Region:Europe

Author(s):Shubham

Product Code:KRAB5081

Pages:87

Published On:October 2025

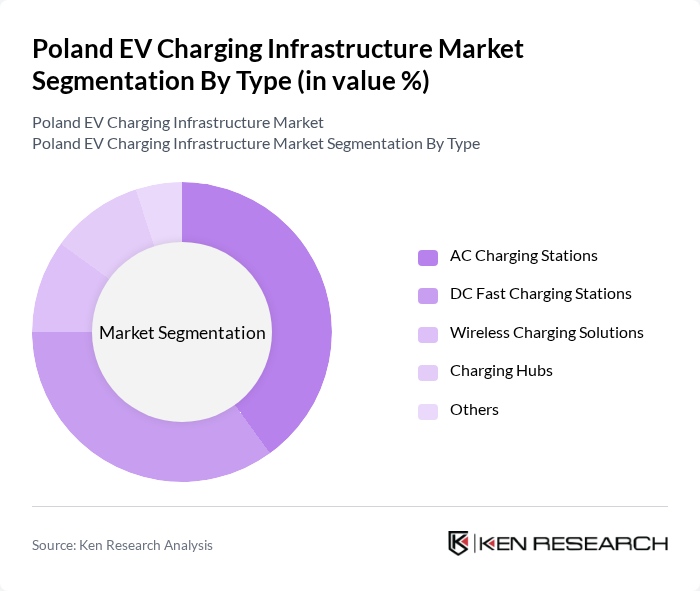

By Type:The market can be segmented into various types of charging solutions, including AC Charging Stations, DC Fast Charging Stations, Wireless Charging Solutions, Charging Hubs, and Others. Each of these sub-segments plays a crucial role in meeting the diverse needs of electric vehicle users.

The AC Charging Stations segment is currently dominating the market due to their widespread availability and lower installation costs compared to DC Fast Charging Stations. AC chargers are commonly used in residential and commercial settings, making them more accessible for everyday users. The growing trend of home charging solutions and the increasing number of public AC charging points contribute to their market leadership. Additionally, the convenience and affordability of AC charging solutions align well with consumer preferences, further solidifying their position in the market.

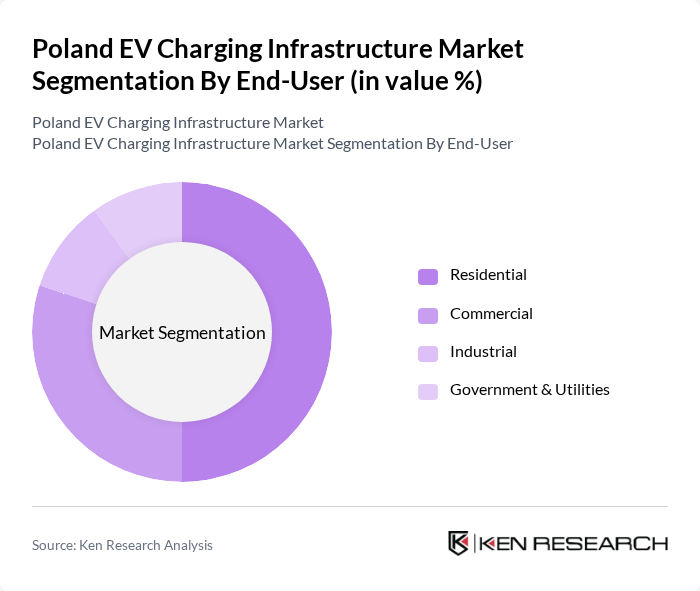

By End-User:The market can also be segmented based on end-users, including Residential, Commercial, Industrial, and Government & Utilities. Each segment has unique requirements and contributes differently to the overall market dynamics.

The Residential segment is leading the market, driven by the increasing adoption of electric vehicles among homeowners and the growing trend of home charging installations. As more consumers invest in electric vehicles, the demand for convenient home charging solutions has surged. Additionally, government incentives and subsidies for residential charging infrastructure further bolster this segment's growth. The Commercial segment follows closely, as businesses seek to provide charging solutions for employees and customers, enhancing their sustainability initiatives.

The Poland EV Charging Infrastructure Market is characterized by a dynamic mix of regional and international players. Leading participants such as GreenWay Infrastructure, ChargePoint, EVBox, Ionity, Tesla Supercharger, Allego, Enel X, Siemens, ABB, Schneider Electric, E.ON, RWE, Engie, EDF, Vattenfall contribute to innovation, geographic expansion, and service delivery in this space.

The future of Poland's EV charging infrastructure market appears promising, driven by increasing government support and technological advancements. With the anticipated rise in electric vehicle adoption, the demand for charging stations is expected to grow significantly. The integration of smart grid technologies and renewable energy sources will enhance the efficiency and sustainability of charging solutions. Additionally, public-private partnerships are likely to play a crucial role in expanding the charging network, particularly in underserved rural areas, ensuring a more comprehensive infrastructure development.

| Segment | Sub-Segments |

|---|---|

| By Type | AC Charging Stations DC Fast Charging Stations Wireless Charging Solutions Charging Hubs Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Public Charging Private Charging Fleet Charging Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) Others |

| By Charging Speed | Level 1 Charging Level 2 Charging Level 3 Charging |

| By Ownership Model | Publicly Owned Privately Owned Hybrid Ownership Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Charging Station Operators | 100 | Operations Managers, Business Development Executives |

| Private Charging Solutions Providers | 80 | Product Managers, Technical Directors |

| EV Users and Owners | 150 | Individual Consumers, Fleet Managers |

| Government Policy Makers | 60 | Urban Planners, Environmental Policy Advisors |

| Automotive Manufacturers | 70 | Product Development Managers, Sustainability Officers |

The Poland EV Charging Infrastructure Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by government initiatives, consumer awareness of sustainability, and the expanding electric vehicle market.