Region:Europe

Author(s):Geetanshi

Product Code:KRAA3315

Pages:86

Published On:September 2025

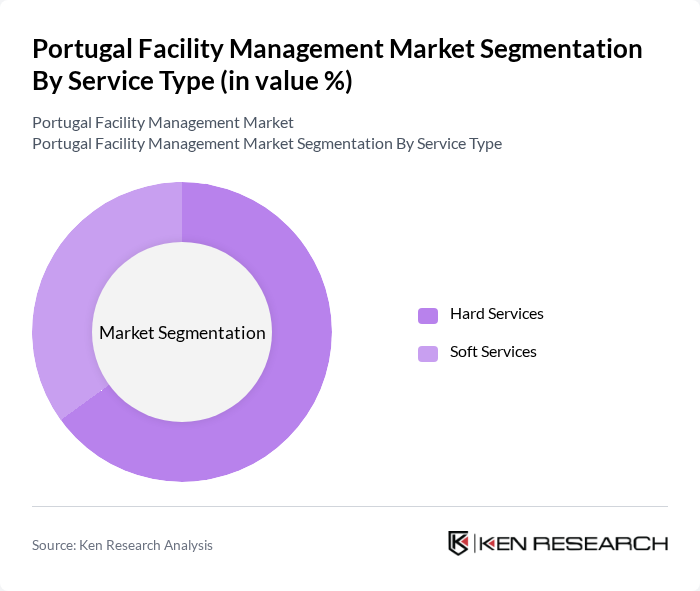

By Service Type:

The service type segmentation includes Hard Services and Soft Services. Hard Services encompass essential maintenance and technical services, such as HVAC, electrical, and plumbing, while Soft Services focus on non-technical support functions like cleaning, security, and landscaping. Hard Services dominate the market due to the critical need for infrastructure maintenance and compliance with safety regulations. The increasing complexity of building systems, integration of smart technologies, and the emphasis on operational efficiency further drive the demand for Hard Services, making it the leading segment in the facility management landscape .

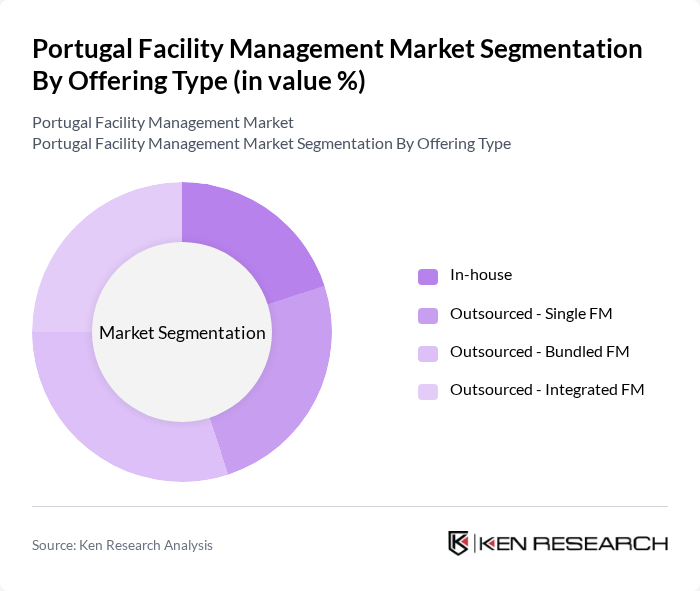

By Offering Type:

This segmentation includes In-house, Outsourced - Single FM, Outsourced - Bundled FM, and Outsourced - Integrated FM. The Outsourced - Bundled FM and Outsourced - Integrated FM segments are leading the market, driven by organizations seeking comprehensive solutions that combine multiple services under unified contracts. This approach streamlines operations, enhances service quality, and increases accountability, making it a preferred choice among businesses aiming to optimize their facility management strategies. The growing trend toward outsourcing, particularly bundled and integrated solutions, reflects the need for cost optimization and improved operational efficiency .

The Portugal Facility Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as ISS Facility Services, Apleona GmbH, Infraspeak, CBRE Group, Inc., JLL (Jones Lang LaSalle), Sodexo, Compass Group PLC, Aramark, Mitie Group PLC, Serco Group PLC, Bilfinger SE, Engie Group, Vinci Facilities, Atalian Global Services, Dussmann Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the facility management market in Portugal appears promising, driven by technological advancements and a growing emphasis on sustainability. As businesses increasingly adopt smart building technologies, the demand for integrated facility management solutions is expected to rise. Additionally, the focus on energy efficiency and sustainable practices will likely create new opportunities for service providers to innovate and differentiate themselves in a competitive landscape, fostering long-term growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Hard Services Soft Services |

| By Offering Type | In-house Outsourced - Single FM Outsourced - Bundled FM Outsourced - Integrated FM |

| By End-User | Commercial Hospitality Institutional & Public Infrastructure Healthcare Industrial & Process Sector Others |

| By Hard Services | Asset Management MEP and HVAC Services Fire Systems and Safety Other Hard FM Services |

| By Soft Services | Office Support and Security Cleaning Services Catering Services Other Soft FM Services |

| By Geographic Coverage | Lisbon Region Porto Region Other Regions |

| By Investment Source | Private Investment Public Funding Foreign Direct Investment Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Office Management | 100 | Facility Managers, Operations Directors |

| Healthcare Facility Services | 60 | Healthcare Facility Managers, Facility Coordinators |

| Educational Institution Facilities | 50 | Campus Facility Managers, Administrative Heads |

| Industrial Facility Maintenance | 40 | Maintenance Supervisors, Safety Officers |

| Residential Property Management | 70 | Property Managers, Community Directors |

The Portugal Facility Management Market is valued at approximately USD 1.1 billion, driven by the increasing demand for efficient building management solutions, urbanization, and cost-effective operational strategies across various sectors.