Region:Europe

Author(s):Rebecca

Product Code:KRAB6408

Pages:81

Published On:October 2025

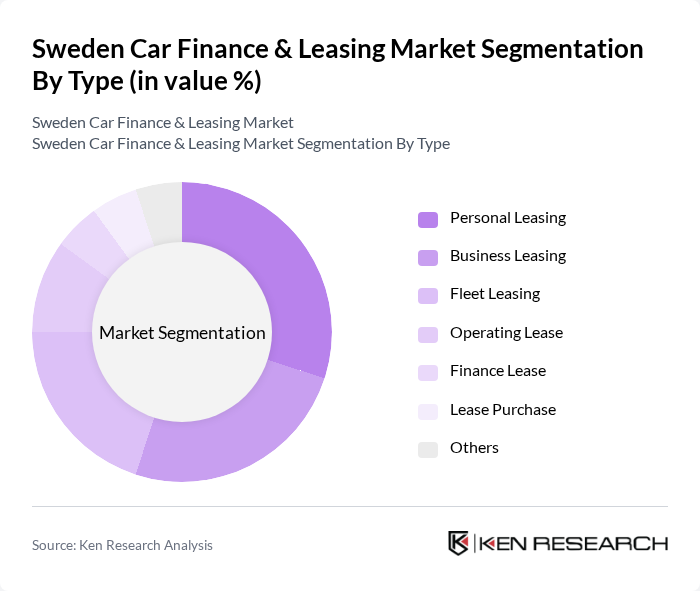

By Type:The market is segmented into various types of leasing options, including Personal Leasing, Business Leasing, Fleet Leasing, Operating Lease, Finance Lease, Lease Purchase, and Others. Each type caters to different consumer needs and preferences, influencing the overall market dynamics.

The Personal Leasing segment is currently dominating the market due to its appeal among individual consumers who prefer the flexibility and lower upfront costs associated with leasing. This trend is particularly strong among younger demographics who prioritize access to the latest vehicle models without the long-term commitment of ownership. Additionally, the rise of digital platforms has made it easier for consumers to compare leasing options, further driving the popularity of personal leasing.

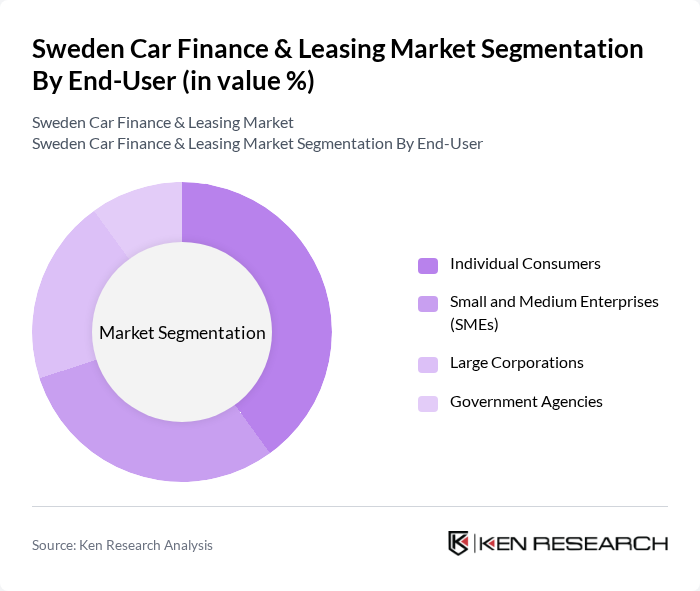

By End-User:The market is segmented by end-users, including Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, and Government Agencies. Each end-user category has distinct financing needs and preferences that shape their leasing choices.

The Individual Consumers segment leads the market, driven by a growing preference for leasing over purchasing vehicles. This trend is fueled by the desire for flexibility, lower monthly payments, and the ability to drive newer models without long-term commitments. Additionally, the increasing availability of online leasing platforms has made it easier for consumers to access and compare various leasing options, further enhancing this segment's dominance.

The Sweden Car Finance & Leasing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Volvo Financial Services, Nordea Finance, SEB Leasing, DNB Finans, Santander Consumer Bank, ALD Automotive, LeasePlan, BMW Financial Services, Mercedes-Benz Financial Services, Volkswagen Financial Services, Toyota Financial Services, Mogo Finance, Resurs Bank, Ikano Bank, Swedbank contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Sweden car finance and leasing market appears promising, driven by the increasing adoption of electric vehicles and the growing preference for digital financing solutions. As consumer awareness of sustainable transport options rises, financial institutions are likely to innovate their offerings to meet evolving demands. Additionally, the integration of advanced technologies, such as AI for credit assessments, will enhance efficiency and customer experience, positioning the market for robust growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Leasing Business Leasing Fleet Leasing Operating Lease Finance Lease Lease Purchase Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Government Agencies |

| By Vehicle Type | Passenger Cars Commercial Vehicles Electric Vehicles Luxury Vehicles |

| By Financing Type | Full-Service Leasing Maintenance Leasing Balloon Financing |

| By Duration | Short-Term Leasing Long-Term Leasing |

| By Payment Structure | Fixed Payments Variable Payments |

| By Distribution Channel | Direct Sales Online Platforms Dealerships Brokers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Car Leasing | 150 | Leasing Customers, Financial Advisors |

| Corporate Fleet Financing | 100 | Fleet Managers, Procurement Officers |

| Electric Vehicle Financing | 80 | EV Owners, Sustainability Managers |

| Dealership Financing Options | 70 | Sales Managers, Finance Directors |

| Consumer Preferences in Car Financing | 120 | Potential Car Buyers, Financial Planners |

The Sweden Car Finance & Leasing Market is valued at approximately USD 15 billion, reflecting a significant growth trend driven by consumer demand for flexible financing options and the increasing popularity of electric vehicles.