Region:Europe

Author(s):Geetanshi

Product Code:KRAA6571

Pages:82

Published On:September 2025

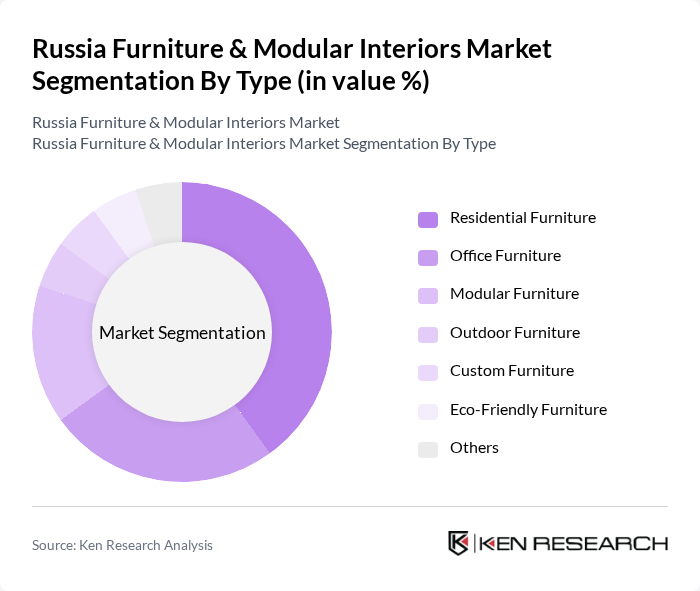

By Type:The market is segmented into various types of furniture, including residential, office, modular, outdoor, custom, eco-friendly, and others. Among these, residential furniture is the most significant segment, driven by the increasing demand for home furnishings as more people invest in their living spaces. The trend towards modular and eco-friendly furniture is also gaining traction, reflecting consumer preferences for sustainability and versatility.

By End-User:The end-user segmentation includes residential, commercial, hospitality, government, educational institutions, healthcare facilities, and others. The residential segment dominates the market, driven by the increasing number of households and the trend of home renovations. The commercial segment is also significant, as businesses invest in office furniture to create productive work environments.

The Russia Furniture & Modular Interiors Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA, Hoff, MebelVia, LEROY MERLIN, AURA, DMI, RUSFURNITURE, KARE, Mebelny Dvor, Sokol, Mebel-Grad, VIKING, TANDY, RUSFURNITURE, FURNITURE FACTORY contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Russia furniture and modular interiors market appears promising, driven by urbanization and rising disposable incomes. As consumers increasingly seek personalized and functional living spaces, manufacturers are likely to innovate with smart furniture solutions and sustainable materials. Additionally, the expansion of e-commerce platforms will facilitate greater access to diverse product offerings, enhancing consumer choice. However, companies must navigate economic uncertainties and supply chain challenges to capitalize on these emerging trends effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Furniture Office Furniture Modular Furniture Outdoor Furniture Custom Furniture Eco-Friendly Furniture Others |

| By End-User | Residential Commercial Hospitality Government Educational Institutions Healthcare Facilities Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Wholesale Showrooms Others |

| By Material | Wood Metal Plastic Fabric Glass Others |

| By Price Range | Budget Mid-Range Premium Luxury Others |

| By Design Style | Modern Traditional Contemporary Rustic Industrial Others |

| By Functionality | Multi-Functional Space-Saving Ergonomic Modular Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Furniture Market | 150 | Homeowners, Interior Designers |

| Commercial Furniture Sector | 100 | Office Managers, Facility Coordinators |

| Modular Interiors Segment | 80 | Architects, Project Managers |

| Online Furniture Retail | 120 | E-commerce Managers, Digital Marketing Specialists |

| Furniture Export Market | 70 | Export Managers, Trade Analysts |

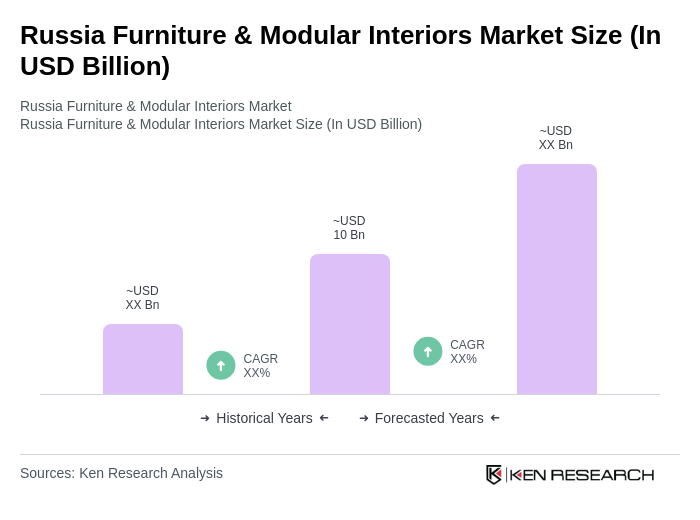

The Russia Furniture & Modular Interiors Market is valued at approximately USD 10 billion, reflecting a five-year historical analysis. This growth is driven by urbanization, rising disposable incomes, and a demand for modern, functional furniture solutions.