Region:Europe

Author(s):Geetanshi

Product Code:KRAB3390

Pages:98

Published On:October 2025

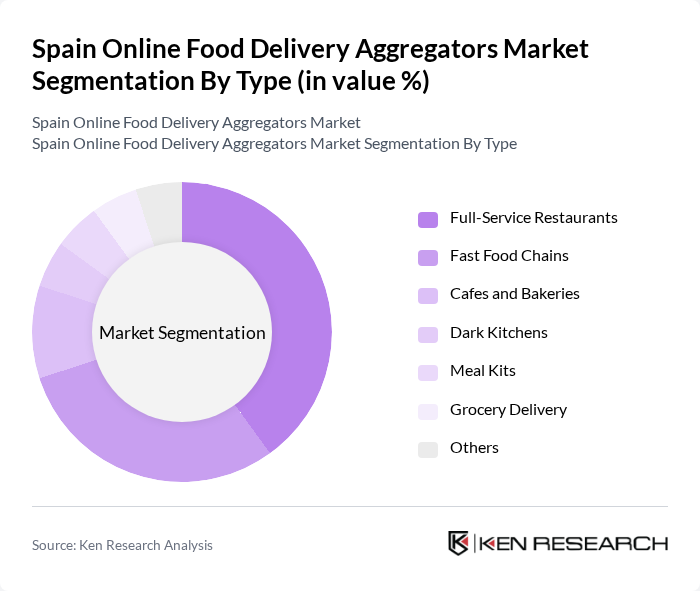

By Type:The market is segmented into various types, including Full-Service Restaurants, Fast Food Chains, Cafes and Bakeries, Dark Kitchens, Meal Kits, Grocery Delivery, and Others. Fast Food Chains currently lead the market, driven by consumer demand for quick and convenient meal options and the rise of mobile applications facilitating online orders. Full-Service Restaurants remain significant, catering to consumers seeking diverse dining experiences at home. Dark Kitchens and Grocery Delivery are emerging segments, reflecting evolving consumer preferences and operational innovations .

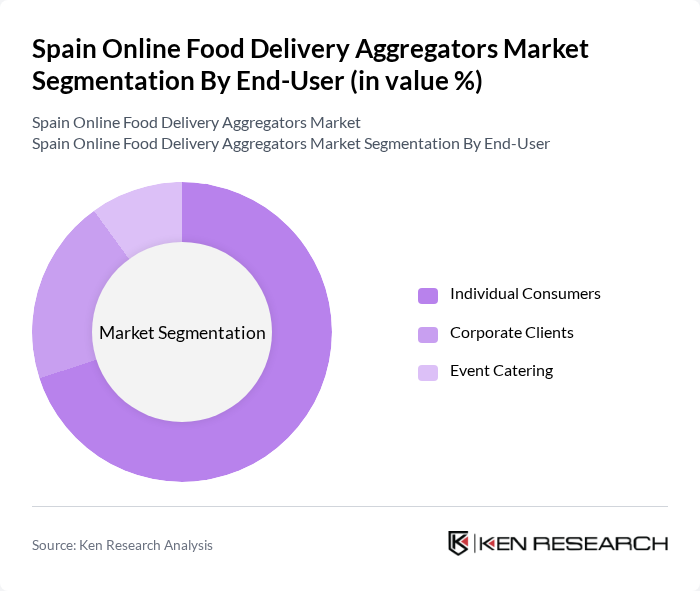

By End-User:The end-user segmentation includes Individual Consumers, Corporate Clients, and Event Catering. Individual Consumers dominate the market, driven by the increasing trend of online food ordering for personal convenience and the rise of remote work. Corporate Clients and Event Catering are growing segments, as businesses increasingly utilize food delivery services for meetings and events, but they currently represent a smaller share of the market .

The Spain Online Food Delivery Aggregators Market is characterized by a dynamic mix of regional and international players. Leading participants such as Just Eat, Glovo, Deliveroo, Uber Eats, Food Delivery Spain, Takeaway.com, Stuart, Rappi, La Nevera Roja, Wolt, Lola Market, Glovo Business, Uber Eats for Business, Just Eat for Business, TastyCloud contribute to innovation, geographic expansion, and service delivery in this space .

The future of the online food delivery market in Spain appears promising, driven by technological advancements and evolving consumer behaviors. As urbanization continues, the demand for convenient food delivery services is expected to rise. Additionally, the integration of AI and data analytics will enhance operational efficiency and customer experience. Companies that adapt to these trends and focus on sustainability will likely gain a competitive edge, positioning themselves favorably in the dynamic market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Full-Service Restaurants Fast Food Chains Cafes and Bakeries Dark Kitchens Meal Kits Grocery Delivery Others |

| By End-User | Individual Consumers Corporate Clients Event Catering |

| By Sales Channel | Mobile Applications Websites Third-Party Platforms |

| By Delivery Mode | On-Demand Delivery Scheduled Delivery |

| By Cuisine Type | Italian Asian Mediterranean Fast Food Vegan/Vegetarian |

| By Pricing Strategy | Premium Mid-Range Budget |

| By Customer Loyalty Programs | Points-Based Systems Subscription Services Referral Discounts |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Usage Patterns | 120 | Frequent Users of Food Delivery Apps |

| Restaurant Partnerships | 60 | Restaurant Owners and Managers |

| Market Trends Analysis | 50 | Industry Analysts and Market Researchers |

| Delivery Service Evaluation | 40 | Logistics and Operations Managers |

| Consumer Satisfaction Insights | 70 | Customers Providing Feedback on Delivery Services |

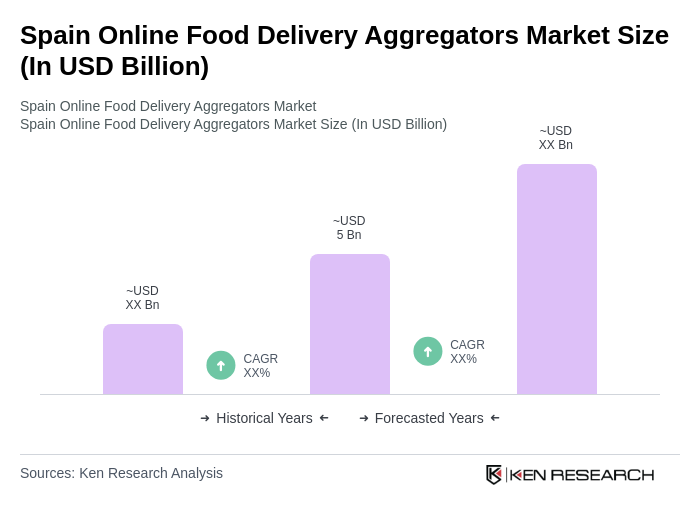

The Spain Online Food Delivery Aggregators Market is valued at approximately USD 5 billion, reflecting significant growth driven by increased digital platform adoption and changing consumer preferences towards convenience, especially during the pandemic.