Region:Middle East

Author(s):Geetanshi

Product Code:KRAC9456

Pages:80

Published On:November 2025

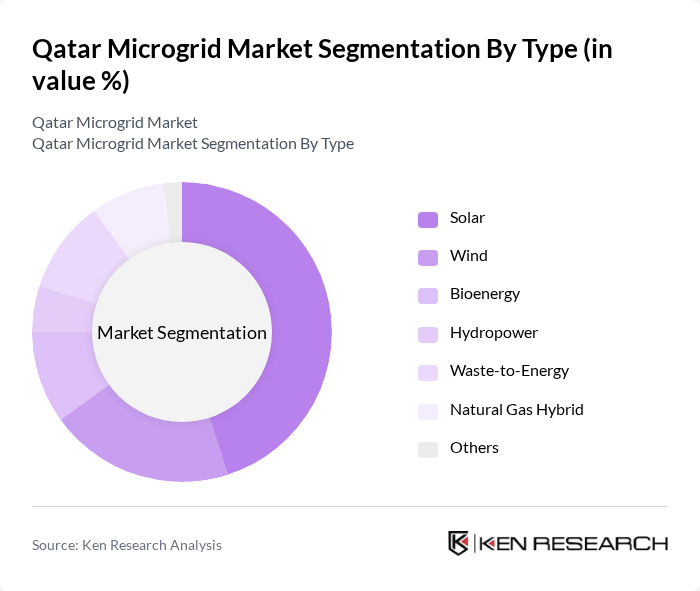

By Type:The market is segmented into Solar, Wind, Bioenergy, Hydropower, Waste-to-Energy, Natural Gas Hybrid, and Others.Solar energyis the leading segment, driven by abundant solar resources and declining technology costs, making it the preferred choice for residential, commercial, and industrial applications. Wind energy is gaining traction, particularly in coastal areas, while Bioenergy and Waste-to-Energy are emerging as viable alternatives for waste management and energy production. Hydropower remains limited due to geographic constraints, but hybrid systems combining natural gas and renewables are increasingly deployed in industrial settings.

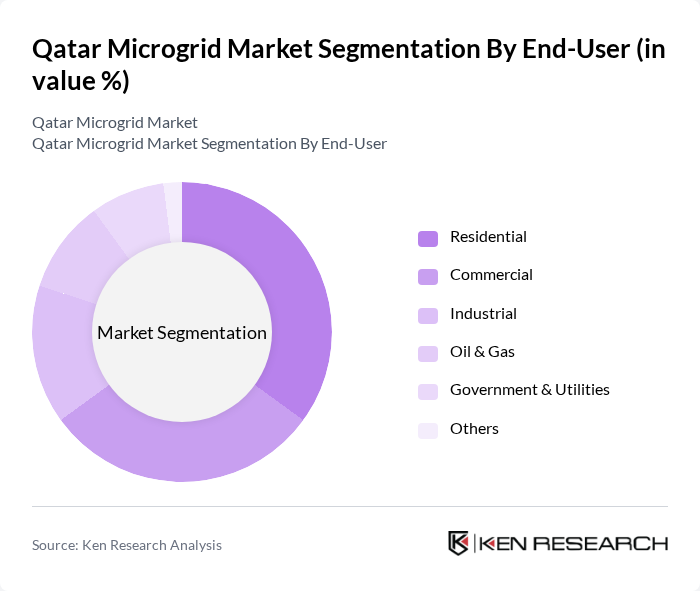

By End-User:The market is segmented by end-users, including Residential, Commercial, Industrial, Oil & Gas, Government & Utilities, and Others. TheResidential segmentleads due to widespread adoption of rooftop solar panels and home energy storage systems, supported by government incentives. The Commercial sector is expanding as businesses seek to reduce energy costs and meet sustainability targets. The Industrial and Oil & Gas sectors are investing in microgrid solutions to ensure energy reliability for critical operations, particularly in remote and off-grid locations. Government and utility segments focus on grid modernization and resilience.

The Qatar Microgrid Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, Schneider Electric, ABB Ltd., General Electric, Enel X, S&C Electric Company, Honeywell International Inc., Mitsubishi Electric, Eaton Corporation, Wärtsilä Corporation, Tesla, Inc., ENGIE, Qatar General Electricity & Water Corporation (Kahramaa), Nebras Power, Marubeni Corporation, Iberdrola S.A., Hitachi Energy, Aggreko contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar microgrid market appears promising, driven by increasing investments in renewable energy and supportive government policies. As the country progresses towards its sustainability goals, the integration of advanced technologies and energy storage solutions will likely enhance microgrid efficiency. Furthermore, the growing emphasis on smart city initiatives will create additional demand for decentralized energy systems, positioning Qatar as a regional leader in microgrid development and innovation.

| Segment | Sub-Segments |

|---|---|

| By Type (e.g., Solar, Wind, Bioenergy, Hydropower, Waste-to-Energy, Natural Gas Hybrid) | Solar Wind Bioenergy Hydropower Waste-to-Energy Natural Gas Hybrid Others |

| By End-User (Residential, Commercial, Industrial, Oil & Gas, Government & Utilities) | Residential Commercial Industrial Oil & Gas Government & Utilities Others |

| By Region | Doha Al Rayyan Al Wakrah Ras Laffan Others |

| By Technology (Photovoltaic, CSP, Onshore/Offshore Wind, Biomass Gasification, Battery Storage, Smart Grid Controls) | Photovoltaic CSP Onshore Wind Offshore Wind Biomass Gasification Battery Storage Smart Grid Controls Others |

| By Application (Grid-Connected, Off-Grid, Rooftop Installations, Utility-Scale Projects, Industrial Complexes) | Grid-Connected Off-Grid Rooftop Installations Utility-Scale Projects Industrial Complexes Others |

| By Investment Source (Domestic, FDI, PPP, Government Schemes, International Development Funds) | Domestic FDI PPP Government Schemes International Development Funds Others |

| By Policy Support (Subsidies, Tax Exemptions, RECs, Net Metering, Green Certificates) | Subsidies Tax Exemptions RECs Net Metering Green Certificates Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Microgrid Solutions | 100 | Homeowners, Energy Consultants |

| Commercial Microgrid Applications | 80 | Facility Managers, Business Owners |

| Industrial Microgrid Projects | 70 | Operations Managers, Energy Managers |

| Government and Policy Insights | 50 | Policy Makers, Regulatory Officials |

| Technology Providers and Innovators | 60 | Product Managers, R&D Engineers |

The Qatar Microgrid Market is valued at approximately USD 1 billion, reflecting a significant investment in renewable energy sources and decentralized energy systems, driven by government initiatives and increasing demand for reliable power supply in various sectors.