Region:Europe

Author(s):Geetanshi

Product Code:KRAA3662

Pages:86

Published On:September 2025

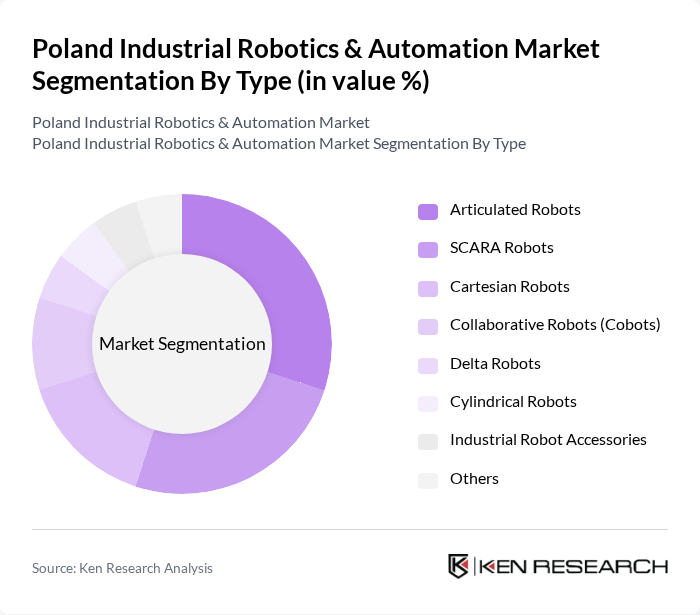

By Type:The market is segmented into various types of robots, including articulated robots, SCARA robots, Cartesian robots, collaborative robots (cobots), delta robots, cylindrical robots, industrial robot accessories, and others. Articulated robots are particularly popular due to their versatility and ability to perform complex tasks in various industries. SCARA robots are favored for their speed and precision in assembly tasks, while collaborative robots are gaining traction for their safety and ease of use in human-robot collaboration, especially as cobot adoption rises in response to flexible manufacturing needs.

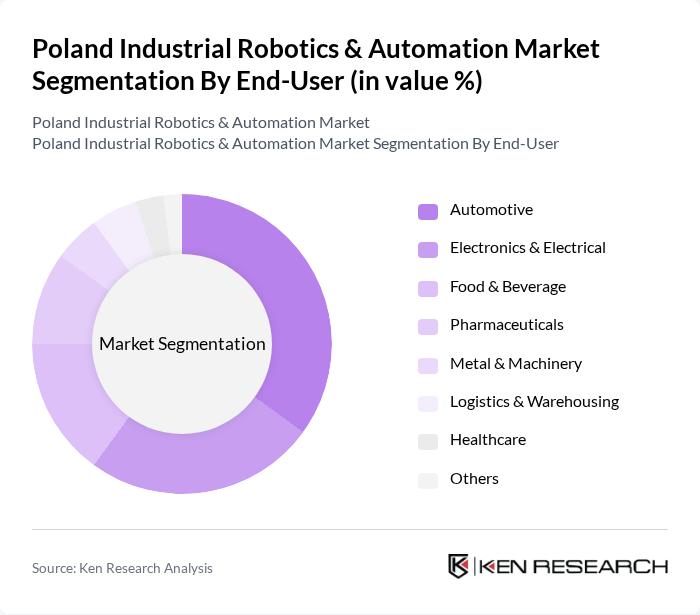

By End-User:The end-user segmentation includes automotive, electronics & electrical, food & beverage, pharmaceuticals, metal & machinery, logistics & warehousing, healthcare, and others. The automotive sector is the largest consumer of industrial robotics, driven by the need for automation in assembly lines. The electronics sector follows closely, with increasing demand for precision and efficiency in manufacturing processes. The food and beverage industry is also adopting robotics for packaging and processing tasks. Healthcare is emerging as a growth area, with robotics being deployed for patient care and medication management in response to demographic shifts.

The Poland Industrial Robotics & Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as KUKA AG, ABB Ltd., FANUC Corporation, Yaskawa Electric Corporation, Siemens AG, Mitsubishi Electric Corporation, Universal Robots A/S, Omron Corporation, Schneider Electric SE, Rockwell Automation, Inc., Epson Robots, Denso Corporation, Stäubli Robotics, Comau S.p.A., Kawasaki Heavy Industries, Ltd., ASTOR Sp. z o.o., APA Group Sp. z o.o., PIAP (Industrial Institute for Automation and Measurements), FANUC Polska Sp. z o.o., ABB Sp. z o.o. contribute to innovation, geographic expansion, and service delivery in this space.

As Poland continues to embrace automation, the industrial robotics market is expected to evolve significantly. The integration of artificial intelligence and machine learning into robotic systems will enhance operational efficiency and adaptability. Additionally, the growing trend of collaborative robots (cobots) will facilitate human-robot interaction, making automation more accessible. With government support and increasing investments in technology, the market is poised for substantial growth, driven by innovation and the need for competitive manufacturing solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Articulated Robots SCARA Robots Cartesian Robots Collaborative Robots (Cobots) Delta Robots Cylindrical Robots Industrial Robot Accessories Others |

| By End-User | Automotive Electronics & Electrical Food & Beverage Pharmaceuticals Metal & Machinery Logistics & Warehousing Healthcare Others |

| By Application | Assembly Material Handling Packaging & Palletizing Welding & Soldering Painting & Coating Inspection & Quality Control Others |

| By Component | Hardware (Sensors, Controllers, End Effectors, Drives) Software (Programming, Simulation, Analytics) Services (Installation, Maintenance, Training) |

| By Distribution Channel | Direct Sales Distributors/Integrators Online Sales |

| By Industry Vertical | Manufacturing Process Industries Logistics Healthcare Aerospace Others |

| By Region | Central Poland Northern Poland Southern Poland Western Poland Eastern Poland |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Manufacturing Automation | 85 | Production Managers, Automation Engineers |

| Electronics Assembly Robotics | 65 | Operations Directors, Quality Assurance Managers |

| Food Processing Automation | 55 | Plant Managers, Supply Chain Coordinators |

| Logistics and Warehousing Automation | 75 | Warehouse Managers, Logistics Analysts |

| Healthcare Robotics Applications | 45 | Healthcare Administrators, Robotics Specialists |

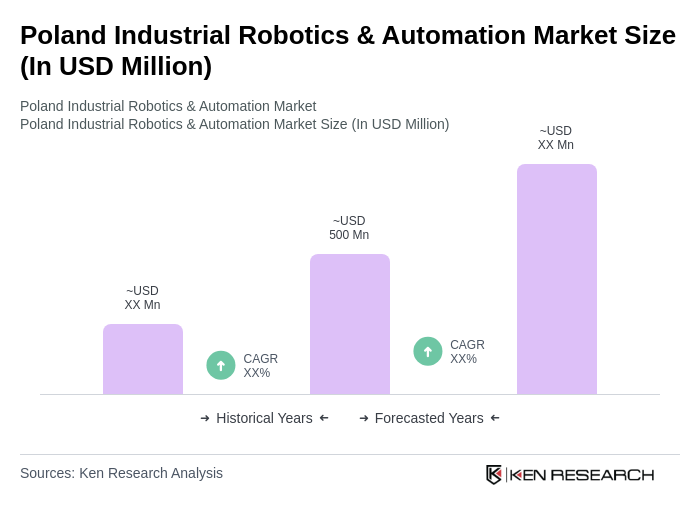

The Poland Industrial Robotics & Automation Market is valued at approximately USD 500 million, driven by the increasing demand for automation in manufacturing processes and the rise of Industry 4.0, enhancing productivity and efficiency across various sectors.