Region:Global

Author(s):Rebecca

Product Code:KRAC2521

Pages:86

Published On:October 2025

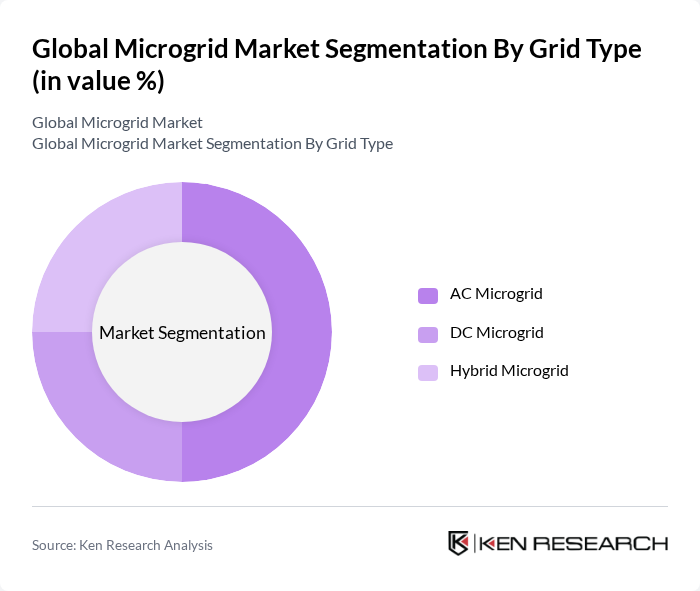

By Grid Type:The microgrid market is segmented into AC Microgrid, DC Microgrid, and Hybrid Microgrid. AC Microgrids are widely adopted due to their compatibility with existing power systems and ease of integration with renewable energy sources. DC Microgrids are gaining traction in specific applications, particularly in data centers and electric vehicle charging stations. Hybrid Microgrids, which combine both AC and DC systems, are increasingly favored for their flexibility and efficiency in energy management.

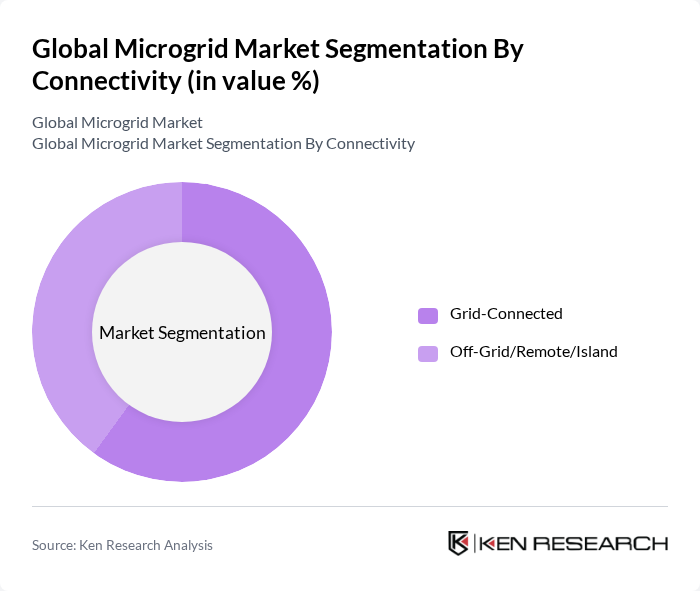

By Connectivity:The connectivity segment includes Grid-Connected and Off-Grid/Remote/Island microgrids. Grid-Connected microgrids are prevalent in urban areas where they can seamlessly integrate with the main grid, providing backup power and enhancing grid stability. Off-Grid/Remote/Island microgrids are essential in rural and remote locations, offering energy independence and reliability where traditional grid access is limited or non-existent.

The Global Microgrid Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, General Electric Company, Schneider Electric SE, ABB Ltd., Mitsubishi Electric Corporation, Honeywell International Inc., Eaton Corporation plc, Enel X S.r.l., S&C Electric Company, PowerSecure International, Inc., Bloom Energy Corporation, Tesla, Inc., Rolls-Royce Holdings plc, Wärtsilä Corporation, Hitachi Energy Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the microgrid market appears promising, driven by increasing investments in renewable energy and technological advancements. As governments prioritize energy security and sustainability, the adoption of microgrids is expected to rise significantly. Innovations in energy storage and smart grid technologies will further enhance microgrid efficiency and reliability. Additionally, the growing trend towards decentralized energy systems will likely create new opportunities for microgrid deployment, particularly in urban and rural settings.

| Segment | Sub-Segments |

|---|---|

| By Grid Type | AC Microgrid DC Microgrid Hybrid Microgrid |

| By Connectivity | Grid-Connected Off-Grid/Remote/Island |

| By Offering | Hardware Software Services |

| By Power Source | Solar Photovoltaic (PV) Wind Combined Heat and Power (CHP) Natural Gas Diesel Fuel Cell Bioenergy Others |

| By Application | Commercial & Industrial Remote Systems Institution & Campus Utility/Community Defense |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Microgrid Applications | 100 | Facility Managers, Energy Directors |

| Industrial Microgrid Solutions | 80 | Operations Managers, Sustainability Officers |

| Residential Microgrid Systems | 60 | Homeowners, Energy Consultants |

| Microgrid Technology Providers | 70 | Product Managers, Business Development Executives |

| Government and Regulatory Bodies | 50 | Policy Makers, Energy Analysts |

The Global Microgrid Market is valued at approximately USD 43.19 billion. This growth is driven by the increasing demand for reliable energy systems, integration of renewable energy sources, and advancements in energy storage technologies.