Region:Asia

Author(s):Geetanshi

Product Code:KRAA7906

Pages:89

Published On:September 2025

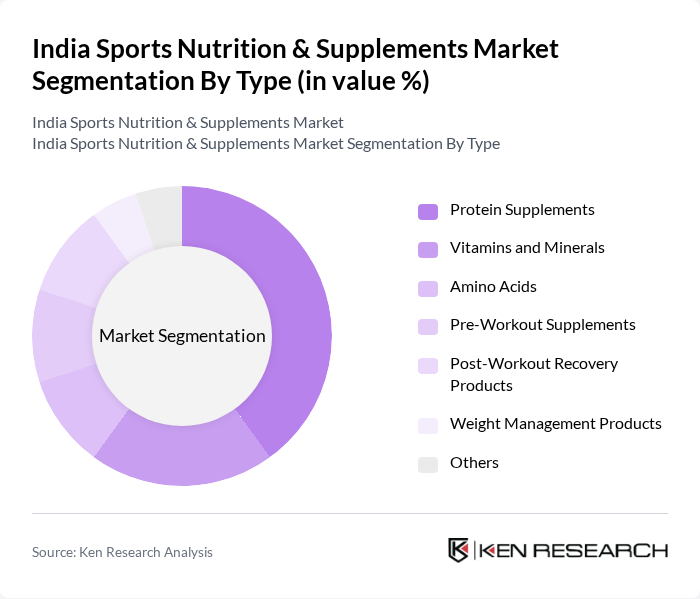

By Type:The market is segmented into various types of products, including Protein Supplements, Vitamins and Minerals, Amino Acids, Pre-Workout Supplements, Post-Workout Recovery Products, Weight Management Products, and Others. Among these, Protein Supplements dominate the market due to their essential role in muscle recovery and growth, appealing to both athletes and fitness enthusiasts. The increasing trend of protein-rich diets and the rise of plant-based protein options are also contributing to the growth of this segment.

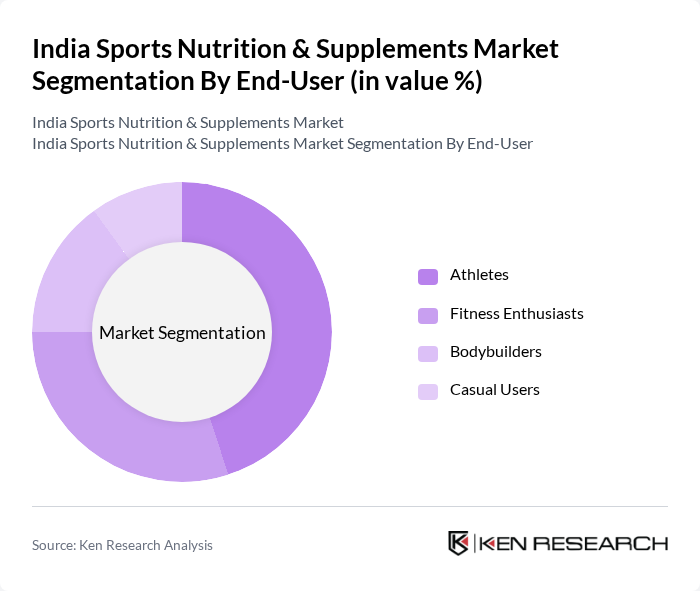

By End-User:The end-user segmentation includes Athletes, Fitness Enthusiasts, Bodybuilders, and Casual Users. Athletes represent the largest segment, driven by their need for specialized nutrition to enhance performance and recovery. The increasing participation in competitive sports and fitness events has led to a higher demand for tailored nutritional products among this group.

The India Sports Nutrition & Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as Herbalife Nutrition Ltd., Optimum Nutrition, MuscleBlaze, Myprotein, GNC Holdings, Inc., BSN (Bio-Engineered Supplements and Nutrition), Nutrabay, ProMix Nutrition, Isopure, Quest Nutrition, True Nutrition, MusclePharm, Dymatize Nutrition, Redcon1, Vega contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India sports nutrition and supplements market appears promising, driven by increasing health awareness and a growing fitness culture. As more consumers prioritize wellness, the demand for tailored nutrition solutions is expected to rise. Additionally, advancements in technology will likely enhance product development, leading to innovative offerings that cater to diverse consumer needs. Brands that adapt to these trends will be well-positioned to capture market share and drive growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Protein Supplements Vitamins and Minerals Amino Acids Pre-Workout Supplements Post-Workout Recovery Products Weight Management Products Others |

| By End-User | Athletes Fitness Enthusiasts Bodybuilders Casual Users |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Stores Pharmacies |

| By Packaging Type | Bottles Sachets Tubs Pouches |

| By Price Range | Budget Mid-Range Premium |

| By Brand Loyalty | Brand Loyal Customers Brand Switchers New Customers |

| By Region | North India South India East India West India |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fitness Enthusiasts | 150 | Athletes, Gym Members, Personal Trainers |

| Health Professionals | 100 | Nutritionists, Dietitians, Sports Coaches |

| Retailers of Sports Supplements | 80 | Store Managers, Sales Representatives |

| Online Supplement Consumers | 120 | eCommerce Shoppers, Fitness App Users |

| Sports Organizations | 70 | Team Managers, Athletic Directors |

The India Sports Nutrition & Supplements Market is valued at approximately INR 155 billion, reflecting significant growth driven by increasing health consciousness and a rise in fitness culture among the youth.