Region:Middle East

Author(s):Shubham

Product Code:KRAC2868

Pages:84

Published On:October 2025

By Type:The seafood packaging market is segmented into Flexible Packaging (such as pouches and bags), Rigid Packaging (trays, boxes, cans), Vacuum Packaging, Modified Atmosphere Packaging (MAP), Skin Packaging, Thermoformed Packaging, and Shrink Films & Others. Flexible packaging is favored for its lightweight, cost-effectiveness, and ability to extend shelf life, while rigid packaging offers superior protection for bulk and export shipments. Vacuum and MAP technologies are increasingly adopted to maintain freshness and safety, especially for premium and export-grade seafood products .

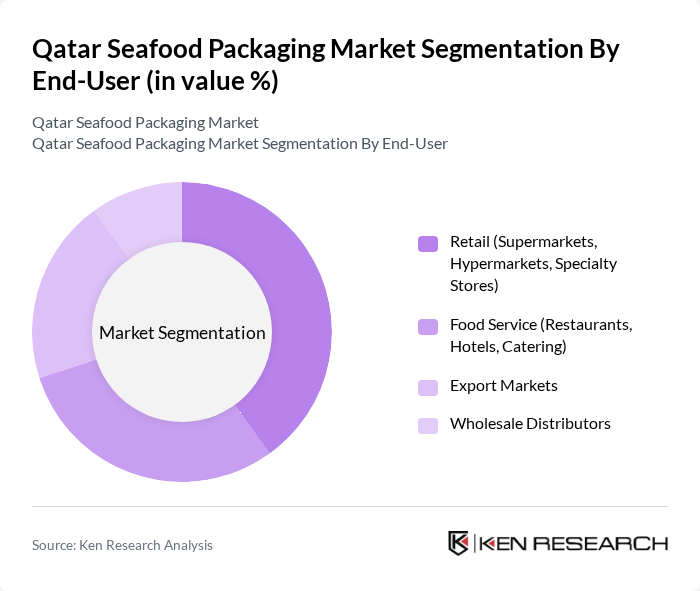

By End-User:End-user segments include Retail (supermarkets, hypermarkets, specialty stores), Food Service (restaurants, hotels, catering), Export Markets, and Wholesale Distributors. Retail and food service sectors are the largest consumers of seafood packaging, driven by the need for attractive, hygienic, and sustainable packaging formats. Export markets prioritize packaging that meets international standards for safety and shelf life, while wholesale distributors focus on bulk and cost-efficient solutions .

The Qatar Seafood Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar Plastic Products Company, Gulf Packaging Industries, Al Jazeera Packaging, Qatar National Plastic Company, Doha Packaging, Qatar Fish Company, Al Meera Consumer Goods Company, Qatar Seafood Company, Al Watania Seafood, Qatar Industrial Manufacturing Company, Qatar Packaging Company, Gulf Fish Company, Al Khor Seafood, Qatar Fish Processing Company, Qatar Marine Services contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar seafood packaging market appears promising, driven by increasing consumer awareness of sustainability and the growing demand for innovative packaging solutions. As the government implements stricter regulations on plastic usage, companies are likely to invest in research and development of biodegradable materials. Additionally, the expansion of the food service sector will further stimulate demand for efficient packaging, creating a dynamic environment for growth and innovation in the seafood packaging industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Flexible Packaging (Pouches, Bags) Rigid Packaging (Trays, Boxes, Cans) Vacuum Packaging Modified Atmosphere Packaging (MAP) Skin Packaging Thermoformed Packaging Shrink Films & Others |

| By End-User | Retail (Supermarkets, Hypermarkets, Specialty Stores) Food Service (Restaurants, Hotels, Catering) Export Markets Wholesale Distributors |

| By Material | Plastic (PET, PE, PP, PVC) Paperboard & Fiber-based Materials Glass Metal (Aluminum, Tin) Biodegradable & Compostable Materials |

| By Packaging Size | Small Packs (?500g) Medium Packs (501g–2kg) Large Packs (>2kg) |

| By Distribution Channel | Direct Sales Online Retail Supermarkets/Hypermarkets Specialty Stores |

| By Price Range | Economy Mid-Range Premium |

| By Application | Fresh Seafood Processed Seafood Frozen Seafood Canned Seafood |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Seafood Processing Facilities | 100 | Production Managers, Quality Control Supervisors |

| Retail Seafood Outlets | 60 | Store Managers, Merchandising Directors |

| Packaging Suppliers | 50 | Sales Representatives, Product Development Managers |

| Logistics and Distribution Companies | 40 | Logistics Coordinators, Supply Chain Analysts |

| Regulatory Bodies and Associations | 40 | Policy Makers, Industry Analysts |

The Qatar Seafood Packaging Market is valued at approximately USD 90 million, driven by increasing demand for fresh and processed seafood, food safety concerns, and sustainability trends, along with advancements in packaging technologies.