Region:Europe

Author(s):Dev

Product Code:KRAA4923

Pages:83

Published On:September 2025

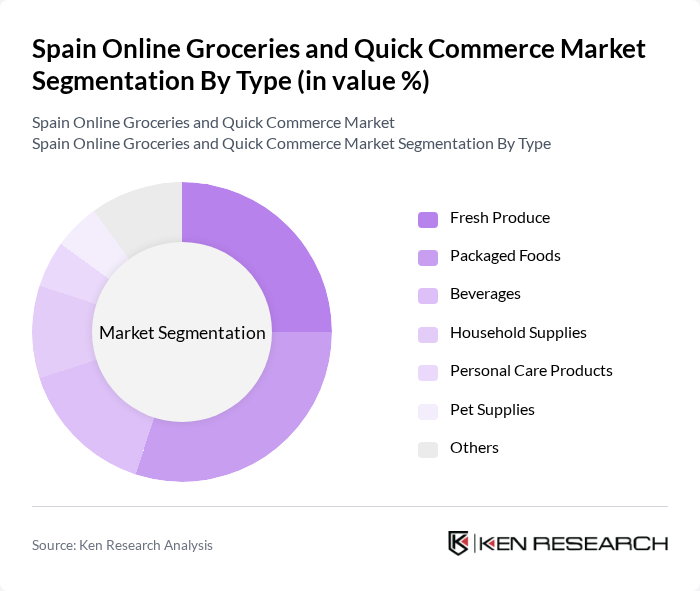

By Type:The market is segmented into various types of products, including Fresh Produce, Packaged Foods, Beverages, Household Supplies, Personal Care Products, Pet Supplies, and Others. Each of these subsegments caters to different consumer needs and preferences, with varying levels of demand and growth potential.

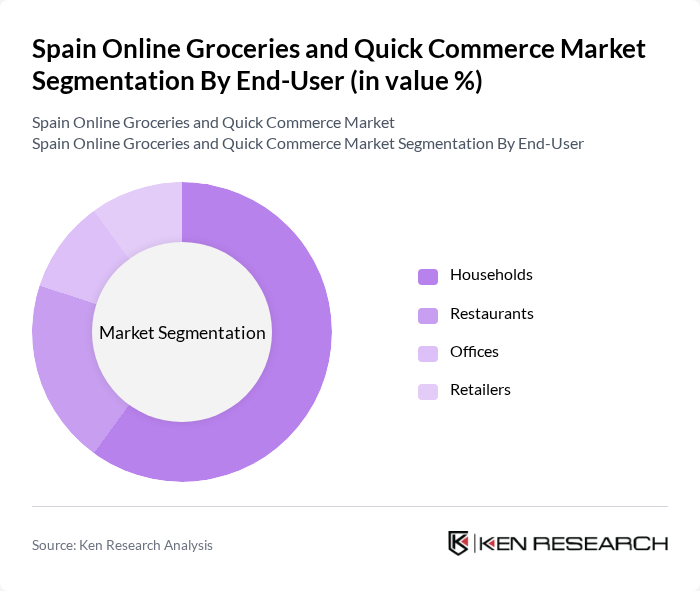

By End-User:The end-user segmentation includes Households, Restaurants, Offices, and Retailers. Each segment has distinct purchasing behaviors and requirements, influencing the overall dynamics of the online grocery market.

The Spain Online Groceries and Quick Commerce Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mercadona, Carrefour, Dia, Glovo, Just Eat, Amazon Spain, El Corte Inglés, Lidl, Ubeeqo, Colruyt, Eroski, Alcampo, Ocado, Food Delivery Spain, Tastyco contribute to innovation, geographic expansion, and service delivery in this space.

The future of the online groceries and quick commerce market in Spain appears promising, driven by technological advancements and evolving consumer preferences. As more consumers embrace digital shopping, retailers are expected to invest in enhancing user experiences through personalized services and AI-driven recommendations. Additionally, the focus on sustainability will likely shape product offerings, with an increasing number of consumers prioritizing eco-friendly options. This evolving landscape presents opportunities for growth and innovation in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Fresh Produce Packaged Foods Beverages Household Supplies Personal Care Products Pet Supplies Others |

| By End-User | Households Restaurants Offices Retailers |

| By Sales Channel | Direct-to-Consumer Third-Party Platforms Subscription Services |

| By Distribution Mode | Home Delivery Click and Collect Automated Pickup Points |

| By Price Range | Budget Mid-Range Premium |

| By Consumer Demographics | Age Group Income Level Urban vs Rural |

| By Product Origin | Local Products Imported Products Organic Products |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Online Grocery Retailers | 150 | CEOs, Marketing Directors, Operations Managers |

| Quick Commerce Platforms | 100 | Product Managers, Logistics Coordinators, Customer Experience Leads |

| Consumer Insights | 200 | Frequent Online Shoppers, Occasional Users, Non-Users |

| Delivery Service Providers | 80 | Delivery Managers, Fleet Coordinators, Customer Service Representatives |

| Market Analysts | 50 | Industry Analysts, Research Directors, Economic Advisors |

The Spain Online Groceries and Quick Commerce Market is valued at approximately USD 5 billion, reflecting significant growth driven by increased digital platform adoption and changing consumer preferences for convenience and time-saving solutions.