Region:Europe

Author(s):Geetanshi

Product Code:KRAA3226

Pages:85

Published On:September 2025

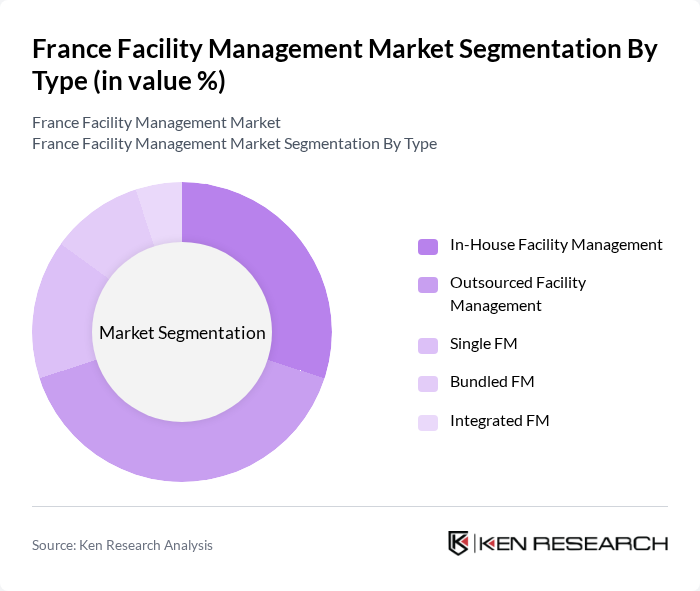

By Type:The facility management market can be segmented into various types, including In-House Facility Management, Outsourced Facility Management, Single FM, Bundled FM, and Integrated FM. Each of these sub-segments caters to different operational needs and preferences of organizations, influencing their choice of facility management solutions. Outsourced FM, particularly bundled and integrated services, is gaining traction as organizations seek single-point accountability and cost efficiencies .

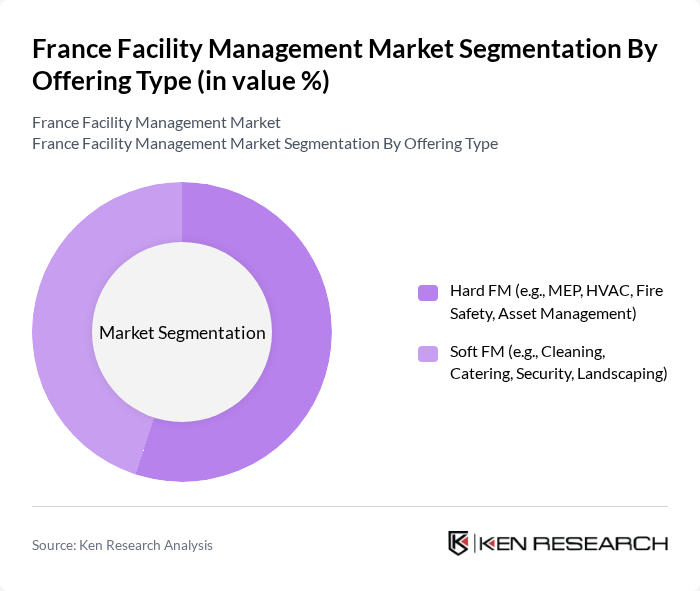

By Offering Type:The market can also be categorized based on the types of services offered, which include Hard FM and Soft FM. Hard FM encompasses essential services such as mechanical, electrical, and plumbing (MEP) maintenance, HVAC, fire safety, and asset management, while Soft FM includes services like cleaning, catering, security, and landscaping. The demand for Soft FM is rising, driven by workplace wellness and experience priorities, while Hard FM remains dominant due to regulatory and safety requirements .

The France Facility Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sodexo, ISS France (ISS Facility Services), CBRE France, Bouygues Energies & Services, Atalian Global Services, VINCI Facilities, ENGIE Solutions, Elior Group, Derichebourg Multiservices, Samsic Facility, Armonia (formerly Phone Régie), Apleona France, Seris Security, Dalkia (EDF Group), GSF Groupe contribute to innovation, geographic expansion, and service delivery in this space.

The future of the facility management market in France appears promising, driven by technological innovations and a growing emphasis on sustainability. As organizations increasingly adopt integrated facility management solutions, the demand for smart technologies and data analytics will rise. Additionally, the focus on employee well-being and remote management practices will reshape service delivery models, enabling companies to enhance operational efficiency while meeting evolving client expectations in a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | In-House Facility Management Outsourced Facility Management Single FM Bundled FM Integrated FM |

| By Offering Type | Hard FM (e.g., MEP, HVAC, Fire Safety, Asset Management) Soft FM (e.g., Cleaning, Catering, Security, Landscaping) |

| By End-User | Commercial Institutional Public/Infrastructure Industrial Others |

| By Sector | Healthcare Education Retail Hospitality Data Centers Others |

| By Geographic Coverage | Northern France Southern France Central France Western France Eastern France |

| By Contract Type | Fixed-Price Contracts Cost-Plus Contracts Time and Materials Contracts |

| By Technology Adoption | Traditional Methods Digital Solutions IoT-Enabled Services |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Facility Management | 100 | Facility Managers, Operations Directors |

| Healthcare Facility Services | 60 | Healthcare Administrators, Facility Coordinators |

| Educational Institution Management | 50 | Campus Facility Managers, Administrative Heads |

| Retail Facility Management | 40 | Store Managers, Regional Facility Directors |

| Government Building Management | 40 | Public Works Directors, Facility Operations Managers |

The France Facility Management Market is valued at approximately USD 73 billion, driven by increasing demand for efficient facility management, urbanization, and cost-effective operational solutions across various sectors.