Region:Europe

Author(s):Shubham

Product Code:KRAB2432

Pages:89

Published On:October 2025

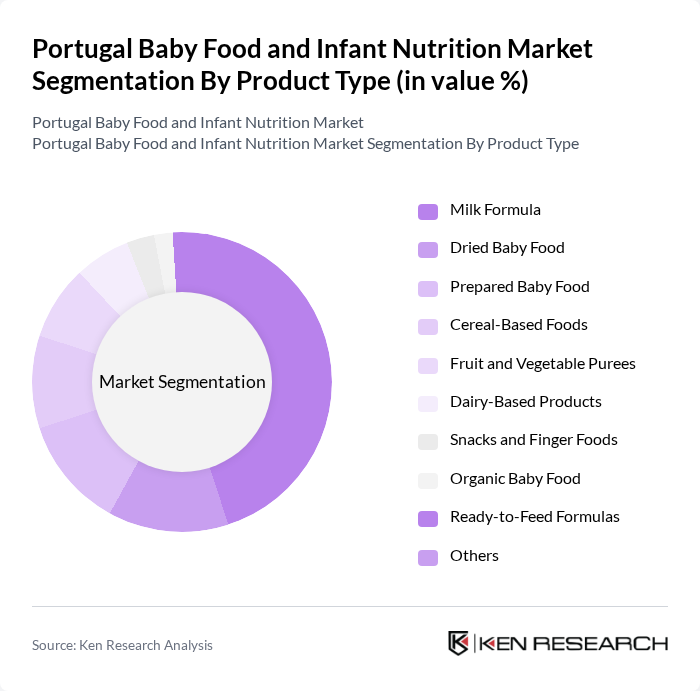

By Product Type:The product type segmentation includes Milk Formula, Dried Baby Food, Prepared Baby Food, Cereal-Based Foods, Fruit and Vegetable Purees, Dairy-Based Products, Snacks and Finger Foods, Organic Baby Food, Ready-to-Feed Formulas, and Others. Milk Formula is the leading sub-segment, accounting for the largest share due to its essential role in infant nutrition, especially among working parents seeking convenience. The trend toward organic baby food is accelerating as parents increasingly prioritize natural and health-focused options for their children .

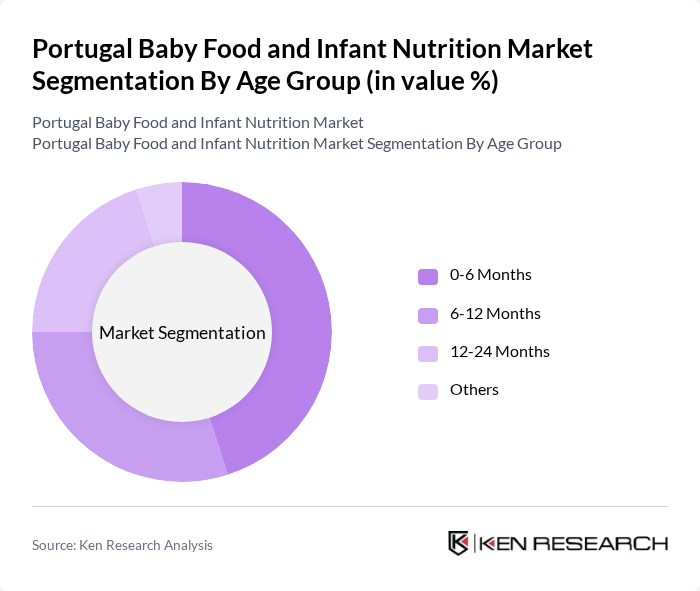

By Age Group:The age group segmentation includes 0-6 Months, 6-12 Months, 12-24 Months, and Others. The 0-6 Months segment is the most significant, as this period is critical for infant nutrition, with breast milk or formula being essential. Parents are increasingly choosing specialized products tailored to the nutritional needs of infants in this age range, driving higher demand for milk formulas and fortified products .

The Portugal Baby Food and Infant Nutrition Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé S.A., Danone S.A., Hero Group, Mead Johnson Nutrition Company, Hain Celestial Group, Inc., Organix Brands, Inc., Plum Organics, Beech-Nut Nutrition Company, Earth's Best Organic, Happy Family Organics, SMA Nutrition (a brand of Nestlé), Aptamil (Nutricia/Danone), Holle Baby Food AG, Bledina (Danone), Nutricia (Danone), Lactalis Group, Milupa (Danone), Hipp GmbH & Co. Vertrieb KG, Continente (Sonae MC, Portugal), Pingo Doce (Jerónimo Martins, Portugal) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the baby food and infant nutrition market in Portugal appears promising, driven by evolving consumer preferences and technological advancements. The increasing focus on sustainability and health will likely shape product development, with brands prioritizing organic and eco-friendly ingredients. Additionally, the rise of e-commerce will facilitate greater access to diverse product offerings, enhancing consumer choice. As parents continue to seek nutritious options for their children, the market is expected to adapt and innovate to meet these demands effectively.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Milk Formula Dried Baby Food Prepared Baby Food Cereal-Based Foods Fruit and Vegetable Purees Dairy-Based Products Snacks and Finger Foods Organic Baby Food Ready-to-Feed Formulas Others |

| By Age Group | 6 Months 12 Months 24 Months Others |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Pharmacies E-Retailers/Online Retail Specialty Stores Others |

| By Packaging Type | Jars Pouches Tetra Packs Cans Others |

| By Brand Type | National Brands Private Labels Organic Brands Others |

| By Nutritional Content | High Protein Low Sugar Fortified Products Plant-Based/Allergy-Friendly Others |

| By Price Range | Premium Mid-Range Budget Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Parent Purchasing Behavior | 120 | Parents of infants aged 0-12 months |

| Pediatric Nutrition Insights | 60 | Pediatric nutritionists and dietitians |

| Retailer Perspectives | 50 | Store managers and category buyers in baby food |

| Market Trends Analysis | 40 | Industry analysts and market researchers |

| Consumer Attitudes towards Organic Baby Food | 70 | Parents interested in organic and health-focused products |

The Portugal Baby Food and Infant Nutrition Market is valued at approximately USD 95 million, reflecting a five-year historical analysis. This growth is driven by increasing parental awareness of infant nutrition and a rising preference for high-quality and organic baby food products.