Region:Africa

Author(s):Dev

Product Code:KRAB5481

Pages:93

Published On:October 2025

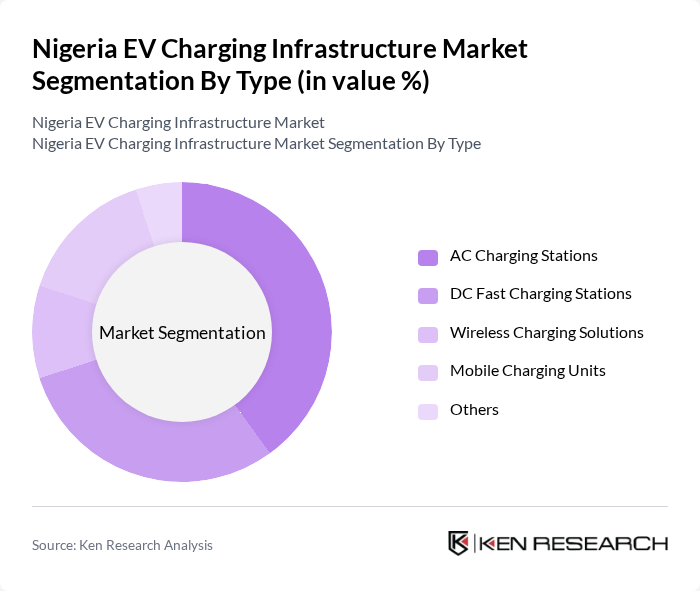

By Type:The market is segmented into various types of charging solutions, including AC Charging Stations, DC Fast Charging Stations, Wireless Charging Solutions, Mobile Charging Units, and Others. AC Charging Stations are widely used for residential and commercial applications due to their cost-effectiveness and ease of installation. DC Fast Charging Stations are gaining traction for their ability to charge vehicles quickly, making them ideal for public charging networks. Wireless Charging Solutions are emerging as a convenient option, while Mobile Charging Units provide flexibility in deployment. The "Others" category includes innovative charging technologies that are still in the development phase.

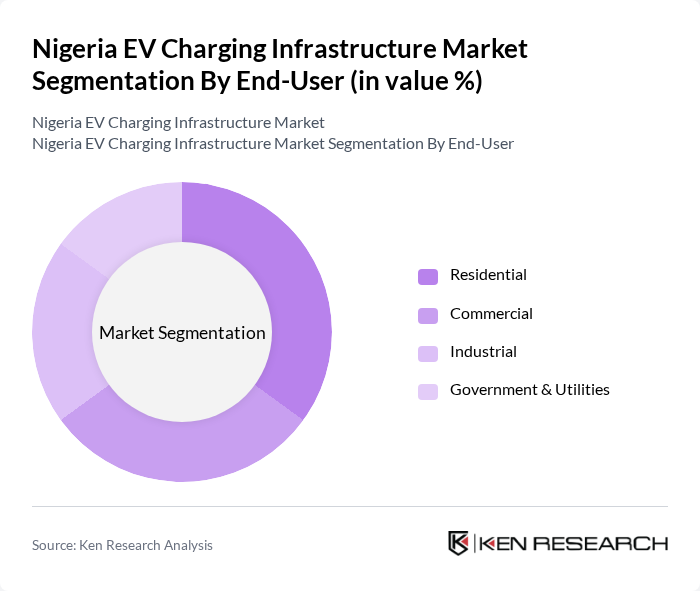

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, and Government & Utilities. The Residential segment is witnessing significant growth as more homeowners adopt electric vehicles and seek convenient charging solutions at home. The Commercial segment is also expanding, driven by businesses investing in charging infrastructure to support their fleets and attract customers. The Industrial segment is growing as companies look to reduce their carbon footprint, while Government & Utilities are investing in public charging stations to promote EV adoption.

The Nigeria EV Charging Infrastructure Market is characterized by a dynamic mix of regional and international players. Leading participants such as ChargePoint, Inc., EVBox B.V., Schneider Electric SE, Siemens AG, ABB Ltd., Blink Charging Co., Tesla, Inc., Greenlots, a Shell Group Company, Electrify America, LLC, Nuvve Corporation, Tritium DCFC Limited, Ionity GmbH, Engie SA, Volta Charging, Inc., ChargePoint Services Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of Nigeria's EV charging infrastructure market appears promising, driven by increasing government initiatives and consumer demand for sustainable transportation. As the government implements policies to enhance EV adoption, the market is expected to witness a surge in charging station installations. Furthermore, advancements in technology and partnerships with renewable energy providers will likely facilitate the development of efficient and accessible charging solutions, ultimately supporting the transition to electric mobility in Nigeria.

| Segment | Sub-Segments |

|---|---|

| By Type | AC Charging Stations DC Fast Charging Stations Wireless Charging Solutions Mobile Charging Units Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Public Charging Stations Private Charging Solutions Fleet Charging Solutions |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) |

| By Charging Speed | Slow Charging Fast Charging Ultra-Fast Charging |

| By Distribution Mode | Direct Sales Online Sales Distributors Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| EV Charging Station Operators | 100 | Operations Managers, Business Development Executives |

| Electric Vehicle Manufacturers | 80 | Product Managers, Sales Directors |

| Government Regulatory Bodies | 50 | Policy Makers, Energy Regulators |

| Consumers of Electric Vehicles | 150 | EV Owners, Potential Buyers |

| Energy Providers | 70 | Business Analysts, Strategic Planners |

The Nigeria EV Charging Infrastructure Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the increasing adoption of electric vehicles, government initiatives, and rising consumer awareness regarding environmental issues.