Region:Asia

Author(s):Dev

Product Code:KRAA1690

Pages:99

Published On:August 2025

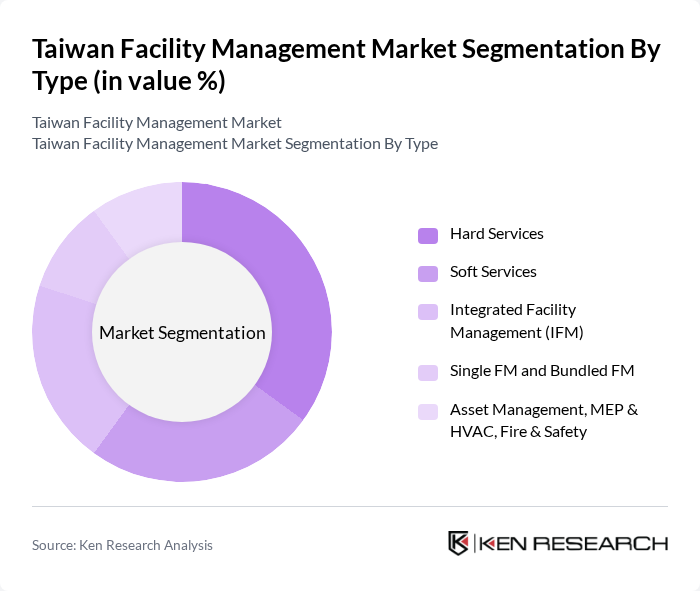

By Type:The facility management market can be segmented into various types, including Hard Services, Soft Services, Integrated Facility Management (IFM), Single FM and Bundled FM, and Asset Management, MEP & HVAC, Fire & Safety. Each of these segments plays a crucial role in the overall market dynamics.

The Hard Services segment is currently dominating the market due to the essential nature of maintenance and repair services in ensuring operational efficiency and safety in facilities. This includes services such as electrical, plumbing, and HVAC maintenance, which are critical for the functionality of commercial and industrial buildings. The increasing focus on compliance with safety regulations and the need for regular maintenance to avoid costly downtimes further drive the demand for hard services.

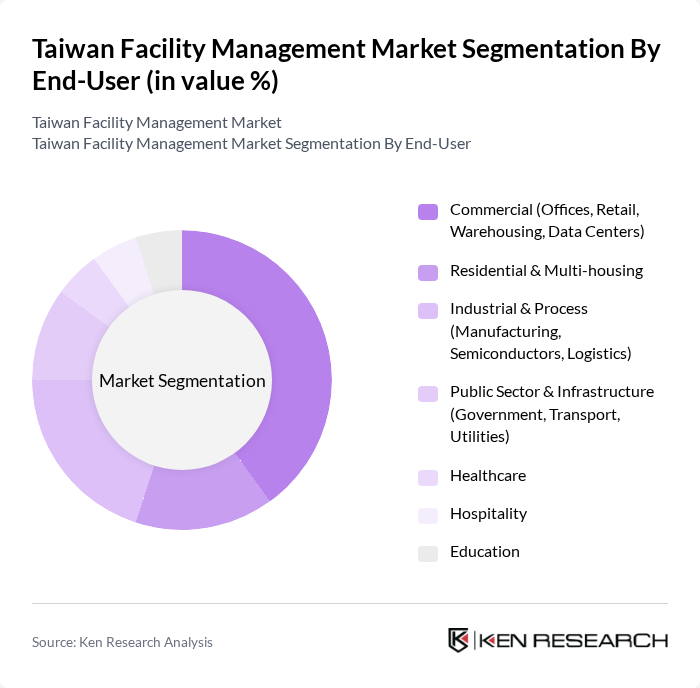

By End-User:The facility management market is also segmented by end-user categories, including Commercial (Offices, Retail, Warehousing, Data Centers), Residential & Multi-housing, Industrial & Process (Manufacturing, Semiconductors, Logistics), Public Sector & Infrastructure (Government, Transport, Utilities), Healthcare, Hospitality, and Education. Each end-user segment has unique requirements and contributes differently to the market.

The Commercial segment is the largest end-user category, driven by the rapid growth of office spaces, retail outlets, and data centers in urban areas. The increasing demand for professional facility management services in these sectors is fueled by the need for operational efficiency, cost reduction, and compliance with health and safety regulations. Additionally, the rise of e-commerce has led to a surge in warehousing and logistics facilities, further enhancing the demand for facility management services.

The Taiwan Facility Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as CBRE Taiwan, Jones Lang LaSalle (JLL) Taiwan, Cushman & Wakefield Taiwan, ISS Facility Services Taiwan, Sodexo Taiwan, Aramark Taiwan, Apleona, Dalkia Taiwan, Johnson Controls Taiwan, Carrier Taiwan (HVAC Services), Honeywell Building Technologies Taiwan, Siemens Smart Infrastructure Taiwan, Taiwan Shin Kong Security Co., Ltd., Tong Hsing Security Co., Ltd., Taiwan International Property Management Corporation (TIPMC) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Taiwan facility management market appears promising, driven by technological advancements and a growing emphasis on sustainability. As urbanization continues, the demand for integrated facility management solutions will rise, prompting service providers to innovate and adapt. Additionally, the increasing focus on energy efficiency and smart building technologies will create new opportunities for growth. Companies that invest in training and development will be better positioned to overcome workforce challenges and capitalize on emerging trends in the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Hard Services Soft Services Integrated Facility Management (IFM) Single FM and Bundled FM Asset Management, MEP & HVAC, Fire & Safety |

| By End-User | Commercial (Offices, Retail, Warehousing, Data Centers) Residential & Multi-housing Industrial & Process (Manufacturing, Semiconductors, Logistics) Public Sector & Infrastructure (Government, Transport, Utilities) Healthcare Hospitality Education |

| By Service Model | In-House Outsourced Hybrid Outsourced Format: Single FM, Bundled FM, IFM |

| By Sector | Healthcare Education Retail Hospitality Government and Public Infrastructure Industrial & High-tech Manufacturing |

| By Geographic Coverage | Taipei & New Taipei Taoyuan & Hsinchu (Science Parks) Taichung & Central Taiwan Tainan & Kaohsiung (Southern Industrial Corridor) Others (Eastern and Rural Counties) |

| By Technology Adoption | Traditional Methods Digital CAFM/CMMS Solutions Smart Building & IoT-enabled FM Energy Management & ESG Reporting Tools |

| By Pricing Model | Fixed Pricing Variable Pricing Subscription-Based Performance-based/Outcome-based Contracts |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Office Management | 120 | Facility Managers, Building Owners |

| Healthcare Facility Services | 90 | Operations Directors, Compliance Officers |

| Educational Institution Facilities | 70 | Campus Facility Managers, Administrative Heads |

| Retail Space Management | 80 | Store Managers, Regional Operations Managers |

| Industrial Facility Maintenance | 60 | Maintenance Supervisors, Safety Officers |

The Taiwan Facility Management Market is valued at approximately USD 3.5 billion, driven by factors such as increased outsourcing of non-core services, urbanization, and the expansion of commercial and industrial real estate, particularly in technology-intensive sectors.