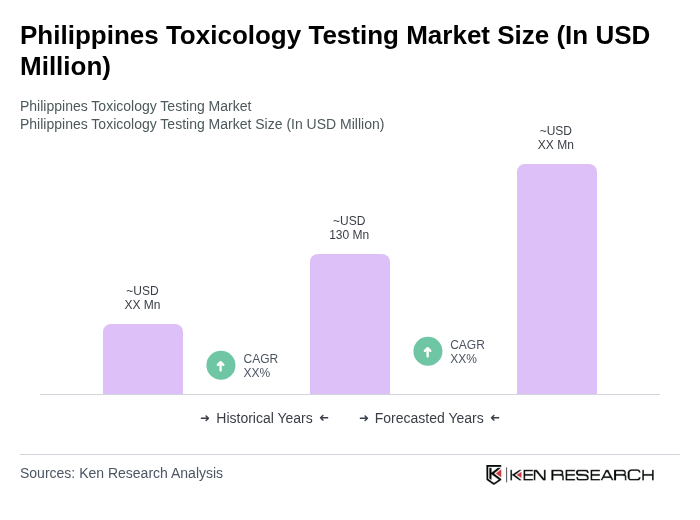

The Philippines Toxicology Testing Market is valued at approximately USD 130 million, reflecting a comprehensive analysis of drug screening and clinical laboratory services in the country over the past five years.