Region:Middle East

Author(s):Rebecca

Product Code:KRAC4652

Pages:81

Published On:October 2025

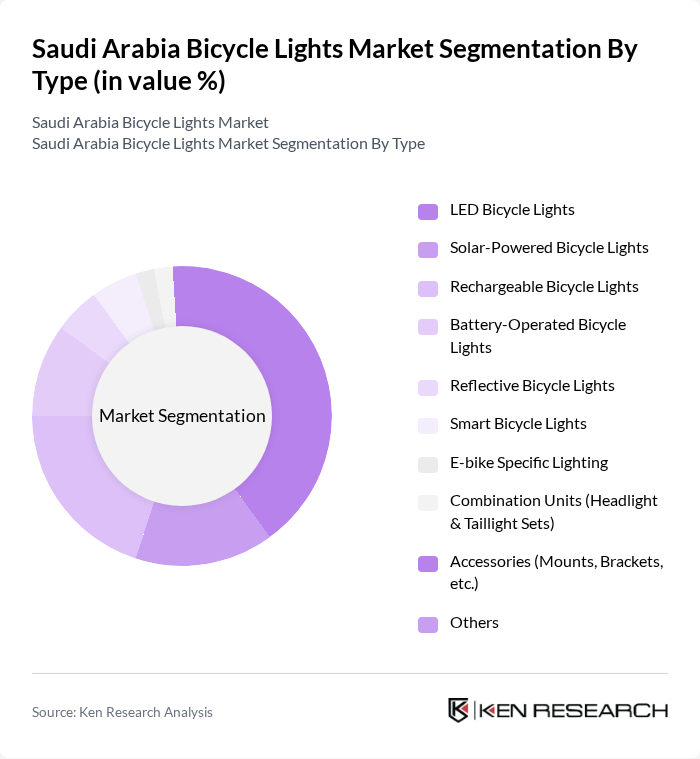

By Type:The market is segmented into various types of bicycle lights, including LED Bicycle Lights, Solar-Powered Bicycle Lights, Rechargeable Bicycle Lights, Battery-Operated Bicycle Lights, Reflective Bicycle Lights, Smart Bicycle Lights, E-bike Specific Lighting, Combination Units (Headlight & Taillight Sets), Accessories (Mounts, Brackets, etc.), and Others. Among these, LED Bicycle Lights are the most popular due to their energy efficiency, brightness, and longevity. The trend towards eco-friendly products has also boosted the demand for solar-powered and rechargeable options. The increasing adoption of smart technology in cycling gear has led to a rise in smart bicycle lights, appealing to tech-savvy consumers. Market demand is further influenced by the integration of USB-rechargeable and multi-mode lighting solutions, which address both convenience and regulatory compliance .

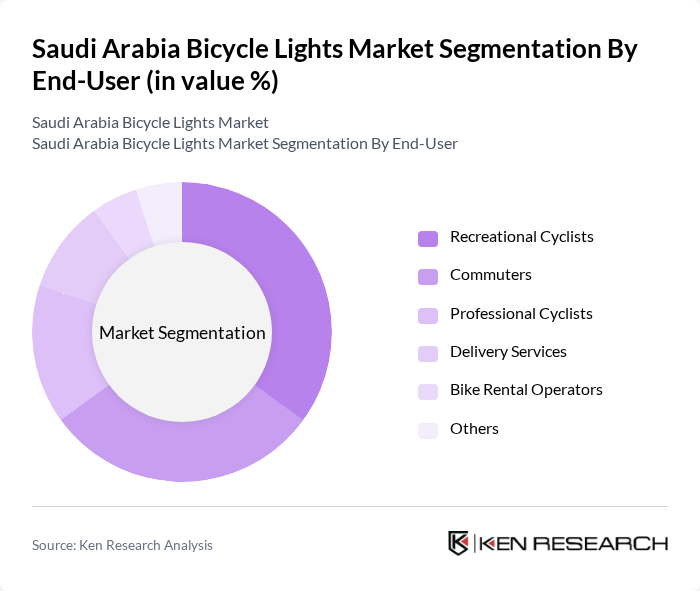

By End-User:The end-user segmentation includes Recreational Cyclists, Commuters, Professional Cyclists, Delivery Services, Bike Rental Operators, and Others. Recreational cyclists represent the largest segment, driven by the growing trend of cycling for leisure and fitness. Commuters are increasingly adopting bicycles for daily travel, especially in urban areas with improved cycling infrastructure. The rise of e-commerce has also led to a significant demand for bicycle lights among delivery services, as safety regulations require proper lighting for night deliveries. Professional cyclists and bike rental operators are also contributing to market growth, with a focus on advanced lighting solutions for performance and safety .

The Saudi Arabia Bicycle Lights Market is characterized by a dynamic mix of regional and international players. Leading participants such as Giant Manufacturing Co. Ltd., Trek Bicycle Corporation, Specialized Bicycle Components, Inc., Shimano Inc., CatEye Co., Ltd., Lezyne, Blackburn Design, Bontrager, Knog, Cygolite, NiteRider Technical Lighting Systems, Moon Sport Ltd., Exposure Lights, Light & Motion, Serfas, Sigma Sport, Topeak, Roxim Technologies Inc., Local Saudi Distributors (e.g., Wheels, Aljazeera Cycles, Al Rakeb Company) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the bicycle lights market in Saudi Arabia appears promising, driven by increasing urban cycling initiatives and government support for sustainable transport. As more consumers become aware of the importance of safety and visibility, the demand for innovative lighting solutions is expected to rise. Additionally, the integration of smart technologies and eco-friendly products will likely shape the market landscape, providing opportunities for manufacturers to cater to evolving consumer preferences and enhance product offerings.

| Segment | Sub-Segments |

|---|---|

| By Type | LED Bicycle Lights Solar-Powered Bicycle Lights Rechargeable Bicycle Lights Battery-Operated Bicycle Lights Reflective Bicycle Lights Smart Bicycle Lights E-bike Specific Lighting Combination Units (Headlight & Taillight Sets) Accessories (Mounts, Brackets, etc.) Others |

| By End-User | Recreational Cyclists Commuters Professional Cyclists Delivery Services Bike Rental Operators Others |

| By Sales Channel | Online Retail Specialty Bicycle Shops Supermarkets and Hypermarkets Direct Sales Others |

| By Price Range | Budget Mid-Range Premium Luxury |

| By Brand | Local Brands International Brands Emerging Brands Others |

| By Application | Urban Commuting Off-Road Cycling Night Riding Competitive Racing Delivery/Logistics Others |

| By Distribution Mode | Direct Distribution Indirect Distribution E-commerce Distribution Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Bicycle Lights Sales | 60 | Store Managers, Sales Representatives |

| Consumer Preferences in Cycling Accessories | 100 | Cyclists, Outdoor Enthusiasts |

| Manufacturing Insights on Bicycle Lights | 50 | Production Managers, Quality Control Officers |

| Distribution Channels for Bicycle Accessories | 40 | Logistics Coordinators, Supply Chain Managers |

| Market Trends and Innovations in Lighting Technology | 40 | Product Developers, R&D Managers |

The Saudi Arabia Bicycle Lights Market is valued at approximately USD 25 million, reflecting a growing demand driven by increased cycling popularity and safety awareness among cyclists in urban areas.