Region:Europe

Author(s):Rebecca

Product Code:KRAB2913

Pages:91

Published On:October 2025

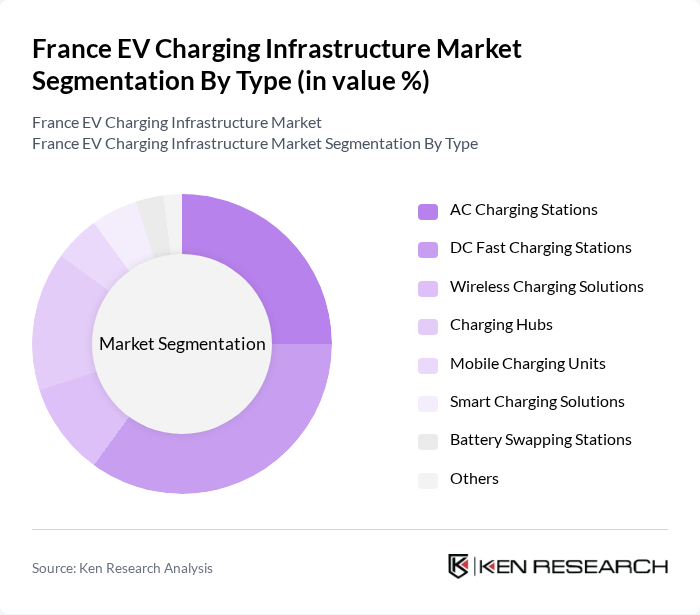

By Type:The market is segmented into various types of charging solutions, including AC Charging Stations, DC Fast Charging Stations, Wireless Charging Solutions, Charging Hubs, Mobile Charging Units, Smart Charging Solutions, Battery Swapping Stations, and Others. Each of these sub-segments addresses specific consumer needs and charging requirements, reflecting the diverse and evolving landscape of electric vehicle charging infrastructure in France. The ongoing deployment of DC fast chargers and the emergence of wireless and smart charging technologies are particularly notable trends .

The DC Fast Charging Stations segment is currently dominating the market due to the increasing demand for rapid charging solutions that minimize downtime for electric vehicle users. As consumers prioritize convenience and efficiency, the adoption of DC fast chargers has surged, particularly in urban areas and along major highways. This trend is further supported by advancements in charging technology and the expansion of charging networks, making fast charging more accessible to a broader audience .

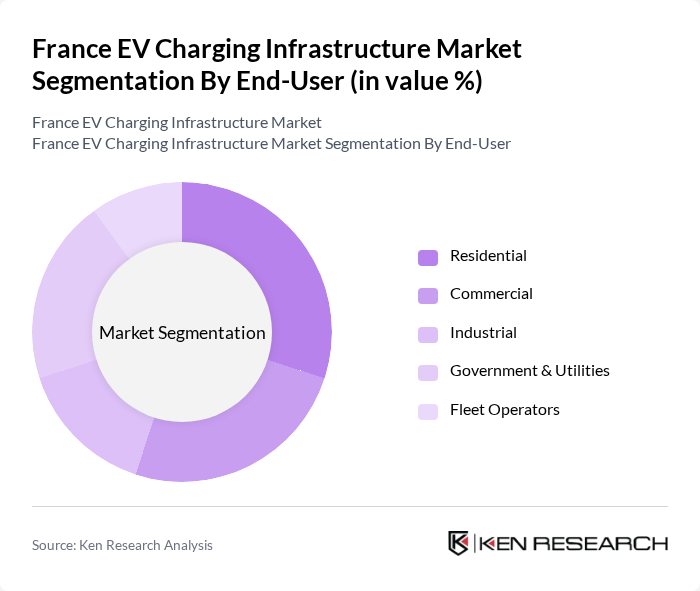

By End-User:The market is segmented by end-users into Residential, Commercial, Industrial, Government & Utilities, and Fleet Operators. Each segment has unique requirements and usage patterns, influencing the overall demand for charging infrastructure. The residential and commercial segments are experiencing strong growth, driven by both private investments and public policy incentives .

The Residential segment is leading the market as more homeowners install charging stations to support their electric vehicles. This trend is driven by government incentives, the increasing availability of home charging solutions, and heightened consumer awareness of the benefits of electric vehicles. The commercial and fleet operator segments are also expanding, supported by regulatory requirements and the electrification of corporate and municipal vehicle fleets .

The France EV Charging Infrastructure Market is characterized by a dynamic mix of regional and international players. Leading participants such as TotalEnergies, EDF (Électricité de France), Engie, EVBox, ChargePoint, Ionity, Allego, Fastned, Shell Recharge, Tesla, ABB, Siemens, Wallbox, BP Pulse, and Alfen contribute to innovation, geographic expansion, and service delivery in this space.

The future of the France EV charging infrastructure market appears promising, driven by increasing government support and technological advancements. The government aims to have100,000 public charging points in future, significantly enhancing accessibility. Additionally, the integration of smart grid technologies will optimize energy distribution, making charging more efficient. As consumer demand for sustainable transportation grows, the market is expected to evolve, with innovative solutions emerging to address existing challenges and capitalize on new opportunities.

| Segment | Sub-Segments |

|---|---|

| By Type | AC Charging Stations DC Fast Charging Stations Wireless Charging Solutions Charging Hubs Mobile Charging Units Smart Charging Solutions Battery Swapping Stations Others |

| By End-User | Residential Commercial Industrial Government & Utilities Fleet Operators |

| By Application | Public Charging Private Charging Fleet Charging Destination Charging Highway Charging |

| By Investment Source | Private Investments Government Funding Public-Private Partnerships International Funding |

| By Policy Support | Subsidies Tax Exemptions Grants Regulatory Support |

| By Charging Speed | Level 1 Charging (?3.7 kW) Level 2 Charging (3.7–22 kW) DC Fast Charging (?50 kW) Ultra-Fast Charging (?150 kW) |

| By Distribution Mode | Direct Sales Online Sales Distributors Retail Partnerships |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Charging Infrastructure Providers | 60 | Operations Managers, Business Development Executives |

| Private Charging Station Owners | 50 | Facility Managers, Property Owners |

| EV Users and Consumers | 100 | Electric Vehicle Owners, Potential Buyers |

| Government and Regulatory Bodies | 40 | Policy Makers, Environmental Analysts |

| Automotive Manufacturers | 40 | Product Managers, R&D Engineers |

The France EV Charging Infrastructure Market is valued at approximately USD 2.1 billion, reflecting significant growth driven by the increasing adoption of electric vehicles, government incentives, and the expansion of charging networks across urban and rural areas.