Region:Middle East

Author(s):Dev

Product Code:KRAD7676

Pages:91

Published On:December 2025

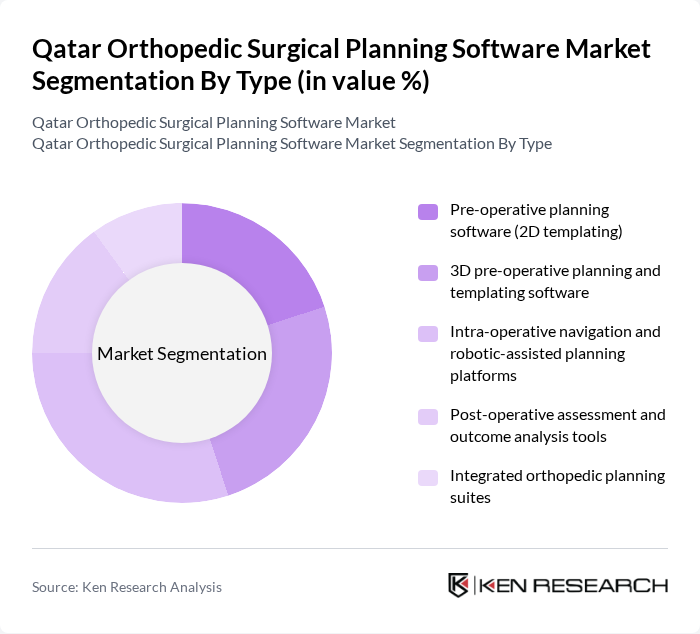

By Type:The market is segmented into various types of orthopedic surgical planning software, including pre-operative planning software (2D templating), 3D pre-operative planning and templating software, intra-operative navigation and robotic-assisted planning platforms, post-operative assessment and outcome analysis tools, and integrated orthopedic planning suites. Each of these sub-segments plays a crucial role in enhancing surgical precision and improving patient outcomes.

By End-User:The end-user segment includes public hospitals (e.g., Hamad Medical Corporation facilities), private hospitals and specialty hospitals, orthopedic and sports medicine centers, ambulatory surgical centers, and academic and research institutions. Each of these end-users has unique requirements and preferences, influencing the adoption of specific types of orthopedic surgical planning software.

The Qatar Orthopedic Surgical Planning Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as Stryker Corporation, Zimmer Biomet Holdings, Inc., DePuy Synthes (Johnson & Johnson MedTech), Smith & Nephew plc, Medtronic plc, Brainlab AG, 3D Systems Corporation, Materialise NV, Exactech, Inc., Arthrex, Inc., NuVasive, Inc., OrthAlign, Inc., Caresyntax GmbH, Surgical Theater, Inc., Aesculap AG (a B. Braun company) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the orthopedic surgical planning software market in Qatar appears promising, driven by technological advancements and increasing healthcare investments. As the government continues to prioritize healthcare modernization, the integration of artificial intelligence and machine learning into surgical planning tools is expected to enhance precision and efficiency. Furthermore, the growing trend of telemedicine will likely facilitate remote consultations, expanding access to orthopedic care and driving software adoption across the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Pre-operative planning software (2D templating) D pre-operative planning and templating software Intra-operative navigation and robotic-assisted planning platforms Post-operative assessment and outcome analysis tools Integrated orthopedic planning suites |

| By End-User | Public hospitals (e.g., Hamad Medical Corporation facilities) Private hospitals and specialty hospitals Orthopedic and sports medicine centers Ambulatory surgical centers Academic and research institutions |

| By Deployment Model | On-premise solutions Cloud-based (SaaS) solutions Hybrid deployment models Web-based / thin-client solutions |

| By Functionality | Digital templating for joint replacement and trauma D modeling, simulation, and virtual surgery Surgical workflow and case management Image acquisition and PACS / RIS integration Patient data management and outcome analytics |

| By Region | Doha Al Rayyan Al Wakrah & Mesaieed Al Khor & Al Shamal Umm Salal & Al Daayen |

| By Pricing Model | Subscription-based licensing (per user/per OR) Perpetual license with annual maintenance Pay-per-procedure / volume-based model Enterprise site-wide licensing |

| By Integration Capability | Standalone orthopedic planning systems Integrated with hospital information systems (HIS) Integrated with PACS / VNA and radiology systems Interoperable with EMR/EHR and surgical navigation/robotic systems |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Orthopedic Surgeons | 100 | Orthopedic Surgeons, Surgical Directors |

| Hospital Administrators | 80 | Healthcare Administrators, IT Managers |

| Medical Device Distributors | 60 | Sales Managers, Product Specialists |

| Software Developers | 50 | Software Engineers, Product Managers |

| Healthcare IT Consultants | 70 | Consultants, Analysts |

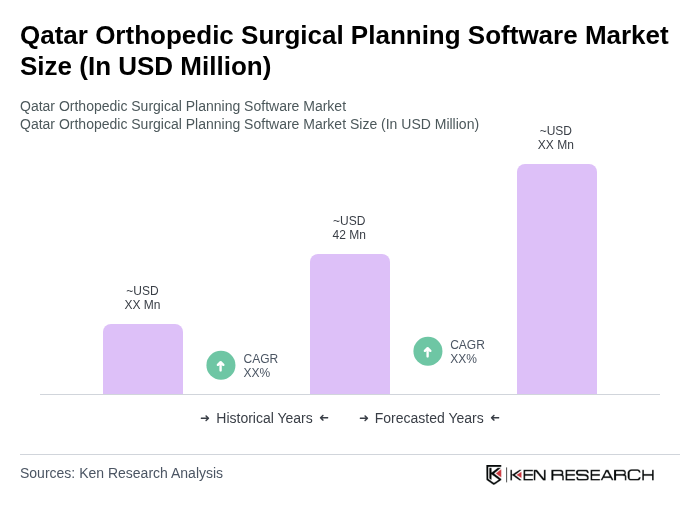

The Qatar Orthopedic Surgical Planning Software Market is valued at approximately USD 42 million, reflecting a significant growth driven by the increasing prevalence of orthopedic disorders and advancements in surgical technologies, including AI and cloud-based solutions.