Region:Middle East

Author(s):Geetanshi

Product Code:KRAC8148

Pages:96

Published On:November 2025

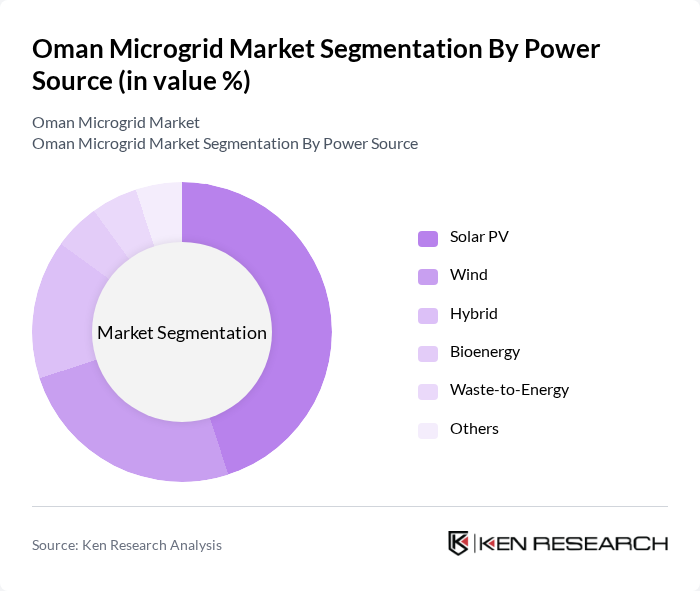

By Power Source:The power source segmentation of the Oman Microgrid Market includes various renewable and non-renewable energy options. Solar PV is leading the market due to its abundant sunlight and decreasing costs. Wind energy is also gaining traction, particularly in coastal and southern regions such as Dhofar. Hybrid systems, combining solar, wind, and battery storage, are increasingly popular for their flexibility and reliability. Bioenergy and waste-to-energy solutions are emerging as sustainable alternatives, while other sources contribute to the diversification of the energy mix .

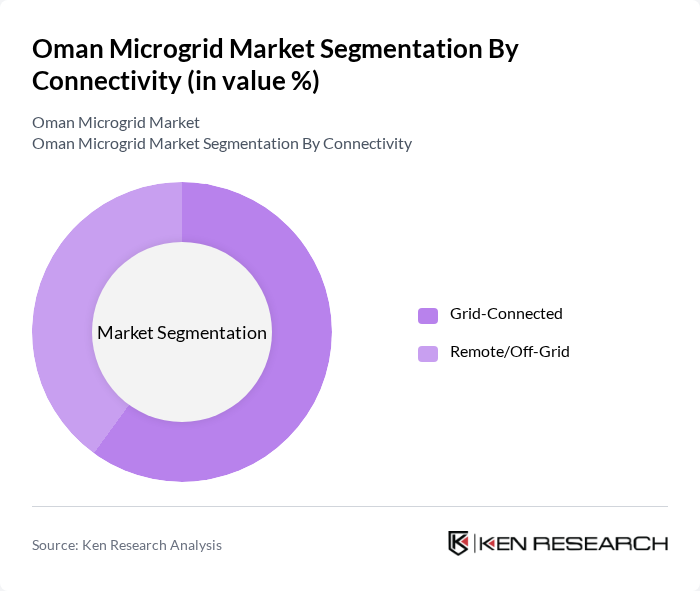

By Connectivity:The connectivity segmentation highlights the two primary types of microgrids: grid-connected and remote/off-grid systems. Grid-connected microgrids are prevalent in urban areas where they can integrate with the national grid, providing stability and reliability. In contrast, remote/off-grid systems are essential for rural and isolated communities, offering energy independence and resilience against grid failures. The demand for off-grid solutions is increasing due to the need for energy access in underserved regions, particularly in Oman's interior and desert areas .

The Oman Microgrid Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nama Group (Oman Electricity Transmission Company), Petroleum Development Oman (PDO), Siemens AG, Schneider Electric, ABB Ltd., General Electric, ENGIE, ACWA Power, Marubeni Corporation, JinkoSolar Holding Co., Ltd., Voltamp Energy SAOG, Oman Oil Marketing Company (OOMCO), Shell Development Oman, TotalEnergies SE, Oman Hydrogen Centre (Hydrom) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman microgrid market appears promising, driven by increasing investments in renewable energy and supportive government policies. As the country aims for 35% of its energy generation from renewables in the future, microgrids will play a crucial role in achieving this target. Additionally, the integration of advanced technologies and energy storage solutions will enhance the efficiency and reliability of microgrids, making them a viable option for both urban and rural electrification projects in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Power Source (Solar PV, Wind, Hybrid, Diesel-Solar, Bioenergy, Waste-to-Energy, Others) | Solar PV Wind Hybrid (Solar-Wind, Diesel-Solar, etc.) Bioenergy Waste-to-Energy Others |

| By Connectivity (Grid-Connected, Remote/Off-Grid) | Grid-Connected Remote/Off-Grid |

| By End-User (Government, Utilities, Industrial, Commercial, Residential, Oil & Gas, Mining, Others) | Government Utilities Industrial Commercial Residential Oil & Gas Mining Others |

| By Region | Muscat Dhofar Al Batinah Al Dakhiliyah Al Wusta Others |

| By Technology (Photovoltaic, CSP, Onshore Wind, Battery Storage, Biomass Gasification, Others) | Photovoltaic Concentrated Solar Power (CSP) Onshore Wind Battery Storage Biomass Gasification Others |

| By Application (Utility-Scale, Commercial & Industrial, Community, Remote/Rural Electrification, Others) | Utility-Scale Commercial & Industrial Community Remote/Rural Electrification Others |

| By Investment Source (Domestic, Foreign Direct Investment, Public-Private Partnerships, Government Schemes, Others) | Domestic Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes Others |

| By Service Model (Microgrid-as-a-Service, EPC, O&M, Others) | Microgrid-as-a-Service (MaaS) Engineering, Procurement & Construction (EPC) Operation & Maintenance (O&M) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Microgrid Adoption | 100 | Homeowners, Energy Consultants |

| Commercial Microgrid Solutions | 80 | Facility Managers, Business Owners |

| Industrial Microgrid Implementation | 60 | Operations Managers, Energy Managers |

| Government Policy Impact | 50 | Policy Makers, Regulatory Authorities |

| Microgrid Technology Providers | 70 | Product Managers, Technical Directors |

The Oman Microgrid Market is valued at approximately USD 1.0 billion, driven by the increasing demand for reliable and sustainable energy solutions, particularly in remote areas, and supported by government initiatives under Oman Vision 2040.