Region:Middle East

Author(s):Shubham

Product Code:KRAD6759

Pages:90

Published On:December 2025

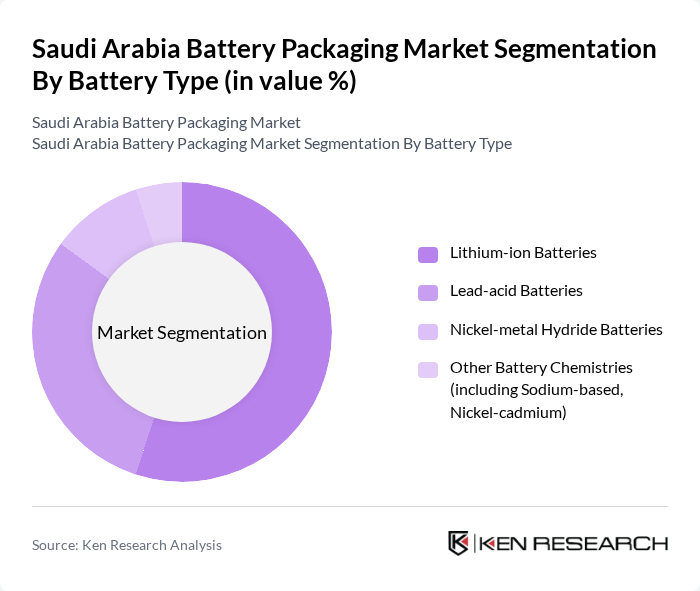

By Battery Type:The battery packaging market is segmented into various types, including Lithium-ion Batteries, Lead-acid Batteries, Nickel-metal Hydride Batteries, and Other Battery Chemistries. Among these, Lithium-ion Batteries dominate the market due to their widespread use in electric vehicles, stationary energy storage systems, and portable electronics, driven by their high energy density, long cycle life, and falling cost per kWh. Lead-acid batteries are also significant, particularly in automotive starter batteries, backup power, and industrial applications, supported by established local manufacturing in Saudi Arabia. Nickel-metal Hydride and other chemistries such as sodium-based and nickel-cadmium mainly cater to niche industrial, backup, and specialty applications where durability and specific operating conditions are prioritized over energy density.

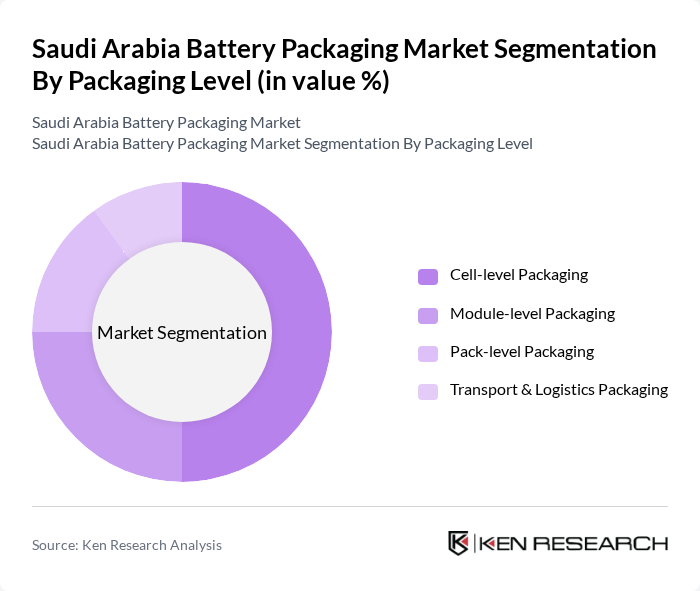

By Packaging Level:The market is also segmented by packaging level, which includes Cell-level Packaging, Module-level Packaging, Pack-level Packaging, and Transport & Logistics Packaging. Cell-level packaging is the most significant segment, as it is essential for the protection, insulation, and safety performance of individual battery cells across lithium-ion, lead-acid, and emerging chemistries. Module-level and pack-level packaging follow, catering to larger battery systems used in EVs, UPS, telecom backup, and grid-scale storage, where thermal management, mechanical robustness, and serviceability are critical. Transport and logistics packaging are crucial for safe and efficient distribution, ensuring compliance with international dangerous goods transport standards, vibration and shock protection, and optimized packing density for import–export flows in and out of Saudi ports.

The Saudi Arabia Battery Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Batteries Manufacturing Co. (SBM), National Batteries Co. (Battariat), Middle East Battery Co. (MEBCO), Alfanar Co., NEFAB Group (Saudi Arabia Operations), Thielmann – The Container Company (Regional Battery Packaging Solutions), Al-Babtain Power & Telecom Co., Al-Rajhi Holding Group (Industrial & Logistics Packaging Investments), Saudi Basic Industries Corporation (SABIC – Advanced Plastics for Battery Packaging), Saudi Arabian Amiantit Co. (Industrial Composite & Enclosure Solutions), Gulf Batteries Co. Ltd., Saudi Industrial Services Co. – SISCO (Logistics & Industrial Packaging Infrastructure), Nefab Saudi Arabia Packaging and Crating Co. Ltd., Takween Advanced Industries, Manarat Al Riyadh Co. (Specialized Industrial & Electronics Packaging) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the battery packaging market in Saudi Arabia appears promising, driven by the increasing adoption of electric vehicles and renewable energy solutions. As the government continues to invest in sustainable technologies, the demand for innovative battery packaging will likely rise. Additionally, advancements in smart battery technologies and sustainable packaging materials will shape the market landscape, fostering growth and attracting investments. Companies that adapt to these trends will be well-positioned to capitalize on emerging opportunities in the sector.

| Segment | Sub-Segments |

|---|---|

| By Battery Type | Lithium-ion Batteries Lead-acid Batteries Nickel-metal Hydride Batteries Other Battery Chemistries (including Sodium-based, Nickel-cadmium) |

| By Packaging Level | Cell-level Packaging Module-level Packaging Pack-level Packaging Transport & Logistics Packaging |

| By Packaging Material | Plastics (PP, ABS, PA and others) Metals (Aluminum, Steel) Paper & Paperboard Composite & Advanced Materials |

| By Application | Electric Vehicles Stationary Energy Storage Systems Consumer & Portable Electronics Industrial & Telecom Power Backup |

| By End-User Industry | Automotive OEMs & EV Assemblers Battery Cell & Pack Manufacturers Renewable & Utility-scale Storage Developers Consumer Electronics & Appliance Manufacturers Others (Industrial, Data Centers, Telecom) |

| By Packaging Type | Rigid Packaging Flexible & Semi-flexible Packaging Custom/Engineered Enclosures |

| By Region | Central Region (including Riyadh) Eastern Region (including Dammam, Jubail, NEOM industrial linkages) Western Region (including Jeddah, Makkah, Madinah) Southern & Northern Regions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Battery Manufacturing Insights | 100 | Production Managers, Quality Assurance Leads |

| Packaging Material Suppliers | 60 | Sales Directors, Product Development Managers |

| Logistics and Distribution Channels | 50 | Logistics Coordinators, Supply Chain Analysts |

| Regulatory Compliance and Standards | 40 | Compliance Officers, Regulatory Affairs Managers |

| End-user Feedback on Battery Packaging | 80 | Procurement Managers, Sustainability Officers |

The Saudi Arabia Battery Packaging Market is valued at approximately USD 1.0 billion, reflecting its growth driven by the increasing demand for electric vehicles, renewable energy storage, and consumer electronics.