Region:Europe

Author(s):Rebecca

Product Code:KRAA6866

Pages:87

Published On:September 2025

By Type:The market is segmented into various types of financing options, including personal car loans, business car loans, operating leases, finance leases, car subscription services, fleet leasing, and others. Personal car loans and operating leases are particularly popular among consumers due to their flexibility and affordability. The increasing trend of car subscriptions is also gaining traction, especially among younger consumers who prefer access over ownership.

By End-User:The end-user segmentation includes individual consumers, small and medium enterprises (SMEs), large corporations, and government entities. Individual consumers represent a significant portion of the market, driven by the increasing preference for personal vehicles. SMEs are also a growing segment, as they seek flexible financing options to manage their transportation needs efficiently.

The Poland Car Finance & Leasing Market is characterized by a dynamic mix of regional and international players. Leading participants such as PKO Bank Polski, Santander Consumer Bank, mBank, Getin Noble Bank, Alior Bank, Raiffeisen Polbank, Volkswagen Financial Services, Toyota Financial Services, LeasePlan, Arval, BNP Paribas Leasing Solutions, PKO Leasing, ING Lease, Cetelem, Credit Agricole contribute to innovation, geographic expansion, and service delivery in this space.

The Poland car finance and leasing market is poised for significant transformation in the coming years, driven by technological advancements and changing consumer preferences. The shift towards digital financing platforms is expected to streamline the application process, enhancing customer experience. Additionally, the growing emphasis on sustainability will likely lead to increased financing options for electric vehicles, aligning with government initiatives. As these trends evolve, the market will adapt, presenting new opportunities for growth and innovation in vehicle financing solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Car Loans Business Car Loans Operating Leases Finance Leases Car Subscription Services Fleet Leasing Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Government Entities |

| By Vehicle Type | Passenger Cars Commercial Vehicles Electric Vehicles Luxury Vehicles |

| By Financing Type | Secured Loans Unsecured Loans Leases |

| By Duration | Short-term Financing Medium-term Financing Long-term Financing |

| By Payment Structure | Fixed Payments Variable Payments Balloon Payments |

| By Distribution Channel | Direct Sales Online Platforms Dealerships Brokers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Car Financing | 150 | Individual Car Buyers, Financial Advisors |

| Corporate Leasing Solutions | 100 | Fleet Managers, Procurement Officers |

| Dealership Financing Practices | 80 | Sales Managers, Finance Managers |

| Leasing Company Insights | 70 | Business Development Managers, Risk Analysts |

| Consumer Preferences in Leasing vs. Buying | 90 | Car Owners, Financial Planners |

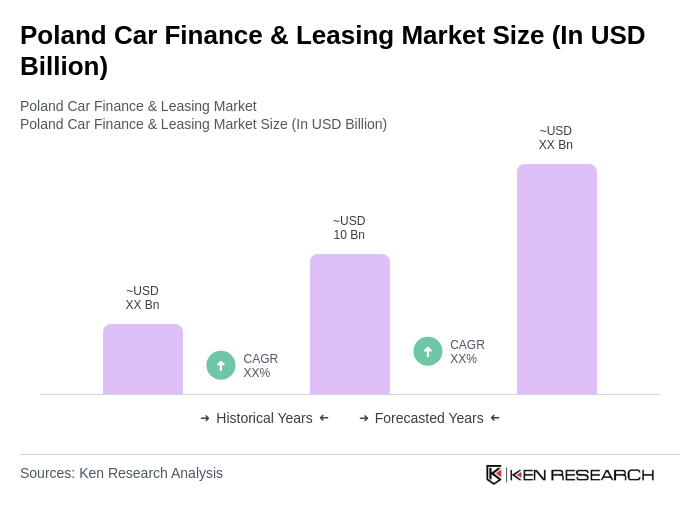

The Poland Car Finance & Leasing Market is valued at approximately USD 10 billion, driven by increasing consumer demand for vehicles and favorable financing options. This growth reflects a robust market environment supported by competitive interest rates and rising disposable incomes.