Region:Middle East

Author(s):Shubham

Product Code:KRAC3509

Pages:97

Published On:October 2025

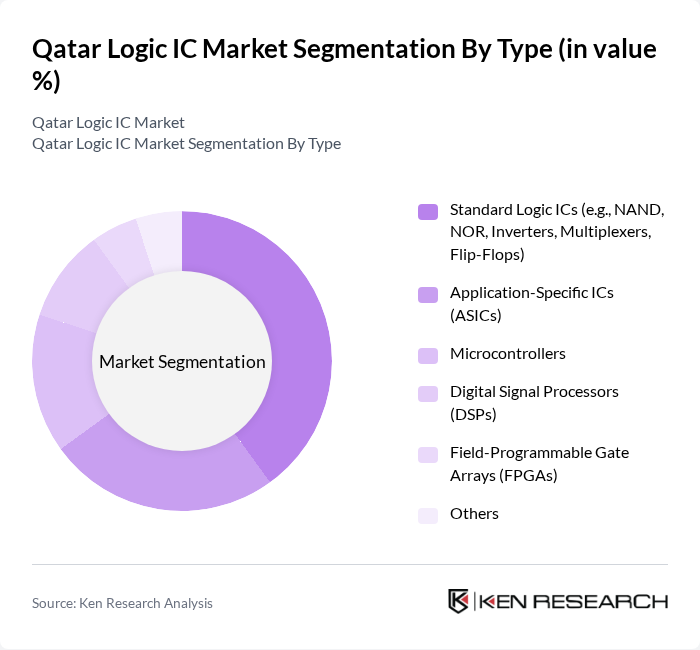

By Type:The market is segmented into various types of logic ICs, including Standard Logic ICs, Application-Specific ICs (ASICs), Microcontrollers, Digital Signal Processors (DSPs), Field-Programmable Gate Arrays (FPGAs), and Others. Among these, Standard Logic ICs continue to lead due to their widespread application in consumer electronics and telecommunications, driven by the need for efficient data processing and communication systems. The Application-Specific ICs segment is gaining traction in specialized computing applications, while Microcontrollers and DSPs are increasingly adopted in automotive and industrial automation. FPGAs are seeing growing use in prototyping and high-performance computing scenarios.

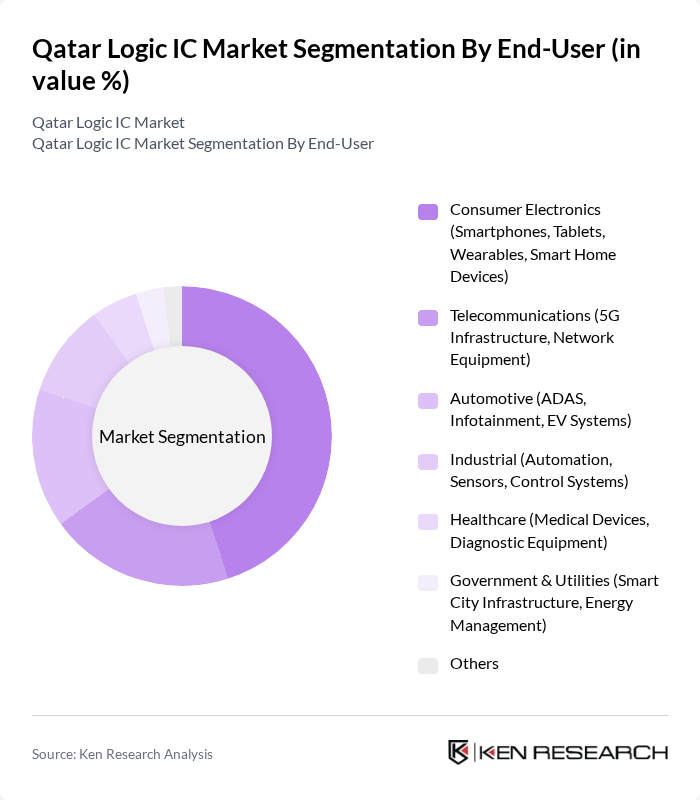

By End-User:The end-user segmentation includes Consumer Electronics, Telecommunications, Automotive, Industrial, Healthcare, Government & Utilities, and Others. The Consumer Electronics segment remains dominant, fueled by rising demand for smartphones, tablets, wearables, and smart home devices, as consumers prioritize advanced features and seamless connectivity. Telecommunications is the second-largest segment, driven by 5G infrastructure rollout and network equipment upgrades. Automotive applications are expanding with the adoption of advanced driver-assistance systems (ADAS), infotainment, and electric vehicle (EV) platforms. Industrial automation, healthcare devices, and smart city initiatives also contribute to diversified demand across the market.

The Qatar Logic IC Market is characterized by a dynamic mix of regional and international players. Leading participants such as Texas Instruments, NXP Semiconductors, STMicroelectronics, Infineon Technologies, ON Semiconductor, Renesas Electronics, Toshiba Electronic Devices & Storage Corporation, Microchip Technology, Analog Devices, Broadcom Inc., Intel Corporation, Qualcomm Technologies, Samsung Electronics, SK Hynix, MediaTek contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar logic IC market appears promising, driven by technological advancements and increasing investments in digital infrastructure. The government's commitment to smart city initiatives and the expansion of telecommunications will likely create a robust demand for innovative IC solutions. Additionally, the growing focus on energy efficiency and sustainability in electronics will further propel the market, encouraging local firms to enhance their capabilities and explore new technologies to meet evolving consumer needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Standard Logic ICs (e.g., NAND, NOR, Inverters, Multiplexers, Flip-Flops) Application-Specific ICs (ASICs) Microcontrollers Digital Signal Processors (DSPs) Field-Programmable Gate Arrays (FPGAs) Others |

| By End-User | Consumer Electronics (Smartphones, Tablets, Wearables, Smart Home Devices) Telecommunications (5G Infrastructure, Network Equipment) Automotive (ADAS, Infotainment, EV Systems) Industrial (Automation, Sensors, Control Systems) Healthcare (Medical Devices, Diagnostic Equipment) Government & Utilities (Smart City Infrastructure, Energy Management) Others |

| By Application | Communication Systems Computing Devices Consumer Appliances Automotive Systems Industrial Automation Medical Equipment Others |

| By Distribution Channel | Direct Sales Distributors Online Retail Retail Outlets Others |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing Penetration Pricing Others |

| By Component | Integrated Circuits Discrete Components Passive Components Connectors Others |

| By Technology | CMOS Technology BiCMOS Technology SOI Technology GaN Technology Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Manufacturers | 100 | Product Managers, R&D Engineers |

| Automotive IC Suppliers | 60 | Supply Chain Managers, Technical Directors |

| Telecommunications Equipment Providers | 50 | Network Engineers, Procurement Specialists |

| Government Regulatory Bodies | 40 | Policy Makers, Industry Analysts |

| Research Institutions and Universities | 40 | Academic Researchers, Technology Analysts |

The Qatar Logic IC Market is valued at approximately USD 1.1 billion, reflecting a significant growth driven by the increasing demand for consumer electronics, telecommunications infrastructure, and automotive applications.