Region:Middle East

Author(s):Geetanshi

Product Code:KRAA3274

Pages:82

Published On:September 2025

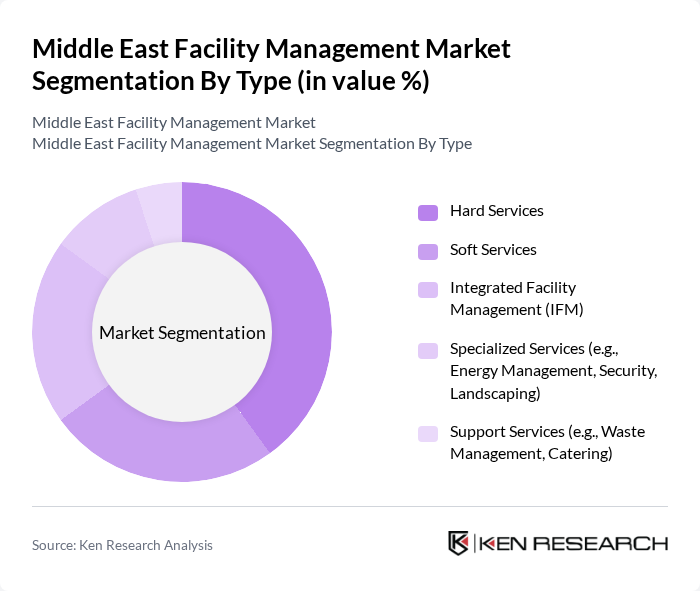

By Type:The facility management market is segmented into Hard Services, Soft Services, Integrated Facility Management (IFM), Specialized Services, and Support Services. Hard Services include essential maintenance and repair functions such as mechanical, electrical, and plumbing (MEP), while Soft Services cover cleaning, security, and landscaping. IFM combines multiple service lines under a single contract for operational efficiency. Specialized Services focus on areas like energy management and security, and Support Services include waste management and catering.

TheHard Servicessegment leads the facility management market, accounting for the largest share. This dominance is attributed to the critical nature of maintenance and repair services, which are essential for building safety, compliance, and operational efficiency. The continued expansion of infrastructure projects and the region’s focus on safety standards and regulatory compliance further drive demand for hard services, especially MEP and asset management.

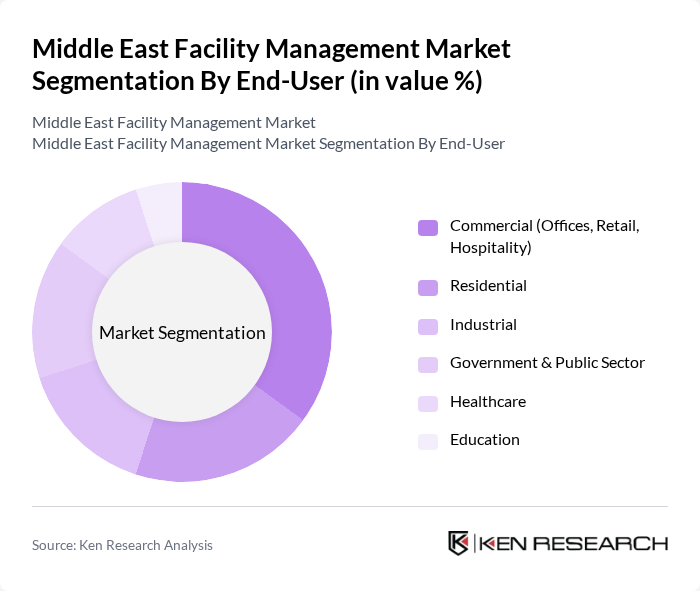

By End-User:The facility management market is segmented by end-user categories: Commercial, Residential, Industrial, Government & Public Sector, Healthcare, and Education. Commercial end-users include offices, retail, and hospitality, which require a broad range of facility management services. Residential covers apartment complexes and gated communities, Industrial includes factories and logistics centers, Government & Public Sector comprises municipal buildings and infrastructure, Healthcare covers hospitals and clinics, and Education includes schools and universities.

