Region:Middle East

Author(s):Geetanshi

Product Code:KRAB7340

Pages:85

Published On:October 2025

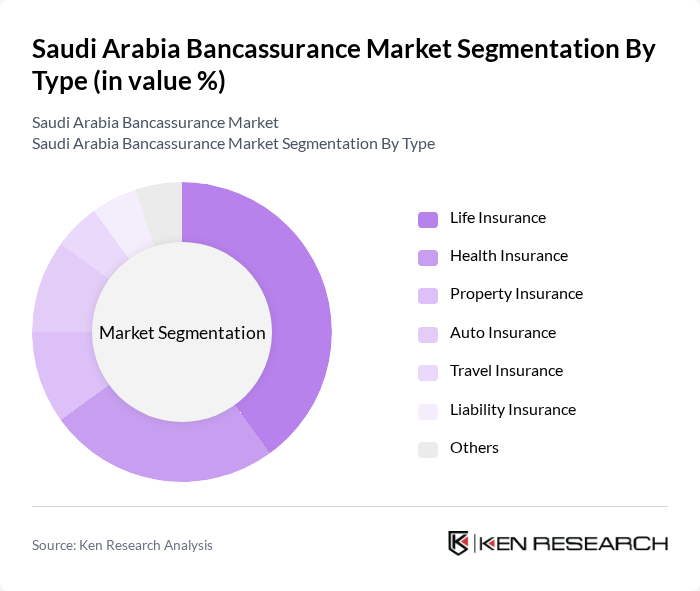

By Type:

The bancassurance market is segmented into various types, including Life Insurance, Health Insurance, Property Insurance, Auto Insurance, Travel Insurance, Liability Insurance, and Others. Among these, Life Insurance is the dominant segment, driven by the increasing awareness of the importance of life coverage and the growing trend of long-term savings among consumers. Health Insurance is also gaining traction due to rising healthcare costs and the need for comprehensive health coverage. The demand for Auto and Property Insurance is influenced by the growing vehicle ownership and real estate development in the region.

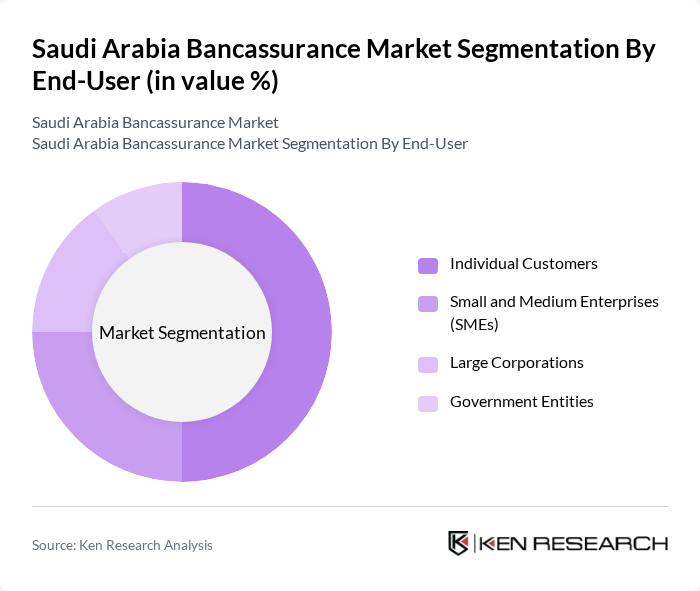

By End-User:

The market is segmented by end-users into Individual Customers, Small and Medium Enterprises (SMEs), Large Corporations, and Government Entities. Individual Customers represent the largest segment, driven by the increasing need for personal financial security and the growing trend of purchasing insurance products through banks. SMEs are also a significant segment, as they seek affordable insurance solutions to protect their businesses. Large Corporations and Government Entities contribute to the market through comprehensive insurance policies tailored to their specific needs.

The Saudi Arabia Bancassurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi National Bank, Al Rajhi Bank, Riyad Bank, Banque Saudi Fransi, Arab National Bank, SABB (Saudi British Bank), Alinma Bank, Gulf International Bank, Saudi Investment Bank, MetLife AIG ANB, AXA Cooperative Insurance, Tawuniya, Al-Etihad Cooperative Insurance, Bupa Arabia, Allianz Saudi Fransi contribute to innovation, geographic expansion, and service delivery in this space.

The future of the bancassurance market in Saudi Arabia appears promising, driven by ongoing digital transformation and evolving consumer preferences. As banks increasingly adopt digital platforms, the accessibility of insurance products is expected to improve significantly. Additionally, the focus on customer-centric solutions will likely lead to innovative product offerings tailored to individual needs, enhancing customer engagement and satisfaction. This evolution will position bancassurance as a vital component of the financial services landscape in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Life Insurance Health Insurance Property Insurance Auto Insurance Travel Insurance Liability Insurance Others |

| By End-User | Individual Customers Small and Medium Enterprises (SMEs) Large Corporations Government Entities |

| By Distribution Channel | Direct Sales Online Platforms Bank Branches Insurance Brokers |

| By Product Offering | Bundled Products Standalone Products |

| By Customer Demographics | Age Group Income Level Geographic Location |

| By Policy Duration | Short-Term Policies Long-Term Policies |

| By Premium Payment Frequency | Monthly Payments Annual Payments One-Time Payments |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Bancassurance Product Awareness | 150 | Bank Customers, Insurance Policyholders |

| Consumer Preferences in Insurance | 100 | Financial Advisors, Insurance Agents |

| Market Trends in Bancassurance | 80 | Banking Executives, Insurance Executives |

| Regulatory Impact Assessment | 60 | Regulatory Officials, Compliance Officers |

| Customer Satisfaction with Bancassurance | 90 | End Consumers, Customer Service Representatives |

The Saudi Arabia Bancassurance Market is valued at approximately USD 2.5 billion, reflecting a significant growth trend driven by the integration of banking and insurance services and increased consumer awareness of financial products.