Region:Asia

Author(s):Rebecca

Product Code:KRAB6393

Pages:88

Published On:October 2025

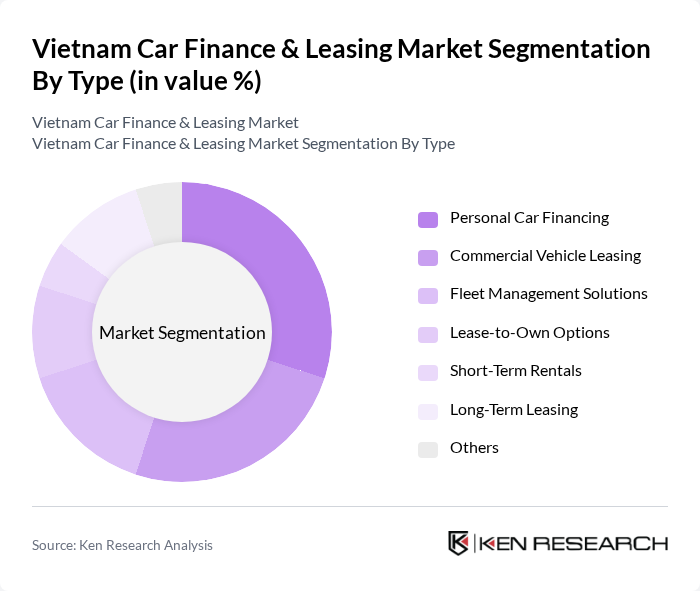

By Type:The market is segmented into various types of financing and leasing options, including personal car financing, commercial vehicle leasing, fleet management solutions, lease-to-own options, short-term rentals, long-term leasing, and others. Each of these segments caters to different consumer needs and preferences, reflecting the diverse landscape of vehicle financing in Vietnam.

The personal car financing segment is currently dominating the market, driven by the increasing number of individual consumers seeking affordable financing options for vehicle ownership. This trend is supported by favorable loan terms and a growing preference for personal vehicles over public transport. The rise in disposable income among the middle class has further fueled this demand, making personal car financing a key player in the overall market.

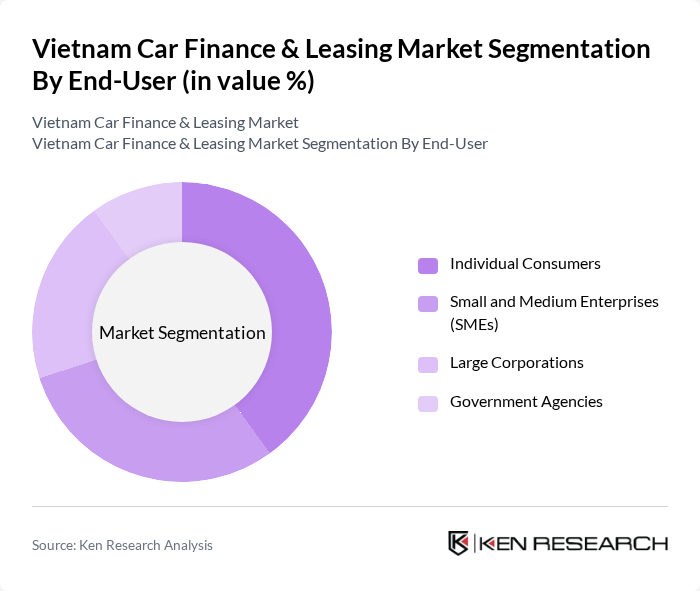

By End-User:The market is segmented by end-users, including individual consumers, small and medium enterprises (SMEs), large corporations, and government agencies. Each segment has distinct financing needs and preferences, influencing the overall dynamics of the car finance and leasing market.

The individual consumers segment is the largest in the market, driven by the increasing demand for personal vehicles among the growing middle class. This demographic is more inclined to seek financing options that offer flexibility and affordability, leading to a significant market share for individual consumers. The rise in urbanization and disposable income further supports this trend, making it a critical segment for financial institutions.

The Vietnam Car Finance & Leasing Market is characterized by a dynamic mix of regional and international players. Leading participants such as VietinBank, BIDV, Techcombank, VPBank, Maritime Bank, MBBank, Sacombank, HDBank, ANZ Vietnam, Shinhan Bank Vietnam, VietCapital Bank, LienVietPostBank, Saigon-Hanoi Bank, Eximbank, ACB contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam car finance and leasing market is poised for significant transformation as urbanization accelerates and disposable incomes rise. In the future, the market is expected to witness a shift towards digital financing platforms, enhancing accessibility for consumers. Additionally, the growing interest in electric vehicles will likely drive innovative financing solutions, enabling more individuals to transition to sustainable mobility options. As these trends unfold, the market will adapt to meet evolving consumer preferences and regulatory frameworks.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Car Financing Commercial Vehicle Leasing Fleet Management Solutions Lease-to-Own Options Short-Term Rentals Long-Term Leasing Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Government Agencies |

| By Financing Type | Traditional Loans Leasing Agreements Hire Purchase Balloon Payment Financing |

| By Vehicle Type | Sedans SUVs Trucks Vans |

| By Duration of Financing | Short-Term Financing Medium-Term Financing Long-Term Financing |

| By Payment Structure | Fixed Payment Plans Variable Payment Plans Deferred Payment Plans |

| By Region | Northern Vietnam Central Vietnam Southern Vietnam Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Car Financing | 150 | Car Buyers, Financial Advisors |

| Leasing Options for Businesses | 100 | Fleet Managers, Business Owners |

| Banking Sector Insights | 80 | Loan Officers, Risk Managers |

| Dealership Financing Practices | 70 | Sales Managers, Finance Managers |

| Consumer Attitudes towards Leasing | 90 | Potential Lessees, Market Researchers |

The Vietnam Car Finance & Leasing Market is valued at approximately USD 3.5 billion, driven by increasing disposable incomes, urbanization, and a growing middle class seeking affordable vehicle ownership options.