Region:Middle East

Author(s):Geetanshi

Product Code:KRAD7169

Pages:98

Published On:December 2025

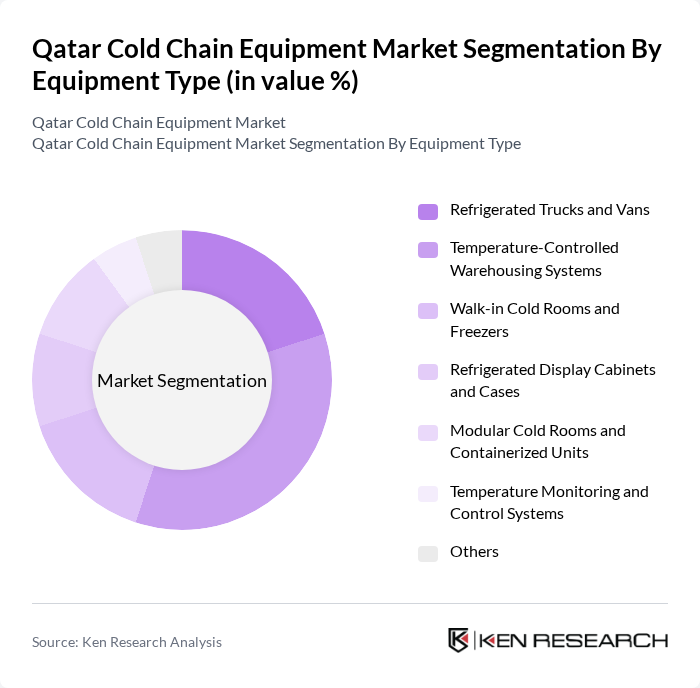

By Equipment Type:The equipment type segmentation includes various subsegments such as Refrigerated Trucks and Vans, Temperature-Controlled Warehousing Systems, Walk-in Cold Rooms and Freezers, Refrigerated Display Cabinets and Cases, Modular Cold Rooms and Containerized Units, Temperature Monitoring and Control Systems, and Others. Among these, Temperature-Controlled Warehousing Systems are leading the market due to the increasing need for efficient storage solutions that maintain product integrity over extended periods. The rise in e-commerce and online grocery shopping has further fueled the demand for these systems, as businesses seek to optimize their supply chains.

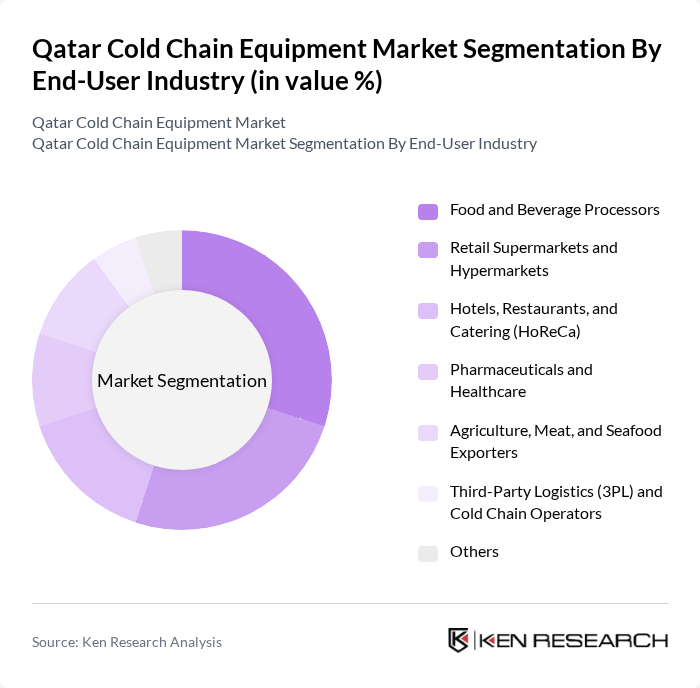

By End-User Industry:The end-user industry segmentation encompasses Food and Beverage Processors, Retail Supermarkets and Hypermarkets, Hotels, Restaurants, and Catering (HoReCa), Pharmaceuticals and Healthcare, Agriculture, Meat, and Seafood Exporters, Third-Party Logistics (3PL) and Cold Chain Operators, and Others. The Food and Beverage Processors segment is currently the most significant contributor to the market, driven by the rising consumer demand for fresh and frozen products. The increasing focus on food safety and quality assurance has led to greater investments in cold chain solutions within this sector.

The Qatar Cold Chain Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gulf Warehousing Company Q.P.S.C. (GWC), Al Watania Logistics, Milaha Maritime & Logistics, Nakilat Agency Company Ltd. (NAC), Trags Engineering & Contracting W.L.L. (Trags Trading), United Logistics Company W.L.L., Qatar Cool, Doha Qatar Logistics (DQL), Agility Logistics – Qatar, DHL Global Forwarding – Qatar, GAC Qatar, Kuehne+Nagel Qatar, Maersk Qatar, Hellmann Worldwide Logistics – Qatar, Yusen Logistics – Qatar contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cold chain equipment market in Qatar appears promising, driven by technological advancements and increasing consumer awareness regarding food safety. As the government continues to invest in infrastructure and regulatory compliance, the market is expected to witness significant growth. Additionally, the integration of IoT and automation technologies will enhance operational efficiency, allowing businesses to optimize their cold chain processes and reduce costs, ultimately benefiting consumers and suppliers alike.

| Segment | Sub-Segments |

|---|---|

| By Equipment Type | Refrigerated Trucks and Vans Temperature-Controlled Warehousing Systems Walk-in Cold Rooms and Freezers Refrigerated Display Cabinets and Cases Modular Cold Rooms and Containerized Units Temperature Monitoring and Control Systems Others |

| By End-User Industry | Food and Beverage Processors Retail Supermarkets and Hypermarkets Hotels, Restaurants, and Catering (HoReCa) Pharmaceuticals and Healthcare Agriculture, Meat, and Seafood Exporters Third-Party Logistics (3PL) and Cold Chain Operators Others |

| By Application | Chilled Food Storage Frozen Food Storage Pharmaceutical and Vaccine Storage Cross-Docking and Distribution Hubs Last-Mile Delivery and Retail Display Others |

| By Refrigeration Technology | Vapor Compression Systems (On-Grid) Vapor Compression Systems with Backup Power Hybrid and Solar-Powered Refrigeration Cryogenic and Phase-Change Based Systems Others |

| By Ownership & Investment Model | End-User Owned Facilities Third-Party Logistics (3PL) Owned Assets Leased and Rental Equipment Public-Private Partnership (PPP) Assets Others |

| By Temperature Range | Chilled (0°C to 10°C) Frozen (-18°C to -25°C) Deep Frozen (Below -25°C) Controlled Room Temperature and Others |

| By Market Maturity | Emerging Facilities (New Builds) Upgraded / Expansion Projects Brownfield Modernization and Retrofit Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Cold Storage | 120 | Warehouse Managers, Supply Chain Coordinators |

| Pharmaceutical Cold Chain Management | 90 | Quality Assurance Managers, Logistics Directors |

| Retail Cold Chain Solutions | 80 | Operations Managers, Procurement Specialists |

| Cold Chain Technology Providers | 60 | Product Development Managers, Sales Executives |

| Government Regulatory Bodies | 40 | Policy Makers, Regulatory Affairs Managers |

The Qatar Cold Chain Equipment Market is valued at approximately USD 1.5 billion, driven by the increasing demand for temperature-sensitive products in the food and pharmaceutical sectors, as well as the expansion of logistics and distribution networks in the region.