Region:Middle East

Author(s):Geetanshi

Product Code:KRAB7713

Pages:100

Published On:October 2025

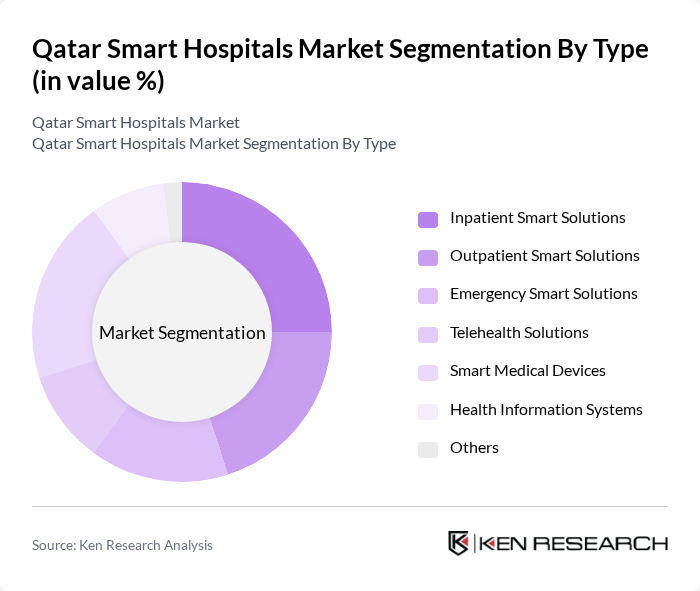

By Type:The market is segmented into various types of smart solutions that cater to different healthcare needs. The subsegments include Inpatient Smart Solutions, Outpatient Smart Solutions, Emergency Smart Solutions, Telehealth Solutions, Smart Medical Devices, Health Information Systems, and Others. Each of these subsegments plays a crucial role in enhancing the efficiency and effectiveness of healthcare delivery.

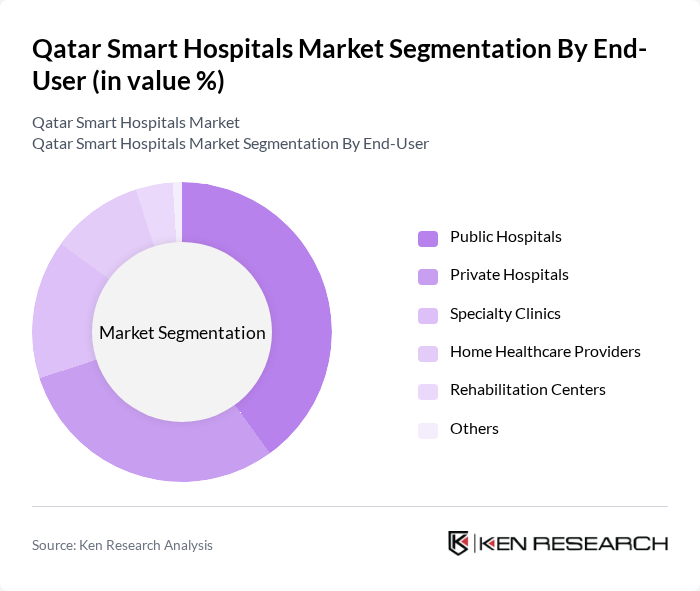

By End-User:The market is also segmented based on end-users, which include Public Hospitals, Private Hospitals, Specialty Clinics, Home Healthcare Providers, Rehabilitation Centers, and Others. Each end-user category has distinct requirements and preferences, influencing the adoption of smart hospital solutions.

The Qatar Smart Hospitals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hamad Medical Corporation, Sidra Medicine, Qatar University, Al Ahli Hospital, Doha Clinic Hospital, Aspetar Orthopaedic and Sports Medicine Hospital, Qatar Red Crescent Society, Al Emadi Hospital, Royal Hospital, Qatar Medical Center, Aster Hospital, Medicare Group, Doha Healthcare, Gulf Medical University, Qatar International Medical Center contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar smart hospitals market is poised for significant transformation, driven by technological advancements and evolving patient needs. As healthcare providers increasingly adopt AI and IoT solutions, operational efficiencies will improve, leading to enhanced patient outcomes. Additionally, the focus on telemedicine and personalized care will continue to grow, supported by government initiatives aimed at digitizing healthcare services. This evolving landscape presents opportunities for innovation and collaboration among stakeholders in the healthcare ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Type | Inpatient Smart Solutions Outpatient Smart Solutions Emergency Smart Solutions Telehealth Solutions Smart Medical Devices Health Information Systems Others |

| By End-User | Public Hospitals Private Hospitals Specialty Clinics Home Healthcare Providers Rehabilitation Centers Others |

| By Application | Patient Monitoring Data Management Remote Consultation Workflow Optimization Others |

| By Component | Hardware Software Services Others |

| By Sales Channel | Direct Sales Distributors Online Sales Others |

| By Distribution Mode | Retail Distribution Wholesale Distribution Direct-to-Consumer Others |

| By Price Range | Low Price Range Mid Price Range High Price Range Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Smart Hospital Technology Adoption | 100 | Hospital Administrators, IT Directors |

| Telemedicine Implementation | 80 | Healthcare Providers, Telehealth Coordinators |

| IoT Solutions in Healthcare | 70 | Biomedical Engineers, Technology Managers |

| AI in Patient Care | 60 | Clinical Decision Support Specialists, Data Analysts |

| Healthcare Data Security | 50 | Chief Information Security Officers, Compliance Officers |

The Qatar Smart Hospitals Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by advanced healthcare technologies, rising patient expectations, and government initiatives to enhance healthcare infrastructure.