Region:Asia

Author(s):Rebecca

Product Code:KRAB6395

Pages:97

Published On:October 2025

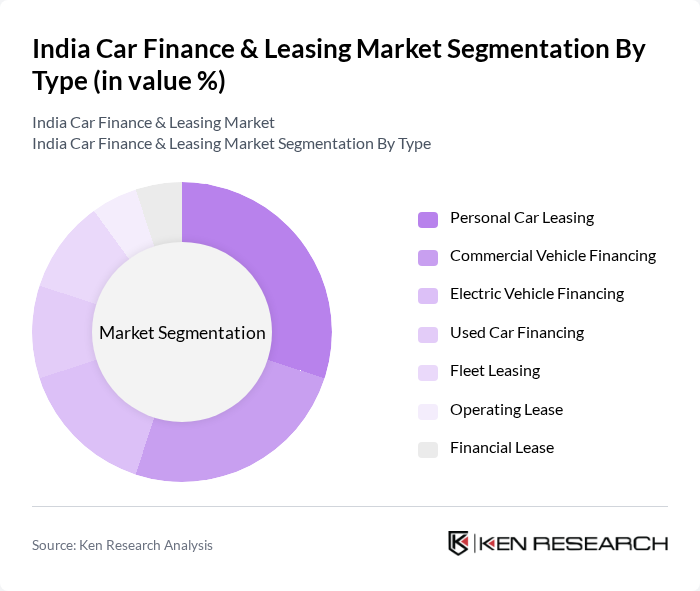

By Type:The segmentation by type includes various financing options available in the market. The subsegments are Personal Car Leasing, Commercial Vehicle Financing, Electric Vehicle Financing, Used Car Financing, Fleet Leasing, Operating Lease, and Financial Lease. Each of these subsegments caters to different consumer needs and preferences, reflecting the diverse landscape of car financing in India.

The Personal Car Leasing segment is currently dominating the market due to the increasing trend of urbanization and the growing preference for flexible financing options among consumers. This segment appeals to individuals who prefer to drive new vehicles without the long-term commitment of ownership. The convenience of lower monthly payments and the ability to upgrade to newer models frequently are significant factors driving this trend. Additionally, the rise in digital platforms facilitating easy access to leasing options has further boosted this segment's growth.

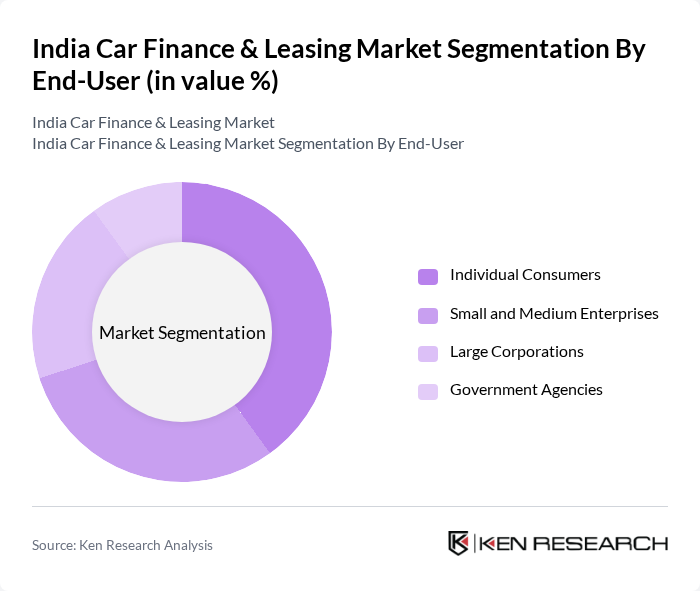

By End-User:The segmentation by end-user includes Individual Consumers, Small and Medium Enterprises, Large Corporations, and Government Agencies. Each of these end-users has distinct financing needs and preferences, influencing the overall dynamics of the car finance and leasing market.

The Individual Consumers segment is the largest in the market, driven by the increasing purchasing power and changing lifestyle preferences of the urban population. Consumers are increasingly opting for financing options that allow them to manage their budgets effectively while enjoying the benefits of vehicle ownership. The rise of digital financing platforms has also made it easier for individuals to access car loans and leasing options, further propelling this segment's growth.

The India Car Finance & Leasing Market is characterized by a dynamic mix of regional and international players. Leading participants such as HDFC Bank, ICICI Bank, Axis Bank, Mahindra Finance, Tata Capital, SBI Bank, Kotak Mahindra Bank, Bajaj Finserv, Yes Bank, IndusInd Bank, Shriram Transport Finance, Maruti Suzuki Finance, Toyota Financial Services, Ford Credit India, Mahindra First Choice Wheels contribute to innovation, geographic expansion, and service delivery in this space.

The India car finance and leasing market is poised for significant transformation as consumer preferences shift towards more sustainable and flexible financing solutions. The rise of electric vehicles (EVs) and the increasing adoption of digital platforms for financing applications are expected to reshape the landscape. Additionally, partnerships with ride-sharing companies will create new avenues for growth, enhancing accessibility and affordability for consumers. As these trends evolve, the market will likely witness innovative financing models that cater to changing consumer needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Car Leasing Commercial Vehicle Financing Electric Vehicle Financing Used Car Financing Fleet Leasing Operating Lease Financial Lease |

| By End-User | Individual Consumers Small and Medium Enterprises Large Corporations Government Agencies |

| By Region | North India South India East India West India |

| By Financing Type | Lease Financing Loan Financing Hire Purchase |

| By Vehicle Type | Hatchbacks Sedans SUVs Luxury Cars |

| By Duration | Short-term Leasing Long-term Leasing |

| By Policy Support | Subsidies for Electric Vehicles Tax Exemptions for Leasing Government Financing Schemes |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Car Financing Options | 150 | Financial Advisors, Loan Officers |

| Leasing Market Insights | 100 | Leasing Managers, Automotive Finance Executives |

| Consumer Preferences in Car Financing | 200 | Car Buyers, Financial Decision Makers |

| Impact of Digital Platforms on Financing | 80 | Digital Marketing Managers, IT Specialists in Finance |

| Regulatory Impact on Car Financing | 70 | Policy Makers, Compliance Officers |

The India Car Finance & Leasing Market is valued at approximately INR 1,200 billion, driven by increasing disposable incomes, a growing middle class, and a rising demand for both personal and commercial vehicles.