Region:Middle East

Author(s):Dev

Product Code:KRAA9630

Pages:95

Published On:November 2025

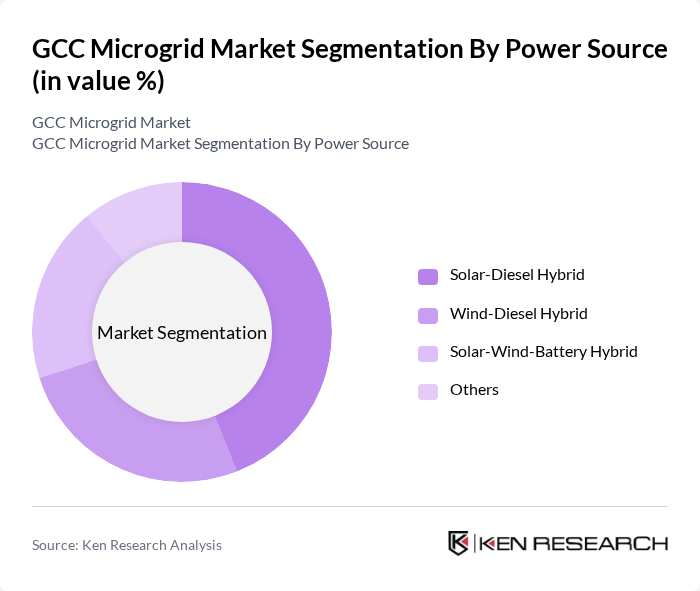

By Power Source:The power source segmentation of the market includes Solar-Diesel Hybrid, Wind-Diesel Hybrid, Solar-Wind-Battery Hybrid, and Others. Among these,Solar-Diesel Hybridsystems are gaining traction due to their ability to provide reliable power in off-grid locations while utilizing renewable energy. The increasing adoption of solar technologies, the need for backup power solutions in remote areas, and the growing emphasis on hybridization to reduce diesel consumption are driving this segment's growth .

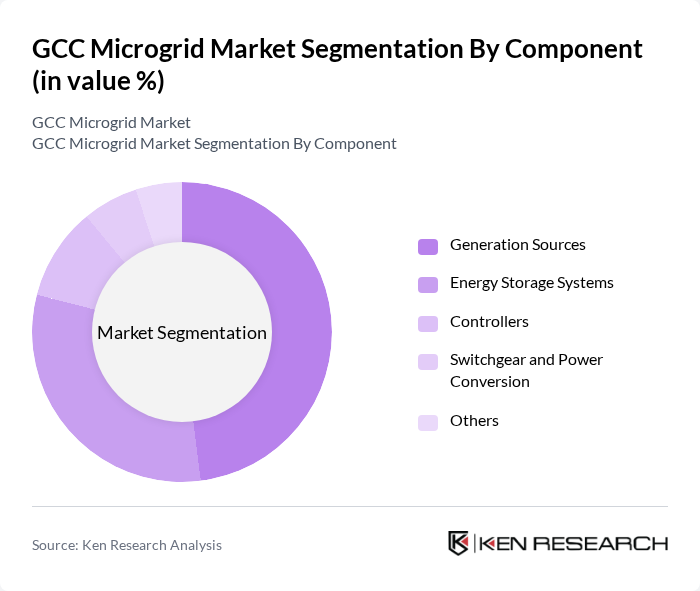

By Component:The component segmentation includes Generation Sources, Energy Storage Systems, Controllers, Switchgear and Power Conversion, and Others. TheGeneration Sourcessegment is currently leading the market, driven by the increasing deployment of solar and wind technologies. The demand for efficient energy generation, integration of renewable sources into existing grids, and the adoption of modular microgrid architectures are key factors contributing to the growth of this segment .

The GCC Microgrid Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, Schneider Electric, General Electric (GE), ABB Ltd., Enel X, S&C Electric Company, Honeywell International Inc., Mitsubishi Electric Corporation, Eaton Corporation plc, Wärtsilä Corporation, Tesla, Inc., ENGIE, ACWA Power, Masdar (Abu Dhabi Future Energy Company), Desert Technologies, Aggreko, Hitachi Energy, Elsewedy Electric, Advanced Energy Systems (ADES), Alfanar contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC microgrid market appears promising, driven by increasing investments in renewable energy and supportive government policies. As the region aims for carbon neutrality by 2050, microgrids will play a crucial role in achieving these targets. The integration of smart technologies and energy management systems is expected to enhance operational efficiency. Additionally, the growing focus on sustainability will likely lead to more community-based microgrid projects, fostering local energy resilience and independence.

| Segment | Sub-Segments |

|---|---|

| By Power Source (Solar-Diesel Hybrid, Wind-Diesel Hybrid, Solar-Wind-Battery Hybrid, Others) | Solar-Diesel Hybrid Wind-Diesel Hybrid Solar-Wind-Battery Hybrid Others |

| By Component (Generation Sources, Energy Storage Systems, Controllers, Switchgear and Power Conversion, Others) | Generation Sources Energy Storage Systems Controllers Switchgear and Power Conversion Others |

| By End-User (Industrial, Commercial, Utilities, Remote/Off-grid, Defense, Others) | Industrial Commercial Utilities Remote/Off-grid Defense Others |

| By Connectivity (Grid-Connected, Off-Grid/Islanded) | Grid-Connected Off-Grid/Islanded |

| By Technology (Photovoltaic, CSP, Onshore/Offshore Wind, Biomass Gasification, Hydrogen-based, Others) | Photovoltaic Concentrated Solar Power (CSP) Onshore Wind Offshore Wind Biomass Gasification Hydrogen-based Others |

| By Application (Remote Systems, Community Microgrids, Institutional Buildings, Utility Distribution, Others) | Remote Systems Community Microgrids Institutional Buildings Utility Distribution Others |

| By Country (Saudi Arabia, United Arab Emirates, Qatar, Kuwait, Oman, Bahrain) | Saudi Arabia United Arab Emirates Qatar Kuwait Oman Bahrain |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Microgrid Applications | 100 | Facility Managers, Energy Directors |

| Industrial Microgrid Solutions | 80 | Operations Managers, Sustainability Officers |

| Residential Microgrid Systems | 60 | Homeowners, Community Leaders |

| Government and Policy Insights | 50 | Regulatory Officials, Policy Advisors |

| Technology Providers and Developers | 70 | Product Managers, Business Development Executives |

The GCC Microgrid Market is valued at approximately USD 1.3 billion, driven by the increasing demand for reliable and sustainable energy solutions, particularly in remote areas and during peak load times.