Region:Asia

Author(s):Dev

Product Code:KRAA7239

Pages:85

Published On:September 2025

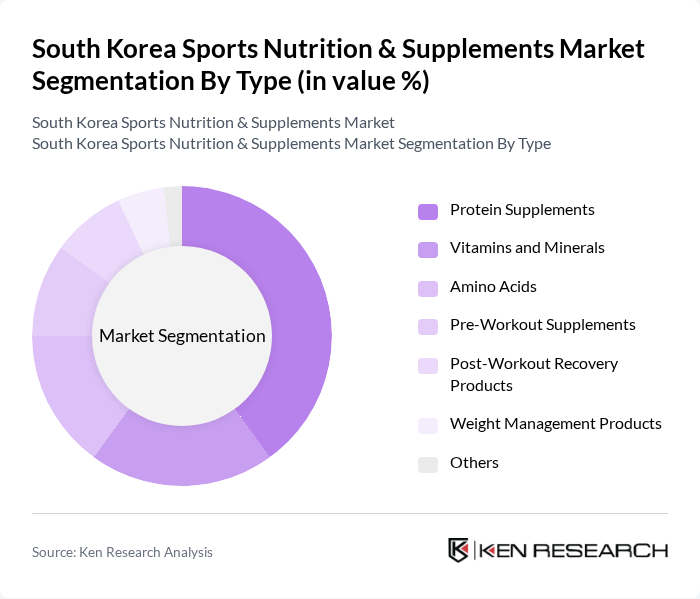

By Type:The market is segmented into various types of products, including protein supplements, vitamins and minerals, amino acids, pre-workout supplements, post-workout recovery products, weight management products, and others. Among these, protein supplements dominate the market due to their widespread use among athletes and fitness enthusiasts seeking to enhance muscle recovery and growth. The increasing trend of fitness and bodybuilding has led to a significant rise in the consumption of protein-based products, making them a preferred choice for consumers.

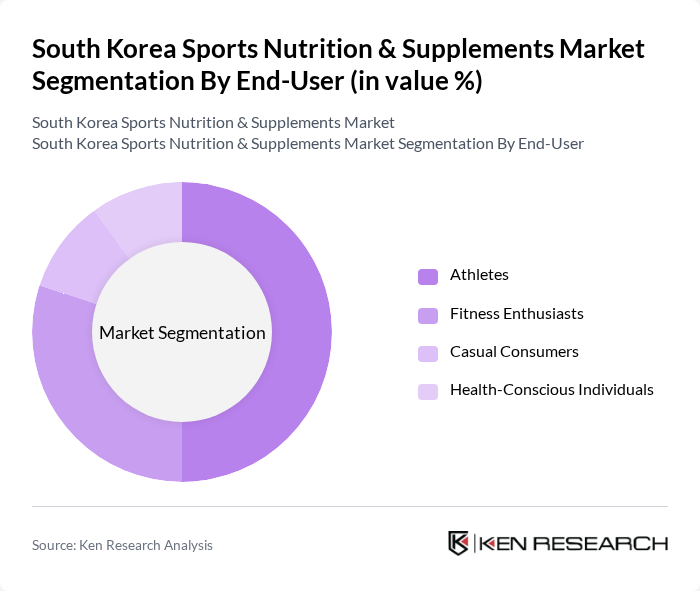

By End-User:The end-user segmentation includes athletes, fitness enthusiasts, casual consumers, and health-conscious individuals. Athletes represent the largest segment, as they require specialized nutrition to enhance performance and recovery. Fitness enthusiasts also contribute significantly to the market, driven by the growing trend of gym culture and personal fitness. Casual consumers and health-conscious individuals are increasingly turning to sports nutrition products to support their active lifestyles and overall health, further expanding the market.

The South Korea Sports Nutrition & Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amway Korea, Herbalife Korea, GNC Korea, Nutrilite, MusclePharm, Optimum Nutrition, BSN (Bio-Engineered Supplements and Nutrition), MyProtein, Isagenix, Dymatize Nutrition, Quest Nutrition, Bodybuilding.com, EAS (Energy Athletic Science), ProMix Nutrition, Vega contribute to innovation, geographic expansion, and service delivery in this space.

The South Korean sports nutrition and supplements market is poised for continued growth, driven by evolving consumer preferences and technological advancements. As health consciousness rises, brands are expected to innovate with clean label products and personalized nutrition solutions. Additionally, the integration of technology in product development, such as app-based tracking and tailored supplement recommendations, will enhance consumer engagement. The market is likely to see increased collaboration with fitness influencers, further driving brand visibility and consumer trust in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Protein Supplements Vitamins and Minerals Amino Acids Pre-Workout Supplements Post-Workout Recovery Products Weight Management Products Others |

| By End-User | Athletes Fitness Enthusiasts Casual Consumers Health-Conscious Individuals |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Stores Pharmacies |

| By Price Range | Premium Mid-Range Budget |

| By Formulation | Powder Capsules/Tablets Liquid |

| By Packaging Type | Bottles Sachets Tubs |

| By Brand Loyalty | Brand Loyal Consumers Brand Switchers New Entrants |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| General Consumer Awareness | 150 | Fitness Enthusiasts, Casual Gym Goers |

| Professional Athlete Insights | 100 | Professional Athletes, Coaches |

| Retailer Perspectives | 80 | Health Store Owners, Supplement Retail Managers |

| Nutritionist and Dietitian Feedback | 60 | Sports Nutritionists, Registered Dietitians |

| Fitness Trainer Opinions | 70 | Personal Trainers, Group Fitness Instructors |

The South Korea Sports Nutrition & Supplements Market is valued at approximately USD 1.5 billion, reflecting a significant growth trend driven by increasing health consciousness and fitness activities among consumers.