Region:Middle East

Author(s):Geetanshi

Product Code:KRAB1434

Pages:81

Published On:October 2025

By Product Category:The product category segmentation includes various types of sports nutrition products that cater to different consumer needs. The market is primarily driven by the demand for sports supplements, which include protein powders, amino acids, and creatine. Sports drinks are also gaining traction due to their convenience and effectiveness in hydration and energy replenishment, and were the largest revenue-generating segment in recent years. Other categories such as sports foods, meal replacement products, and vitamins and minerals are also significant contributors to the market. Sports foods, including energy bars and functional snacks, are the fastest-growing segment.

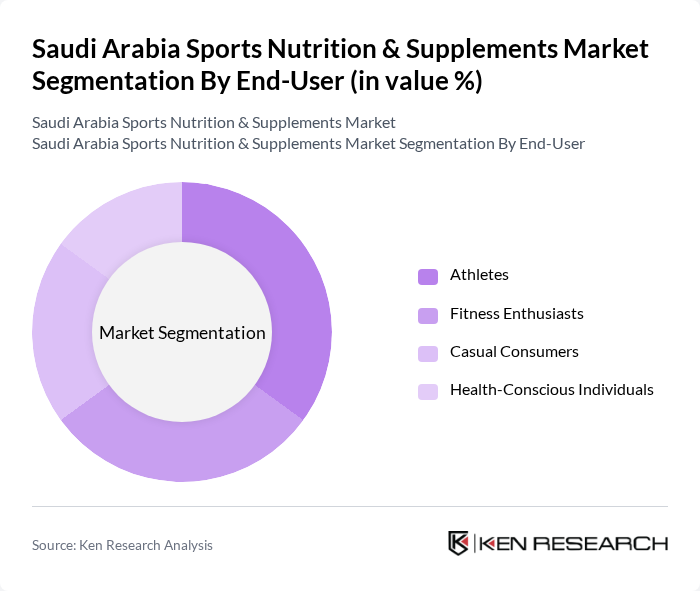

By End-User:The end-user segmentation highlights the various consumer groups that utilize sports nutrition products. Athletes represent a significant portion of the market, as they require specialized nutrition to enhance performance and recovery. Fitness enthusiasts and health-conscious individuals are also key consumers, driven by the desire to maintain a healthy lifestyle. Casual consumers are increasingly exploring these products, contributing to the overall market growth.

The Saudi Arabia Sports Nutrition & Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as Herbalife Nutrition Ltd., Optimum Nutrition (Glanbia Performance Nutrition), BSN (Bio-Engineered Supplements and Nutrition), MusclePharm Corporation, MyProtein (The Hut Group), GNC Holdings, Inc., Quest Nutrition, Dymatize Enterprises, LLC, Isagenix International LLC, PepsiCo Inc. (Gatorade), The Coca-Cola Company (Powerade), Iovate Health Sciences International (MuscleTech), Abbott Laboratories (Ensure, Glucerna), Nestlé S.A. (Nestlé Health Science), Almarai Company (Local Saudi Brand) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia sports nutrition and supplements market appears promising, driven by increasing health awareness and government support for sports initiatives. As consumer preferences shift towards plant-based and organic products, brands are likely to innovate their offerings. Additionally, the rise of digital platforms will facilitate greater access to a diverse range of products, enhancing consumer engagement. The market is expected to evolve with a focus on personalized nutrition solutions, catering to the unique needs of health-conscious consumers.

| Segment | Sub-Segments |

|---|---|

| By Product Category | Sports Supplements (Protein Powders, Amino Acids, Creatine, etc.) Sports Drinks Sports Foods (Energy Bars, Functional Snacks) Meal Replacement Products Weight Management Products Vitamins and Minerals Others (e.g., Hydration Tablets, Electrolytes) |

| By End-User | Athletes Fitness Enthusiasts Casual Consumers Health-Conscious Individuals |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Stores Pharmacies Gyms & Fitness Centers |

| By Price Range | Low Price Mid Price Premium Price |

| By Brand Type | Local Brands International Brands |

| By Packaging Type | Bottles Sachets Tubs Bars & Pouches |

| By Formulation | Powder Liquid Bars Capsules/Tablets |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sports Nutrition Outlets | 100 | Store Managers, Sales Representatives |

| Fitness Centers and Gyms | 70 | Gym Owners, Personal Trainers |

| Health and Wellness Influencers | 40 | Nutritionists, Fitness Bloggers |

| Consumer Surveys on Supplement Usage | 120 | Athletes, Fitness Enthusiasts |

| Online Retail Platforms | 50 | E-commerce Managers, Marketing Directors |

The Saudi Arabia Sports Nutrition & Supplements Market is valued at approximately USD 545 million, reflecting a significant growth trend driven by increasing health consciousness, fitness activities, and the popularity of sports among the youth.