Region:Asia

Author(s):Geetanshi

Product Code:KRAE0569

Pages:100

Published On:December 2025

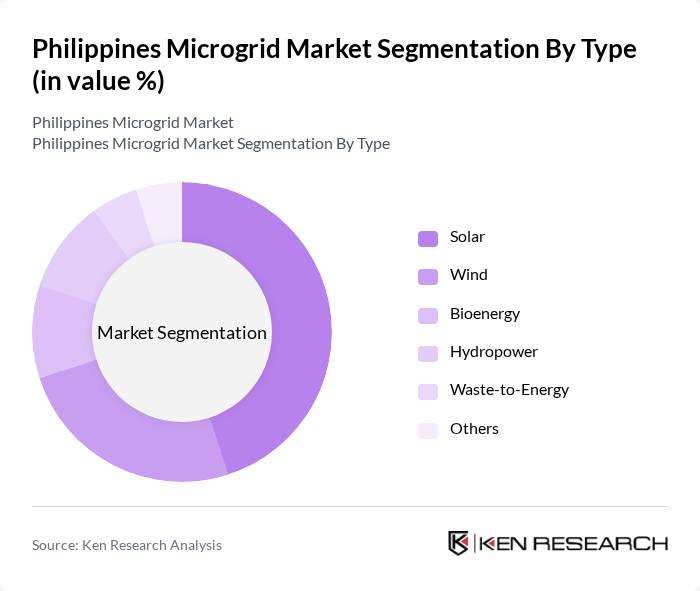

By Type:The microgrid market can be segmented into various types, including Solar, Wind, Bioenergy, Hydropower, Waste-to-Energy, and Others. Among these, solar energy is the most dominant segment due to its abundant availability and decreasing costs of solar technology. The increasing adoption of solar microgrids in rural areas, where traditional grid access is limited, further drives this segment's growth. Wind energy is also gaining traction, particularly in coastal regions, while bioenergy and hydropower contribute significantly to the overall energy mix.

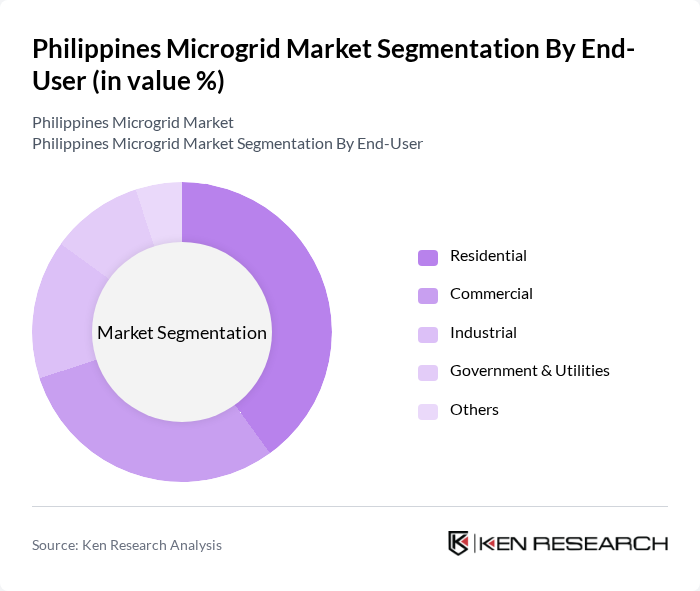

By End-User:The microgrid market is segmented by end-users, including Residential, Commercial, Industrial, Government & Utilities, and Others. The residential segment is the largest, driven by the increasing need for energy independence and reliability in off-grid areas. Commercial and industrial sectors are also significant contributors, as businesses seek to reduce energy costs and enhance sustainability. Government initiatives to electrify remote communities further bolster the demand across all end-user segments.

The Philippines Microgrid Market is characterized by a dynamic mix of regional and international players. Leading participants such as AC Energy Corporation, First Gen Corporation, Solar Philippines, Energy Development Corporation, Aboitiz Power Corporation, Meralco PowerGen Corporation, Philippine National Oil Company (PNOC), SMC Global Power Holdings Corp., Enfinity Global, Green Core Geothermal, Inc., EDC Renewable Energy, SunPower Corporation, JGC Corporation, Siemens Gamesa Renewable Energy, Schneider Electric contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines microgrid market is poised for significant growth as the government continues to prioritize renewable energy and energy security. With increasing investments in technology and infrastructure, the adoption of hybrid microgrid systems is expected to rise. Furthermore, community-based energy solutions will gain traction, driven by local partnerships and enhanced public awareness of sustainability. As regulatory frameworks evolve, the market will likely see a surge in innovative financing options, facilitating broader access to microgrid solutions across the archipelago.

| Segment | Sub-Segments |

|---|---|

| By Type (e.g., Solar, Wind, Bioenergy, Hydropower, Waste-to-Energy) | Solar Wind Bioenergy Hydropower Waste-to-Energy Others |

| By End-User (Residential, Commercial, Industrial, Government & Utilities) | Residential Commercial Industrial Government & Utilities Others |

| By Region (Luzon, Visayas, Mindanao) | Luzon Visayas Mindanao |

| By Technology (Photovoltaic, CSP, Onshore/Offshore Wind, Biomass Gasification) | Photovoltaic CSP Onshore Wind Offshore Wind Biomass Gasification Others |

| By Application (Grid-Connected, Off-Grid, Rooftop Installations, Utility-Scale Projects) | Grid-Connected Off-Grid Rooftop Installations Utility-Scale Projects Others |

| By Investment Source (Domestic, FDI, PPP, Government Schemes) | Domestic FDI PPP Government Schemes Others |

| By Policy Support (Subsidies, Tax Exemptions, RECs) | Subsidies Tax Exemptions RECs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Microgrid Users | 100 | Homeowners, Energy Managers |

| Commercial Microgrid Implementations | 80 | Facility Managers, Sustainability Officers |

| Rural Electrification Projects | 70 | Community Leaders, NGO Representatives |

| Microgrid Technology Providers | 60 | Product Managers, Technical Directors |

| Government Policy Makers | 50 | Energy Policy Analysts, Regulatory Officials |

The Philippines Microgrid Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by the demand for reliable and sustainable energy solutions, especially in remote and off-grid areas.