Region:Europe

Author(s):Dev

Product Code:KRAB4344

Pages:86

Published On:October 2025

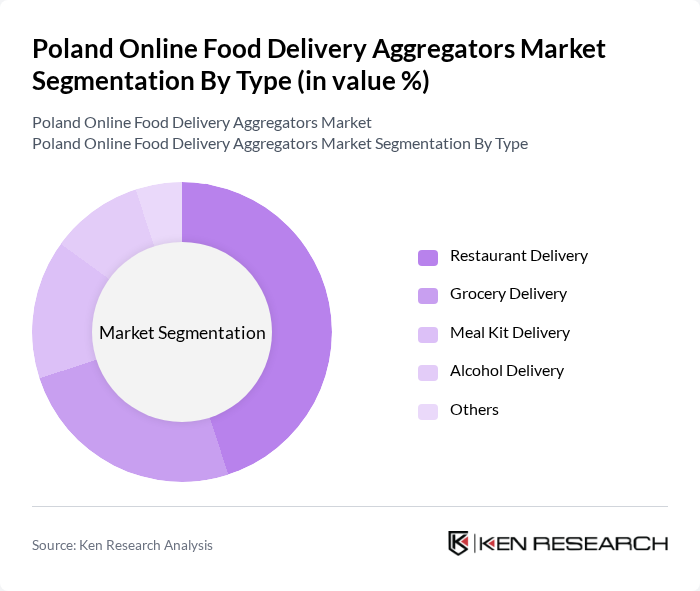

By Type:The market is segmented into various types, including Restaurant Delivery, Grocery Delivery, Meal Kit Delivery, Alcohol Delivery, and Others. Among these, Restaurant Delivery is the most dominant segment, driven by the increasing number of restaurants partnering with delivery platforms and the growing consumer preference for dining at home. Grocery Delivery is also gaining traction as consumers seek convenience in their shopping habits, especially in urban areas.

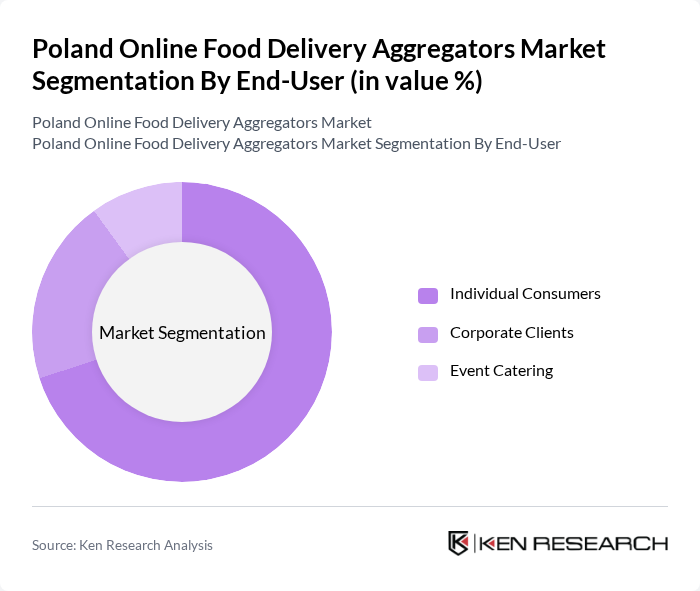

By End-User:The end-user segmentation includes Individual Consumers, Corporate Clients, and Event Catering. Individual Consumers represent the largest segment, as they account for the majority of online food orders. The convenience of ordering food for personal consumption, especially during busy workdays or weekends, drives this segment's growth. Corporate Clients and Event Catering are also significant, catering to business needs and special occasions.

The Poland Online Food Delivery Aggregators Market is characterized by a dynamic mix of regional and international players. Leading participants such as Pyszne.pl, Uber Eats, Glovo, Wolt, Deliveroo, Foodpanda, Just Eat, Zomato, Takeaway.com, LocalEats, Eat24, DoorDash, Menulog, ChowNow, Snackpass contribute to innovation, geographic expansion, and service delivery in this space.

The future of the online food delivery market in Poland appears promising, driven by technological advancements and evolving consumer preferences. As more consumers embrace digital solutions, the integration of AI for personalized recommendations will enhance user experience. Additionally, the trend towards sustainability will likely shape service offerings, with a growing emphasis on eco-friendly packaging and local sourcing. These developments will create a dynamic environment for growth and innovation in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Restaurant Delivery Grocery Delivery Meal Kit Delivery Alcohol Delivery Others |

| By End-User | Individual Consumers Corporate Clients Event Catering |

| By Delivery Mode | Standard Delivery Express Delivery Scheduled Delivery |

| By Payment Method | Credit/Debit Cards Digital Wallets Cash on Delivery |

| By Customer Demographics | Age Group (18-24, 25-34, 35-44, 45+) Income Level (Low, Middle, High) |

| By Cuisine Type | Italian Asian Fast Food Vegetarian/Vegan |

| By Subscription Model | Monthly Subscription Annual Subscription Pay-Per-Order |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Food Delivery | 150 | Regular Users, Occasional Users, Non-Users |

| Restaurant Partnerships and Collaborations | 100 | Restaurant Owners, Managers, Marketing Heads |

| Delivery Service Operations | 80 | Logistics Managers, Delivery Coordinators |

| Market Trends and Innovations | 70 | Industry Analysts, Market Researchers |

| Consumer Satisfaction and Feedback | 120 | Frequent Users, Feedback Providers, Social Media Influencers |

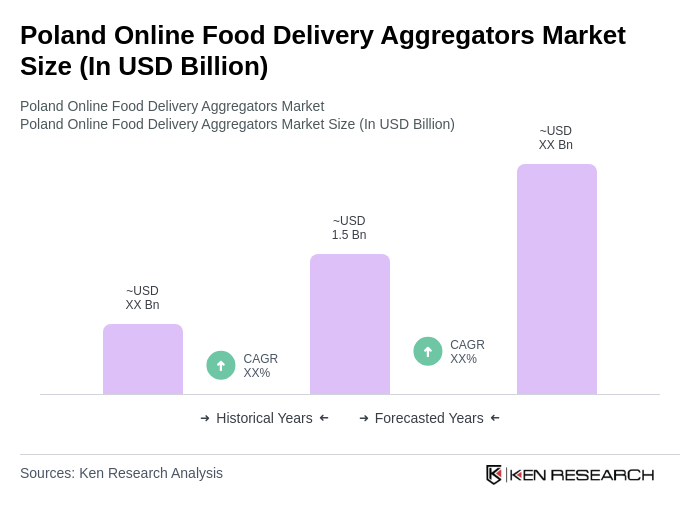

The Poland Online Food Delivery Aggregators Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by increased digital platform adoption and changing consumer preferences for convenience, particularly during the pandemic.