Region:Europe

Author(s):Shubham

Product Code:KRAB6259

Pages:100

Published On:October 2025

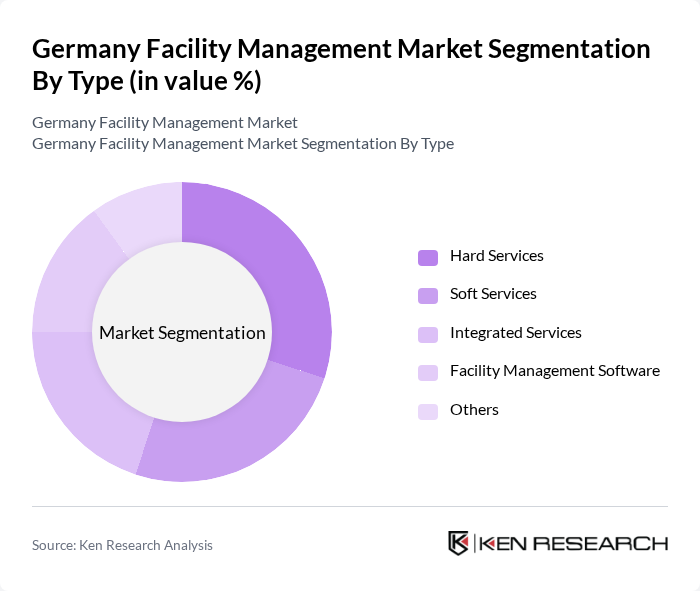

By Type:The facility management market can be segmented into various types, including Hard Services, Soft Services, Integrated Services, Facility Management Software, and Others. Hard Services encompass essential maintenance and repair tasks, while Soft Services include cleaning and security. Integrated Services combine both hard and soft services for a holistic approach. Facility Management Software is increasingly vital for managing operations efficiently, and Other services may include specialized offerings tailored to specific client needs.

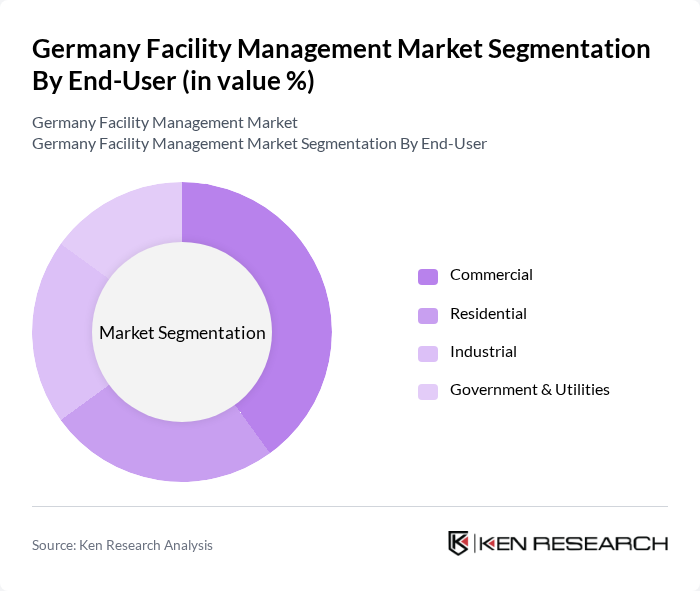

By End-User:The end-user segmentation includes Commercial, Residential, Industrial, and Government & Utilities sectors. The commercial sector is the largest consumer of facility management services, driven by the need for efficient building operations and maintenance. Residential services are growing due to increasing urbanization and the demand for managed living spaces. The industrial sector requires specialized services for manufacturing facilities, while government and utilities focus on compliance and operational efficiency.

The Germany Facility Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as ISS Facility Services GmbH, Sodexo Deutschland GmbH, Dussmann Group, Bilfinger SE, CBRE Group, Inc., JLL (Jones Lang LaSalle), G4S Facilities Management, Apleona GmbH, Strabag Property and Facility Services GmbH, KÖTTER Services, ENGIE Deutschland GmbH, Vebego AG, WISAG Facility Service Holding GmbH, Securitas AB, Apleona GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The future of the facility management market in Germany appears promising, driven by technological advancements and a strong emphasis on sustainability. As companies increasingly adopt smart building technologies and integrated facility management solutions, operational efficiencies are expected to improve significantly. Additionally, the focus on employee well-being and experience will shape service delivery models. With ongoing investments in infrastructure and green initiatives, the market is poised for growth, creating opportunities for innovative service providers to thrive in this evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Hard Services Soft Services Integrated Services Facility Management Software Others |

| By End-User | Commercial Residential Industrial Government & Utilities |

| By Service Model | Outsourced In-House |

| By Sector | Healthcare Education Retail Hospitality |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas |

| By Contract Type | Fixed-Price Contracts Cost-Plus Contracts |

| By Policy Support | Subsidies Tax Exemptions Grants |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Office Space Management | 150 | Facility Managers, Real Estate Directors |

| Healthcare Facility Operations | 100 | Healthcare Administrators, Operations Managers |

| Educational Institution Facilities | 80 | Campus Facility Managers, Procurement Officers |

| Industrial Facility Maintenance | 70 | Maintenance Supervisors, Safety Officers |

| Retail Space Management | 90 | Store Managers, Operations Directors |

The Germany Facility Management Market is valued at approximately USD 45 billion, reflecting a robust growth trajectory driven by the demand for efficient building management solutions and advancements in facility management technologies.