Region:Europe

Author(s):Geetanshi

Product Code:KRAB1446

Pages:98

Published On:October 2025

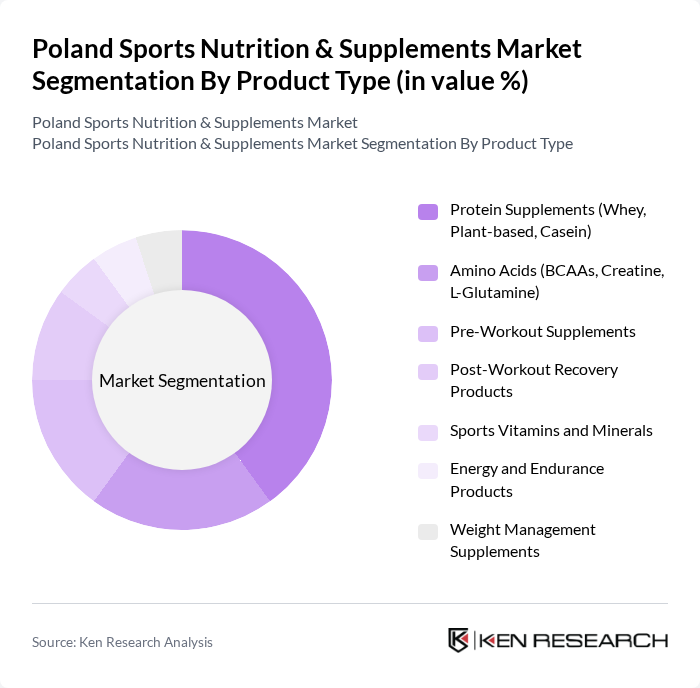

By Product Type:The product type segmentation includes various categories such as Protein Supplements (Whey, Plant-based, Casein), Amino Acids (BCAAs, Creatine, L-Glutamine), Pre-Workout Supplements, Post-Workout Recovery Products, Sports Vitamins and Minerals, Energy and Endurance Products, and Weight Management Supplements. Among these, Protein Supplements are leading the market due to their widespread acceptance among fitness enthusiasts and athletes, driven by the increasing focus on muscle recovery and growth.

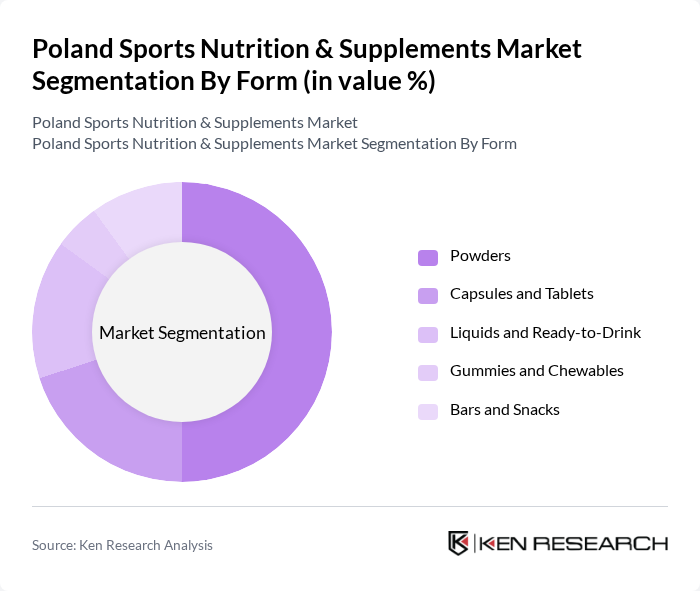

By Form:The market is segmented by form into Powders, Capsules and Tablets, Liquids and Ready-to-Drink, Gummies and Chewables, and Bars and Snacks. Powders dominate the market due to their versatility and ease of use, making them a preferred choice for consumers looking for quick and effective nutrition solutions. The convenience of mixing powders with various beverages also contributes to their popularity among athletes and fitness enthusiasts.

The Poland Sports Nutrition & Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as Olimp Laboratories Sp. z o.o., Aflofarm Farmacja Polska S.A., Trec Nutrition Sp. z o.o., Activlab Sp. z o.o., SFD S.A., KFD Nutrition Sp. z o.o., AllNutrition Sp. z o.o., BioTech USA Kft. (Poland Operations), Nutrend D.S. a.s. (Poland Branch), MyProtein (The Hut Group - Poland), Scitec Nutrition Kft. (Poland Operations), USP Health Sp. z o.o., Amway Polska Sp. z o.o., GNC Holdings LLC (Poland Franchise), Herbalife Nutrition Poland Sp. z o.o. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Poland sports nutrition and supplements market appears promising, driven by ongoing trends in health and fitness. As consumer preferences shift towards personalized nutrition and clean label products, companies are likely to innovate and adapt their offerings. Additionally, the rise of subscription services for supplements is expected to enhance customer loyalty and convenience, further solidifying the market's growth trajectory. The integration of technology in product development will also play a crucial role in shaping future offerings.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Protein Supplements (Whey, Plant-based, Casein) Amino Acids (BCAAs, Creatine, L-Glutamine) Pre-Workout Supplements Post-Workout Recovery Products Sports Vitamins and Minerals Energy and Endurance Products Weight Management Supplements |

| By Form | Powders Capsules and Tablets Liquids and Ready-to-Drink Gummies and Chewables Bars and Snacks |

| By End-User | Professional Athletes Fitness Enthusiasts and Bodybuilders Recreational Sports Participants Health-Conscious Consumers Elderly Population (Active Aging) |

| By Distribution Channel | Online Retail (E-commerce Platforms) Specialty Sports Nutrition Stores Pharmacies and Drugstores Supermarkets and Hypermarkets Gyms and Fitness Centers Direct-to-Consumer Sales |

| By Price Segment | Premium (Above 150 PLN) Mid-Range (50-150 PLN) Budget (Below 50 PLN) |

| By Source | Animal-Based Products Plant-Based Products Synthetic Products |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sports Nutrition Outlets | 100 | Store Managers, Sales Representatives |

| Fitness Centers and Gyms | 80 | Gym Owners, Personal Trainers |

| Health and Wellness Influencers | 60 | Nutrition Bloggers, Fitness Coaches |

| Professional Athletes | 50 | Competitive Athletes, Coaches |

| Dietitians and Nutritionists | 40 | Registered Dietitians, Sports Nutrition Experts |

The Poland Sports Nutrition & Supplements Market is valued at approximately USD 1.5 billion, reflecting a significant growth trend driven by increasing health consciousness and a rise in fitness activities among consumers.