TheCommercialsegment is the largest end-user category, driven by the proliferation of office spaces, retail outlets, and hospitality establishments. The region’s booming tourism sector, especially in the UAE, has increased demand for facility management in hotels and resorts. Efficient management of office spaces to boost productivity and employee satisfaction further supports growth in this segment.

The Middle East Facility Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emrill Services LLC, Farnek Services LLC, JLL (Jones Lang LaSalle), CBRE Group, Inc., Transguard Group LLC, Cofely Besix Facility Management, Dussmann Gulf LLC, Serco Middle East, ISS Facility Services Middle East, G4S Facilities Management, Al-Futtaim Engineering & Technologies, Mace Macro (Middle East), Khidmah LLC, Apleona HSG Facility Management Middle East, Al Asmakh Facilities Management, Muheel Services for Maintenance and Operations LLC, Etisalat Facilities Management LLC, Saudi Binladin Group (SBGOM), Galfar Al Misnad contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East facility management market appears promising, driven by technological advancements and a growing emphasis on sustainability. As urbanization accelerates, the demand for integrated facility management solutions will rise, particularly in smart buildings. Additionally, the increasing focus on energy efficiency and environmental compliance will shape service offerings. Companies that leverage digital platforms and IoT technologies will likely gain a competitive edge, positioning themselves favorably in this evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Hard Services Soft Services Integrated Facility Management (IFM) Specialized Services (e.g., Energy Management, Security, Landscaping) Support Services (e.g., Waste Management, Catering) |

| By End-User | Commercial (Offices, Retail, Hospitality) Residential Industrial Government & Public Sector Healthcare Education |

| By Service Model | Outsourced In-House Hybrid |

| By Region | GCC Countries (Saudi Arabia, UAE, Qatar, Oman, Kuwait, Bahrain) Levant (Jordan, Lebanon, Others) North Africa (Egypt, Morocco, Others) |

| By Sector | Healthcare Education Retail Hospitality & Tourism Transportation & Logistics |

| By Technology Adoption | Building Management Systems (BMS) Energy Management Systems (EMS) Security & Surveillance Systems IoT & Smart Solutions |

| By Investment Source | Private Investment Public Funding Foreign Direct Investment (FDI) Joint Ventures & Strategic Alliances |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Property Management | 100 | Facility Managers, Property Owners |

| Residential Facility Services | 60 | Community Managers, Homeowners Association Leaders |

| Healthcare Facility Management | 40 | Healthcare Facility Managers, Facility Directors |

| Educational Institution Facilities | 50 | Campus Facility Managers, School Administrators |

| Retail Space Management | 45 | Store Managers, Retail Operations Managers |

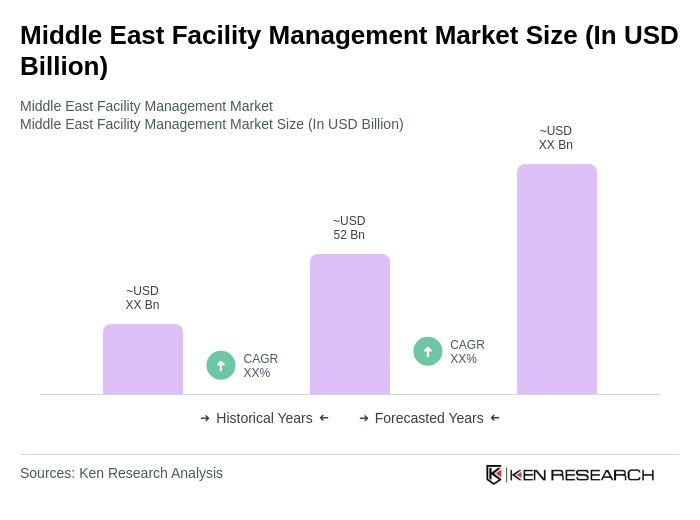

The Middle East Facility Management Market is valued at approximately USD 52 billion, driven by urbanization, infrastructure development, and a focus on operational efficiency. This growth is further supported by technological advancements and the rising demand for integrated services.