Region:Central and South America

Author(s):Rebecca

Product Code:KRAB6396

Pages:95

Published On:October 2025

By Type:The market can be segmented into various types of financing options available to consumers and businesses. These include personal loans, commercial loans, lease financing, hire purchase, balloon payment financing, operating lease, and others. Each type serves different consumer needs and preferences, influencing the overall market dynamics.

The personal loans segment is currently dominating the market due to the increasing number of individual consumers seeking financing options for vehicle purchases. This trend is driven by the rising disposable income and the growing preference for personal vehicles over public transportation. Additionally, the ease of access to personal loans through various financial institutions has made it a popular choice among consumers. Commercial loans also hold a significant share, as businesses increasingly seek financing for fleet purchases to enhance operational efficiency.

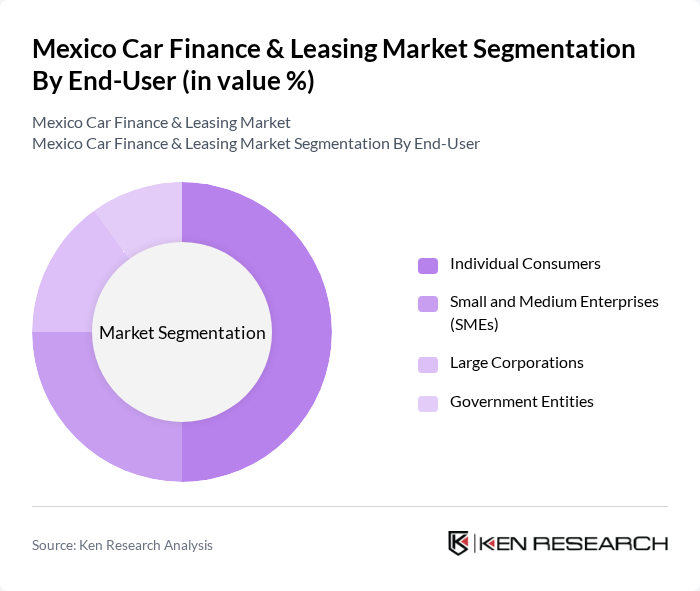

By End-User:The market can also be segmented based on the end-users of car financing, which includes individual consumers, small and medium enterprises (SMEs), large corporations, and government entities. Each of these segments has distinct financing needs and preferences, influencing the overall market landscape.

The individual consumers segment is the largest in the market, driven by the increasing number of people seeking personal vehicles for convenience and mobility. The rise in disposable income and favorable financing options have made it easier for individuals to secure loans. SMEs also represent a significant portion of the market as they seek financing for vehicle purchases to support their operations. Large corporations and government entities, while smaller in comparison, still contribute to the market through fleet purchases and operational needs.

The Mexico Car Finance & Leasing Market is characterized by a dynamic mix of regional and international players. Leading participants such as BBVA Bancomer, Santander Mexico, Citibanamex, Scotiabank Mexico, Banorte, Volkswagen Financial Services, Ford Credit Mexico, Nissan Financial Services, Toyota Financial Services, General Motors Financial, Honda Financial Services, Mercedes-Benz Financial Services, Kia Motors Finance, Hyundai Capital Mexico, CrediAuto contribute to innovation, geographic expansion, and service delivery in this space.

The Mexico car finance and leasing market is poised for transformation, driven by technological advancements and changing consumer preferences. The shift towards digital financing platforms is expected to enhance accessibility and streamline the application process, attracting a broader customer base. Additionally, the increasing focus on sustainability will likely drive demand for electric vehicle financing, as consumers become more environmentally conscious. These trends indicate a dynamic market landscape that will evolve to meet the needs of modern consumers.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Loans Commercial Loans Lease Financing Hire Purchase Balloon Payment Financing Operating Lease Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Government Entities |

| By Vehicle Type | Passenger Cars Commercial Vehicles Electric Vehicles Luxury Vehicles |

| By Financing Type | Fixed Rate Financing Variable Rate Financing Lease-to-Own Financing |

| By Duration | Short-Term Financing Medium-Term Financing Long-Term Financing |

| By Distribution Channel | Direct Sales Online Platforms Dealerships |

| By Customer Segment | First-Time Buyers Repeat Buyers Fleet Buyers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Car Financing | 150 | Car Buyers, Financial Advisors |

| Leasing Company Insights | 100 | Leasing Managers, Financial Analysts |

| Dealership Financing Practices | 80 | Dealership Owners, Sales Managers |

| Regulatory Impact Assessment | 60 | Policy Makers, Regulatory Experts |

| Consumer Preferences in Leasing | 90 | Leased Vehicle Users, Market Researchers |

The Mexico Car Finance & Leasing Market is valued at approximately USD 15 billion, driven by increasing consumer demand for vehicles, favorable financing options, and a growing middle class with rising disposable incomes.