Region:Asia

Author(s):Dev

Product Code:KRAB3063

Pages:85

Published On:October 2025

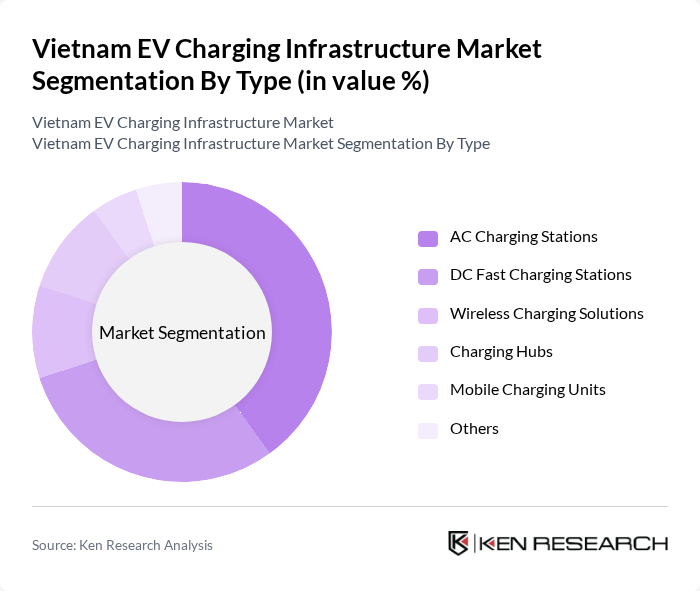

By Type:The market can be segmented into various types of charging solutions, including AC Charging Stations, DC Fast Charging Stations, Wireless Charging Solutions, Charging Hubs, Mobile Charging Units, and Others. Each type serves different consumer needs and preferences, with AC and DC charging stations being the most widely used due to their efficiency and speed.

The AC Charging Stations segment leads the market due to their widespread availability and lower installation costs compared to DC Fast Charging Stations. AC stations are commonly used in residential areas and workplaces, making them accessible for daily charging needs. However, DC Fast Charging Stations are gaining traction, especially in urban areas, due to their ability to charge vehicles quickly, catering to consumers who prioritize convenience and time efficiency.

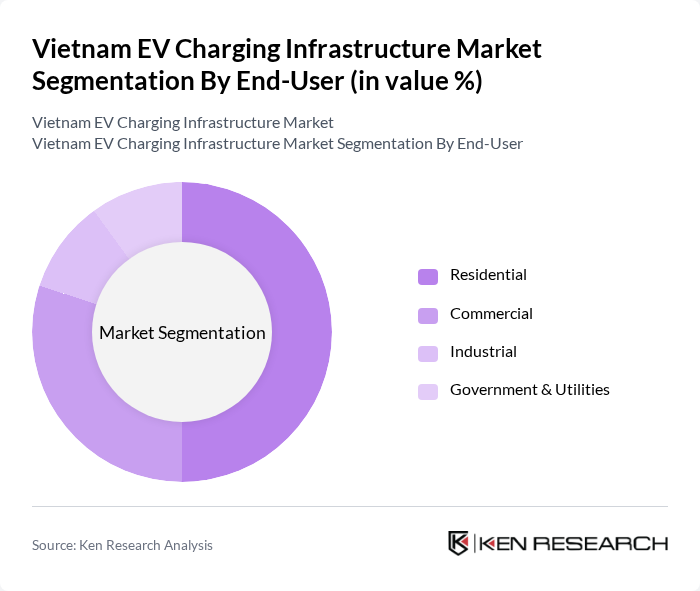

By End-User:The market is segmented based on end-users, including Residential, Commercial, Industrial, and Government & Utilities. Each segment has unique requirements and usage patterns, with residential and commercial sectors being the primary drivers of demand for charging infrastructure.

The Residential segment dominates the market, driven by the increasing number of electric vehicles among households and the growing trend of home charging solutions. Consumers are increasingly investing in home charging stations to facilitate the convenience of charging their vehicles overnight. The Commercial segment follows closely, as businesses recognize the importance of providing charging facilities to attract customers and support their sustainability initiatives.

The Vietnam EV Charging Infrastructure Market is characterized by a dynamic mix of regional and international players. Leading participants such as VinFast, Siemens Vietnam, Schneider Electric Vietnam, ABB Vietnam, EVN (Electricity of Vietnam), Green Energy Solutions, GOGREEN, ChargePoint, Tesla Vietnam, Hyundai Motor Vietnam, Panasonic Vietnam, Nissan Vietnam, BYD Vietnam, TotalEnergies Vietnam, E.ON Vietnam contribute to innovation, geographic expansion, and service delivery in this space.

The future of Vietnam's EV charging infrastructure market appears promising, driven by increasing government initiatives and consumer demand for sustainable transportation. As urban areas expand and smart city projects gain momentum, the integration of EV charging solutions will become essential. Furthermore, advancements in technology and renewable energy sources will likely enhance the efficiency and accessibility of charging stations, fostering a more robust EV ecosystem. The collaboration between public and private sectors will be crucial in overcoming existing challenges and capitalizing on emerging opportunities.

| Segment | Sub-Segments |

|---|---|

| By Type | AC Charging Stations DC Fast Charging Stations Wireless Charging Solutions Charging Hubs Mobile Charging Units Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Public Charging Private Charging Fleet Charging Workplace Charging |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Grants Regulatory Support |

| By Charging Speed | Level 1 Charging Level 2 Charging Level 3 Charging |

| By Ownership Model | Publicly Owned Privately Owned Hybrid Ownership |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Government Policy Makers | 100 | Regulatory Officials, Urban Development Planners |

| Charging Station Operators | 80 | Operations Managers, Business Development Executives |

| EV Manufacturers | 70 | Product Managers, Sales Directors |

| Energy Providers | 60 | Energy Analysts, Infrastructure Development Managers |

| Urban Infrastructure Developers | 50 | Project Managers, Civil Engineers |

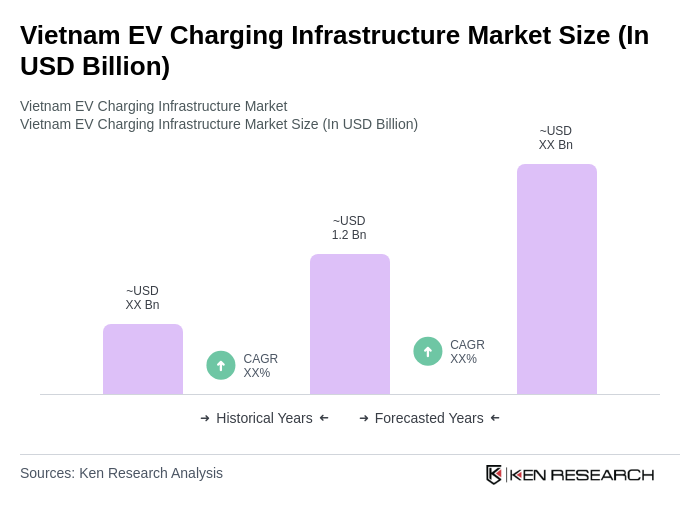

The Vietnam EV Charging Infrastructure Market is valued at approximately USD 1.2 billion, driven by the increasing adoption of electric vehicles, government initiatives for sustainable transportation, and rising consumer awareness regarding environmental issues.