Region:Europe

Author(s):Rebecca

Product Code:KRAB4125

Pages:97

Published On:October 2025

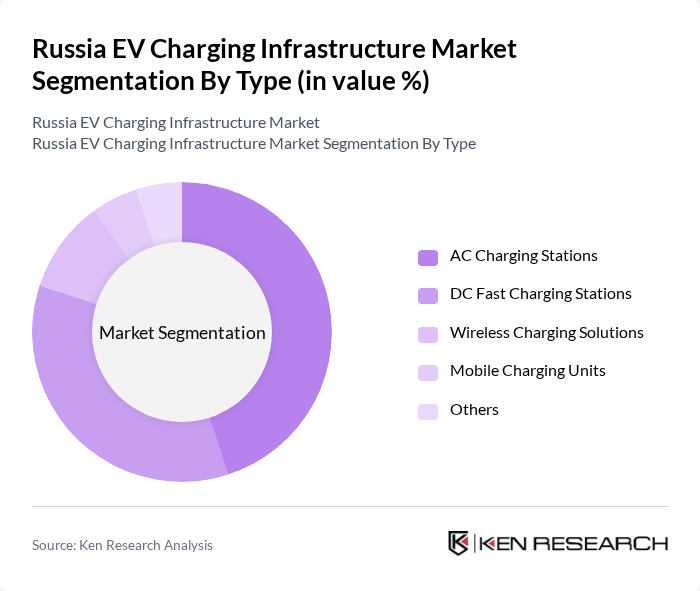

By Type:The market is segmented into various types of charging solutions, including AC Charging Stations, DC Fast Charging Stations, Wireless Charging Solutions, Mobile Charging Units, and Others. Among these, AC Charging Stations are widely used due to their cost-effectiveness and suitability for residential and commercial applications. DC Fast Charging Stations are gaining traction for their ability to charge vehicles quickly, making them ideal for public charging networks and long-distance travel corridors. Wireless Charging Solutions remain in the nascent stage but show promise for future growth as technology adoption increases. Mobile Charging Units and other specialized solutions address niche and emergency charging needs .

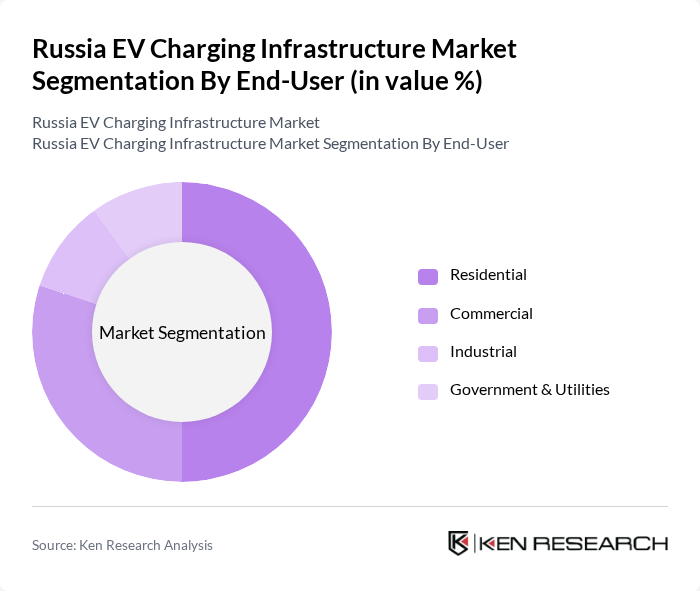

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, and Government & Utilities. The Residential segment is the largest, reflecting the increasing number of electric vehicle owners seeking convenient home charging solutions. The Commercial segment is also significant, driven by businesses and retail locations installing charging stations to attract customers and meet sustainability goals. Industrial users are adopting charging infrastructure for fleet electrification, while government and utilities are investing in public charging networks to support national electrification targets and urban mobility initiatives .

The Russia EV Charging Infrastructure Market is characterized by a dynamic mix of regional and international players. Leading participants such as Rosseti, AtomEnergo LLC (Rosatom Group), GAZ Group, KAMAZ, NPO Energoavtomatika, Kempower, Delta Electronics, Siemens, ABB (Terra), Wallbox, Hitachi, Rewatt, Shanghai MIDA EV Power, Iocharger (Xiamen Galaxy Camphol Technology Co.), and Tesla contribute to innovation, geographic expansion, and service delivery in this space .

The future of the EV charging infrastructure market in Russia appears promising, driven by increasing government initiatives and consumer demand. By 2025, the government aims to have over 5,000 charging stations operational, significantly improving accessibility. Additionally, advancements in charging technology, such as ultra-fast charging solutions, are expected to enhance user experience. As public-private partnerships grow, the market is likely to witness innovative financing models that can alleviate initial investment challenges, fostering a more robust infrastructure ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Type | AC Charging Stations DC Fast Charging Stations Wireless Charging Solutions Mobile Charging Units Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Investment Source | Domestic Investments Foreign Direct Investments (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Application | Public Charging Stations Private Charging Solutions Fleet Charging Solutions Others |

| By Distribution Mode | Direct Sales Online Sales Distributors and Resellers Others |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) Others |

| By Charging Speed | Level 1 Charging Level 2 Charging Level 3 Charging Ultra-Fast Charging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Charging Station Operators | 75 | Operations Managers, Business Development Executives |

| Private Charging Solutions Providers | 65 | Product Managers, Sales Directors |

| Municipal Authorities on EV Infrastructure | 50 | City Planners, Transportation Officials |

| EV Users and Owners | 120 | Individual Consumers, Fleet Managers |

| Energy Providers and Utilities | 55 | Energy Analysts, Strategic Planners |

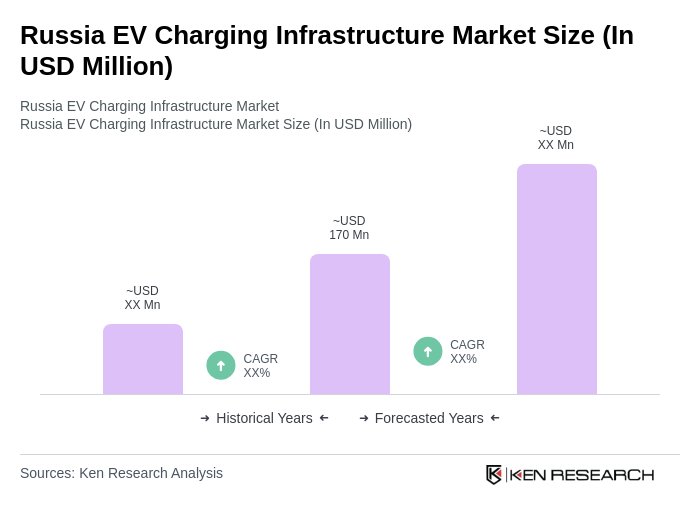

The Russia EV Charging Infrastructure Market is valued at approximately USD 170 million, reflecting significant growth driven by the increasing adoption of electric vehicles and government initiatives promoting sustainable transportation.