Region:Europe

Author(s):Rebecca

Product Code:KRAB2891

Pages:87

Published On:October 2025

By Type:The market is segmented into Fresh Produce, Packaged Groceries, Beverages, Household Supplies, Personal Care Products, Pet Supplies, Organic & Health Foods, Frozen Foods, Bakery & Confectionery, and Others. Among these,Fresh Produceis the leading segment, accounting for over half of the total market revenue, reflecting the increasing focus on healthy eating and demand for high-quality, perishable goods.Packaged Groceriesremain significant due to their convenience and suitability for busy urban lifestyles. The growing popularity of organic and health foods, as well as the integration of specialty categories such as pet supplies and frozen foods, further diversifies the market offering .

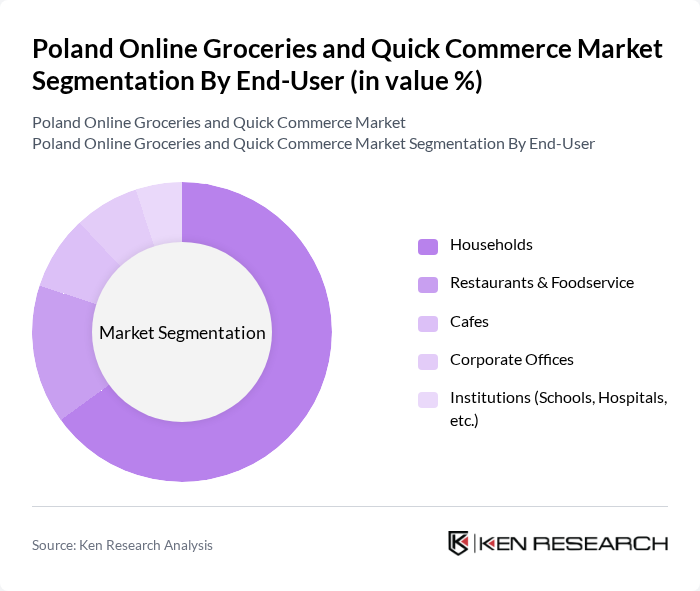

By End-User:The end-user segmentation includes Households, Restaurants & Foodservice, Cafes, Corporate Offices, and Institutions (Schools, Hospitals, etc.).Householdsrepresent the largest segment, driven by the convenience of online shopping, the rise of dual-income families, and increased digital literacy. Restaurants and foodservice providers are also significant users, leveraging online platforms for bulk purchasing and rapid delivery, particularly in urban areas where quick commerce solutions are most prevalent .

The Poland Online Groceries and Quick Commerce Market is characterized by a dynamic mix of regional and international players. Leading participants such as ?abka Polska Sp. z o.o., Carrefour Polska Sp. z o.o., Lidl Polska Sp. z o.o., Auchan Polska Sp. z o.o., Frisco.pl Sp. z o.o., Glovoapp23 S.L., Pyszne.pl Sp. z o.o., Kaufland Polska Markety Sp. z o.o., Makro Cash and Carry Polska S.A., Biedronka (Jeronimo Martins Polska S.A.), Lisek.App Sp. z o.o., Bolt Market Polska Sp. z o.o., JOKR Polska Sp. z o.o., Polomarket Sp. z o.o., Delikatesy Centrum Sp. z o.o. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the online groceries and quick commerce market in Poland appears promising, driven by technological advancements and evolving consumer preferences. As more consumers embrace digital shopping, retailers are likely to invest in enhancing user experiences through personalized services and efficient delivery systems. Additionally, sustainability initiatives will play a crucial role in shaping market dynamics, as consumers increasingly prioritize eco-friendly practices in their purchasing decisions, influencing brand loyalty and market growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Fresh Produce Packaged Groceries Beverages Household Supplies Personal Care Products Pet Supplies Organic & Health Foods Frozen Foods Bakery & Confectionery Others |

| By End-User | Households Restaurants & Foodservice Cafes Corporate Offices Institutions (Schools, Hospitals, etc.) |

| By Sales Channel | Direct-to-Consumer Platforms (e.g., Frisco.pl, Auchan Direct) Third-Party Marketplaces (e.g., Allegro, Glovo, Pyszne.pl) Quick Commerce Apps (e.g., JOKR, Lisek.App, Bolt Market) Subscription Services |

| By Distribution Mode | Home Delivery Click and Collect In-Store Pickup |

| By Price Range | Budget Mid-Range Premium |

| By Consumer Demographics | Age Group Income Level Urban vs Rural |

| By Product Origin | Local Products Imported Products Organic Products |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Online Grocery Shoppers | 120 | Frequent online grocery buyers, varied demographics |

| Quick Commerce Users | 90 | Consumers using rapid delivery services for groceries |

| Retail Executives | 40 | CEOs, CMOs, and Operations Managers of grocery retailers |

| Logistics Providers | 50 | Supply Chain Managers, Delivery Service Coordinators |

| Market Analysts | 40 | Industry analysts, researchers, and consultants |

The Poland Online Groceries and Quick Commerce Market is valued at approximately USD 640 million, reflecting significant growth driven by increased e-commerce adoption and mobile commerce expansion, particularly in urban areas.